RTX (NYSE:RTX - Get Free Report) was upgraded by equities researchers at Royal Bank of Canada from a "sector perform" rating to an "outperform" rating in a research report issued to clients and investors on Thursday, MarketBeat reports. The firm presently has a $140.00 price target on the stock, up from their previous price target of $130.00. Royal Bank of Canada's price target points to a potential upside of 21.25% from the stock's previous close.

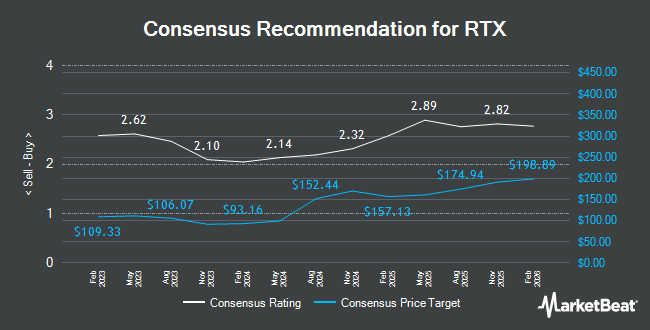

A number of other equities research analysts have also recently weighed in on RTX. StockNews.com raised RTX from a "hold" rating to a "buy" rating in a research note on Friday, September 6th. Citigroup boosted their price target on shares of RTX from $122.00 to $132.00 and gave the stock a "neutral" rating in a research note on Thursday, October 10th. Susquehanna raised their price objective on shares of RTX from $140.00 to $150.00 and gave the company a "positive" rating in a research note on Wednesday, October 23rd. Wells Fargo & Company raised shares of RTX from a "hold" rating to a "strong-buy" rating in a research note on Thursday, November 21st. Finally, UBS Group raised their price target on shares of RTX from $126.00 to $133.00 and gave the company a "neutral" rating in a research report on Wednesday, October 23rd. Seven investment analysts have rated the stock with a hold rating, six have issued a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat, RTX presently has an average rating of "Moderate Buy" and a consensus target price of $177.93.

Get Our Latest Stock Analysis on RTX

RTX Trading Up 0.9 %

NYSE:RTX traded up $1.01 on Thursday, reaching $115.46. The company's stock had a trading volume of 4,645,347 shares, compared to its average volume of 6,448,816. The firm has a market cap of $153.68 billion, a price-to-earnings ratio of 32.99, a price-to-earnings-growth ratio of 2.08 and a beta of 0.80. The company has a quick ratio of 0.73, a current ratio of 0.99 and a debt-to-equity ratio of 0.62. RTX has a 12-month low of $81.37 and a 12-month high of $128.70. The stock has a 50 day moving average price of $120.89 and a 200 day moving average price of $115.70.

RTX (NYSE:RTX - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The company reported $1.45 earnings per share for the quarter, topping the consensus estimate of $1.34 by $0.11. RTX had a net margin of 5.97% and a return on equity of 11.96%. The company had revenue of $20.09 billion during the quarter, compared to analyst estimates of $19.84 billion. During the same quarter last year, the firm posted $1.25 earnings per share. RTX's revenue was up 6.0% compared to the same quarter last year. On average, equities analysts anticipate that RTX will post 5.56 EPS for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the company. Lantz Financial LLC grew its position in RTX by 8.0% during the 2nd quarter. Lantz Financial LLC now owns 2,757 shares of the company's stock worth $277,000 after purchasing an additional 204 shares during the last quarter. Cornerstone Wealth Group LLC raised its stake in RTX by 20.2% during the 2nd quarter. Cornerstone Wealth Group LLC now owns 3,035 shares of the company's stock valued at $305,000 after acquiring an additional 509 shares during the last quarter. Diversified LLC purchased a new stake in RTX during the 2nd quarter valued at approximately $203,000. Everhart Financial Group Inc. lifted its position in RTX by 19.8% during the 2nd quarter. Everhart Financial Group Inc. now owns 6,095 shares of the company's stock worth $612,000 after acquiring an additional 1,006 shares during the period. Finally, TrueWealth Advisors LLC acquired a new position in shares of RTX in the second quarter valued at approximately $201,000. Institutional investors and hedge funds own 86.50% of the company's stock.

RTX Company Profile

(

Get Free Report)

RTX Corporation, an aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally. It operates through three segments: Collins Aerospace, Pratt & Whitney, and Raytheon. The Collins Aerospace Systems segment offers aerospace and defense products, and aftermarket service solutions for civil and military aircraft manufacturers and commercial airlines, as well as regional, business, and general aviation, defense, and commercial space operations.

Read More

Before you consider RTX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RTX wasn't on the list.

While RTX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.