Ruffer LLP lowered its position in Ambev S.A. (NYSE:ABEV - Free Report) by 47.0% in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 25,776,672 shares of the company's stock after selling 22,860,249 shares during the quarter. Ambev makes up about 1.7% of Ruffer LLP's holdings, making the stock its 17th biggest holding. Ruffer LLP owned about 0.16% of Ambev worth $47,687,000 at the end of the most recent reporting period.

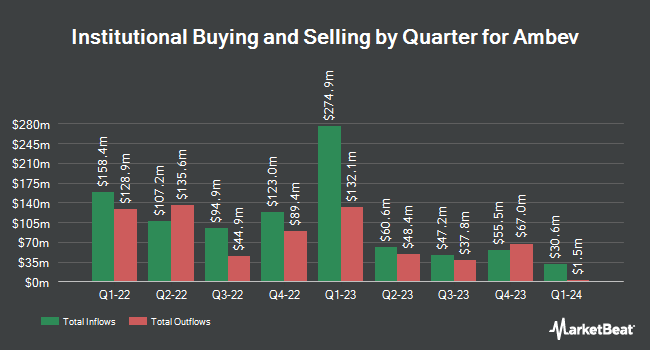

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. MCIA Inc purchased a new stake in shares of Ambev during the 3rd quarter worth approximately $25,000. Insight Inv LLC purchased a new position in shares of Ambev during the fourth quarter worth about $25,000. Wealthstream Advisors Inc. acquired a new stake in shares of Ambev during the third quarter worth about $29,000. Naviter Wealth LLC purchased a new stake in shares of Ambev in the 4th quarter valued at about $29,000. Finally, Exchange Traded Concepts LLC acquired a new stake in shares of Ambev in the 4th quarter valued at about $30,000. Institutional investors and hedge funds own 8.13% of the company's stock.

Ambev Stock Performance

NYSE:ABEV traded up $0.05 during midday trading on Thursday, reaching $2.25. The stock had a trading volume of 34,818,888 shares, compared to its average volume of 25,240,628. The stock has a market cap of $35.37 billion, a P/E ratio of 12.47, a P/E/G ratio of 5.80 and a beta of 0.94. The company has a quick ratio of 0.89, a current ratio of 1.20 and a debt-to-equity ratio of 0.02. Ambev S.A. has a 12-month low of $1.76 and a 12-month high of $2.57. The firm has a fifty day simple moving average of $1.91 and a two-hundred day simple moving average of $2.12.

Ambev (NYSE:ABEV - Get Free Report) last issued its quarterly earnings results on Wednesday, February 26th. The company reported $0.05 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.06 by ($0.01). The firm had revenue of $4.63 billion for the quarter, compared to analyst estimates of $22.42 billion. Ambev had a return on equity of 16.12% and a net margin of 17.02%. On average, equities analysts expect that Ambev S.A. will post 0.18 EPS for the current year.

Ambev Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, April 14th. Stockholders of record on Tuesday, March 18th will be paid a dividend of $0.0221 per share. This represents a $0.09 dividend on an annualized basis and a dividend yield of 3.93%. The ex-dividend date is Tuesday, March 18th. Ambev's dividend payout ratio (DPR) is 52.94%.

Wall Street Analyst Weigh In

ABEV has been the subject of a number of research reports. Bank of America cut Ambev from a "buy" rating to a "neutral" rating in a research note on Friday, January 17th. Barclays dropped their price objective on shares of Ambev from $2.50 to $2.00 and set an "equal weight" rating on the stock in a research note on Tuesday, January 21st. Citigroup reiterated a "neutral" rating on shares of Ambev in a research note on Wednesday, January 22nd. Finally, StockNews.com started coverage on Ambev in a report on Monday, January 27th. They set a "buy" rating on the stock. Three research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, Ambev presently has a consensus rating of "Hold" and an average price target of $2.45.

Check Out Our Latest Research Report on Ambev

Ambev Company Profile

(

Free Report)

Ambev SA, through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada. It offers beer primarily under the Skol, Brahma, Antarctica, Brahva, Budweiser, Bud Light, Beck, Leffe, Hoegaarden, Balboa ICE, Balboa, Atlas Golden Light, Atlas, Bucanero, Cristal, Mayabe, Presidente, Presidente Light, Brahma Light, Bohemia, The One, Corona, Modelo Especial, Stella Artois, Quilmes Clásica, Paceña, Taquiña, Huari, Becker, Cusqueña, Michelob Ultra, Busch, Pilsen, Ouro Fino, Bud 66, Banks, Deputy, Patricia, Labatt Blue, Alexander Keith's, and Kokanee brands.

Recommended Stories

Before you consider Ambev, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambev wasn't on the list.

While Ambev currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report