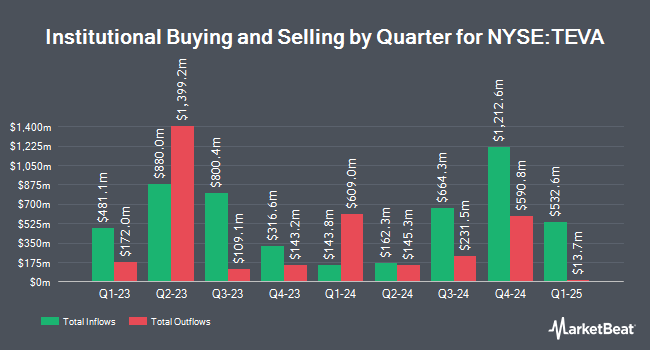

Rubric Capital Management LP lessened its holdings in shares of Teva Pharmaceutical Industries Limited (NYSE:TEVA - Free Report) by 7.3% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 16,005,498 shares of the company's stock after selling 1,256,243 shares during the quarter. Teva Pharmaceutical Industries comprises approximately 4.7% of Rubric Capital Management LP's portfolio, making the stock its 2nd biggest holding. Rubric Capital Management LP owned 1.41% of Teva Pharmaceutical Industries worth $288,419,000 at the end of the most recent quarter.

Several other large investors have also recently modified their holdings of TEVA. New Covenant Trust Company N.A. purchased a new stake in Teva Pharmaceutical Industries during the 1st quarter worth about $28,000. EntryPoint Capital LLC bought a new stake in shares of Teva Pharmaceutical Industries during the first quarter valued at about $30,000. UMB Bank n.a. lifted its holdings in shares of Teva Pharmaceutical Industries by 555.6% in the third quarter. UMB Bank n.a. now owns 2,439 shares of the company's stock worth $44,000 after buying an additional 2,067 shares in the last quarter. Beach Investment Counsel Inc. PA bought a new position in shares of Teva Pharmaceutical Industries in the second quarter valued at approximately $48,000. Finally, Smithfield Trust Co grew its stake in Teva Pharmaceutical Industries by 55.7% during the third quarter. Smithfield Trust Co now owns 2,739 shares of the company's stock valued at $50,000 after acquiring an additional 980 shares in the last quarter. Hedge funds and other institutional investors own 54.05% of the company's stock.

Teva Pharmaceutical Industries Trading Down 0.6 %

NYSE:TEVA opened at $16.59 on Wednesday. The business has a 50 day moving average of $17.62 and a 200 day moving average of $17.36. The company has a debt-to-equity ratio of 2.57, a quick ratio of 0.61 and a current ratio of 0.89. Teva Pharmaceutical Industries Limited has a 1-year low of $9.35 and a 1-year high of $19.31.

Insider Activity

In other news, EVP Christine Fox sold 19,388 shares of Teva Pharmaceutical Industries stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $16.87, for a total value of $327,075.56. Following the transaction, the executive vice president now owns 44,104 shares in the company, valued at approximately $744,034.48. The trade was a 30.54 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.55% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several brokerages have commented on TEVA. UBS Group raised their price target on shares of Teva Pharmaceutical Industries from $24.00 to $26.00 and gave the company a "buy" rating in a report on Tuesday, September 3rd. Barclays boosted their target price on Teva Pharmaceutical Industries from $22.00 to $25.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 23rd. StockNews.com upgraded Teva Pharmaceutical Industries from a "buy" rating to a "strong-buy" rating in a research report on Thursday, October 17th. Finally, JPMorgan Chase & Co. upped their price objective on shares of Teva Pharmaceutical Industries from $16.00 to $18.00 and gave the stock a "neutral" rating in a research report on Monday, October 21st. Two analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $19.67.

Read Our Latest Stock Analysis on Teva Pharmaceutical Industries

Teva Pharmaceutical Industries Company Profile

(

Free Report)

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally. It offers generic medicines in various dosage forms, such as tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams; sterile products, hormones, high-potency drugs, and cytotoxic substances in parenteral and solid dosage forms; and generic products with medical devices and combination products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Teva Pharmaceutical Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teva Pharmaceutical Industries wasn't on the list.

While Teva Pharmaceutical Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.