Royce & Associates LP cut its position in Ziff Davis, Inc. (NASDAQ:ZD - Free Report) by 0.8% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 1,922,921 shares of the technology company's stock after selling 15,322 shares during the period. Ziff Davis makes up 0.9% of Royce & Associates LP's holdings, making the stock its 8th largest position. Royce & Associates LP owned approximately 4.30% of Ziff Davis worth $93,569,000 at the end of the most recent quarter.

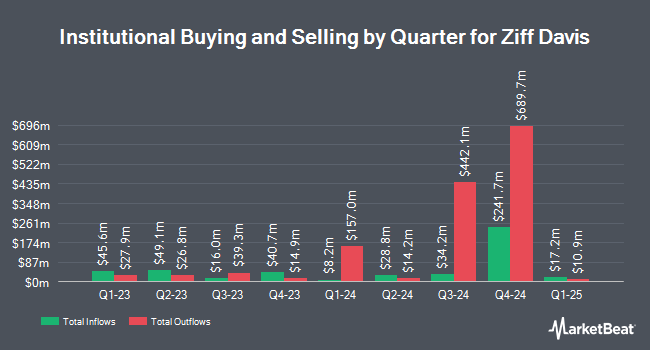

Several other institutional investors have also recently modified their holdings of ZD. GHP Investment Advisors Inc. grew its position in Ziff Davis by 1.4% during the 3rd quarter. GHP Investment Advisors Inc. now owns 17,598 shares of the technology company's stock worth $856,000 after purchasing an additional 250 shares during the period. Arizona State Retirement System boosted its position in Ziff Davis by 2.2% in the 2nd quarter. Arizona State Retirement System now owns 12,913 shares of the technology company's stock worth $711,000 after purchasing an additional 275 shares in the last quarter. ProShare Advisors LLC grew its stake in shares of Ziff Davis by 3.1% during the 1st quarter. ProShare Advisors LLC now owns 10,952 shares of the technology company's stock worth $690,000 after purchasing an additional 329 shares during the period. Russell Investments Group Ltd. lifted its stake in shares of Ziff Davis by 0.5% in the 1st quarter. Russell Investments Group Ltd. now owns 80,020 shares of the technology company's stock valued at $5,044,000 after purchasing an additional 434 shares during the period. Finally, Rothschild Investment LLC acquired a new stake in Ziff Davis during the second quarter valued at $25,000. 99.76% of the stock is currently owned by hedge funds and other institutional investors.

Ziff Davis Trading Down 3.9 %

Ziff Davis stock traded down $2.21 during midday trading on Friday, reaching $55.10. 473,105 shares of the stock traded hands, compared to its average volume of 438,519. The company has a current ratio of 1.42, a quick ratio of 1.91 and a debt-to-equity ratio of 0.49. The firm has a market cap of $2.36 billion, a PE ratio of 47.08 and a beta of 1.29. The company has a 50-day simple moving average of $48.41 and a two-hundred day simple moving average of $50.12. Ziff Davis, Inc. has a 12-month low of $37.76 and a 12-month high of $70.90.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on ZD. Citigroup decreased their target price on Ziff Davis from $52.00 to $47.00 and set a "neutral" rating on the stock in a research report on Friday, August 9th. Royal Bank of Canada reiterated an "outperform" rating and issued a $95.00 target price on shares of Ziff Davis in a research report on Friday, September 6th. Finally, Barclays boosted their target price on shares of Ziff Davis from $44.00 to $61.00 and gave the stock an "equal weight" rating in a research note on Monday. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $71.29.

Check Out Our Latest Research Report on Ziff Davis

Ziff Davis Profile

(

Free Report)

Ziff Davis, Inc, together with its subsidiaries, operates as a digital media and internet company in the United States and internationally. The company offers PCMag, an online resource for laboratory-based product reviews, technology news, buying guides, and research papers; Mashable for publishing technology and culture content; Spiceworks Ziff Davis provides digital content of IT products and services; retailMeNot, a savings destination platform; Offers.com, a coupon and deals website; and event-based properties, including BlackFriday.com, TheBlackFriday.com, BestBlackFriday.com, and DealsofAmerica.com.

Featured Articles

Before you consider Ziff Davis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ziff Davis wasn't on the list.

While Ziff Davis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.