Ruffer LLP bought a new position in New Gold Inc. (NYSE:NGD - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 1,200,000 shares of the company's stock, valued at approximately $2,976,000. Ruffer LLP owned 0.15% of New Gold as of its most recent SEC filing.

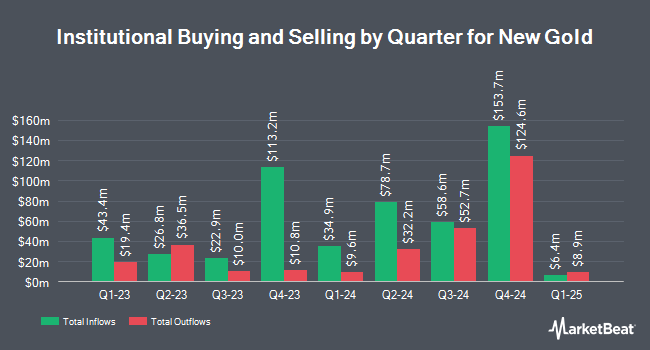

A number of other hedge funds have also added to or reduced their stakes in the stock. BNP Paribas Financial Markets boosted its position in shares of New Gold by 9,360.7% in the third quarter. BNP Paribas Financial Markets now owns 2,692,614 shares of the company's stock valued at $7,755,000 after acquiring an additional 2,664,153 shares during the period. XTX Topco Ltd grew its position in shares of New Gold by 294.7% during the 3rd quarter. XTX Topco Ltd now owns 488,959 shares of the company's stock valued at $1,408,000 after purchasing an additional 365,079 shares in the last quarter. Atria Wealth Solutions Inc. bought a new position in shares of New Gold in the fourth quarter worth $87,000. Centiva Capital LP purchased a new stake in shares of New Gold in the third quarter worth $595,000. Finally, National Bank of Canada FI boosted its stake in New Gold by 22.9% during the third quarter. National Bank of Canada FI now owns 2,374,142 shares of the company's stock valued at $6,844,000 after buying an additional 442,527 shares during the period. Hedge funds and other institutional investors own 42.82% of the company's stock.

New Gold Trading Up 4.9 %

Shares of NYSE:NGD traded up $0.15 on Thursday, reaching $3.23. 28,532,302 shares of the company traded hands, compared to its average volume of 15,034,973. The stock has a market capitalization of $2.55 billion, a P/E ratio of 24.85 and a beta of 1.35. The company has a current ratio of 1.39, a quick ratio of 0.84 and a debt-to-equity ratio of 0.38. The business's 50-day simple moving average is $2.84 and its 200 day simple moving average is $2.79. New Gold Inc. has a 52 week low of $1.52 and a 52 week high of $3.31.

Analysts Set New Price Targets

A number of equities analysts have weighed in on the company. CIBC decreased their target price on New Gold from $3.60 to $3.40 and set an "outperform" rating on the stock in a research note on Thursday, February 27th. Scotiabank raised their target price on shares of New Gold from $3.50 to $4.00 and gave the company a "sector outperform" rating in a research note on Thursday, February 13th. One analyst has rated the stock with a hold rating, five have given a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, New Gold has a consensus rating of "Buy" and a consensus price target of $3.60.

Get Our Latest Report on NGD

New Gold Company Profile

(

Free Report)

New Gold Inc, an intermediate gold mining company, develops and operates of mineral properties in Canada. It primarily explores for gold, silver, and copper deposits. The company's principal operating properties include 100% interest in the Rainy River mine located in Northwestern Ontario, Canada; and New Afton project situated in South-Central British Columbia.

See Also

Before you consider New Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Gold wasn't on the list.

While New Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.