RPG Investment Advisory LLC acquired a new position in shares of Novo Nordisk A/S (NYSE:NVO - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 58,386 shares of the company's stock, valued at approximately $6,952,000.

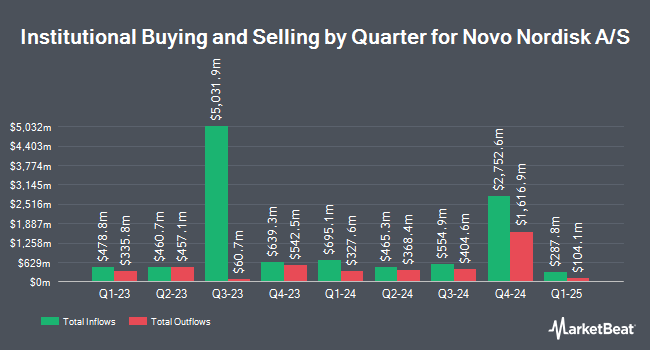

Several other institutional investors also recently modified their holdings of the company. Price T Rowe Associates Inc. MD lifted its position in Novo Nordisk A/S by 10.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 8,589,222 shares of the company's stock worth $1,102,857,000 after acquiring an additional 823,036 shares during the last quarter. Envestnet Asset Management Inc. grew its holdings in Novo Nordisk A/S by 1.4% in the 2nd quarter. Envestnet Asset Management Inc. now owns 4,254,180 shares of the company's stock valued at $607,242,000 after buying an additional 58,935 shares in the last quarter. GQG Partners LLC increased its position in Novo Nordisk A/S by 654.6% during the 1st quarter. GQG Partners LLC now owns 3,633,064 shares of the company's stock worth $466,485,000 after buying an additional 3,151,584 shares during the period. Raymond James & Associates lifted its holdings in shares of Novo Nordisk A/S by 1.0% during the third quarter. Raymond James & Associates now owns 3,526,821 shares of the company's stock worth $419,939,000 after buying an additional 36,223 shares in the last quarter. Finally, 1832 Asset Management L.P. boosted its position in shares of Novo Nordisk A/S by 7.8% in the first quarter. 1832 Asset Management L.P. now owns 2,373,029 shares of the company's stock valued at $304,697,000 after acquiring an additional 172,003 shares during the period. 11.54% of the stock is currently owned by institutional investors and hedge funds.

Novo Nordisk A/S Price Performance

Shares of NVO traded down $0.01 during midday trading on Wednesday, hitting $107.05. The company's stock had a trading volume of 2,016,346 shares, compared to its average volume of 4,435,726. The company's fifty day simple moving average is $120.23 and its two-hundred day simple moving average is $130.08. The stock has a market capitalization of $480.39 billion, a price-to-earnings ratio of 34.74, a price-to-earnings-growth ratio of 1.29 and a beta of 0.42. The company has a quick ratio of 0.75, a current ratio of 0.94 and a debt-to-equity ratio of 0.43. Novo Nordisk A/S has a one year low of $94.73 and a one year high of $148.15.

Wall Street Analyst Weigh In

A number of research firms recently commented on NVO. BMO Capital Markets lowered their price target on shares of Novo Nordisk A/S from $160.00 to $156.00 and set an "outperform" rating on the stock in a research report on Thursday, October 17th. StockNews.com upgraded shares of Novo Nordisk A/S from a "buy" rating to a "strong-buy" rating in a research report on Friday, November 1st. Finally, Cantor Fitzgerald reissued an "overweight" rating and set a $160.00 price target on shares of Novo Nordisk A/S in a research report on Wednesday, November 6th. One equities research analyst has rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Novo Nordisk A/S presently has a consensus rating of "Buy" and an average target price of $144.50.

Check Out Our Latest Research Report on NVO

Novo Nordisk A/S Company Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

Recommended Stories

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.