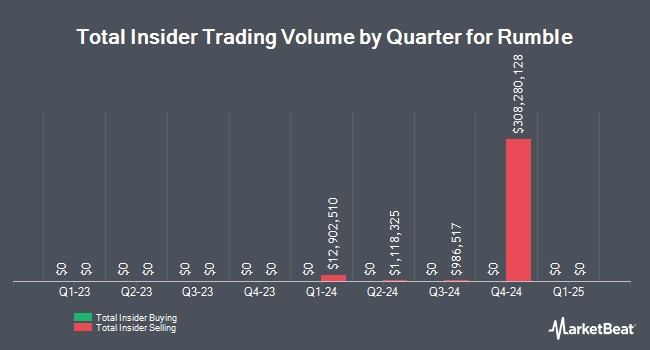

Rumble Inc. (NASDAQ:RUM - Get Free Report) Director Ryan Milnes sold 24,978,210 shares of the business's stock in a transaction on Friday, February 7th. The stock was sold at an average price of $7.50, for a total transaction of $187,336,575.00. Following the completion of the sale, the director now owns 57,290 shares in the company, valued at $429,675. This represents a 99.77 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link.

Rumble Price Performance

Shares of RUM traded up $0.22 during midday trading on Friday, hitting $11.52. The stock had a trading volume of 2,609,559 shares, compared to its average volume of 3,935,989. The stock's 50 day moving average is $11.56 and its 200 day moving average is $7.86. The firm has a market cap of $4.49 billion, a PE ratio of -18.29 and a beta of 0.50. Rumble Inc. has a 1 year low of $4.92 and a 1 year high of $17.40.

Rumble (NASDAQ:RUM - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.15) earnings per share for the quarter, missing analysts' consensus estimates of ($0.13) by ($0.02). The firm had revenue of $25.06 million during the quarter, compared to analysts' expectations of $29.25 million. Rumble had a negative return on equity of 62.75% and a negative net margin of 152.81%. During the same period last year, the company earned ($0.14) earnings per share. As a group, equities research analysts expect that Rumble Inc. will post -0.62 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of research analysts recently commented on the stock. Wedbush reaffirmed a "neutral" rating and issued a $8.00 price target on shares of Rumble in a report on Wednesday, November 13th. Maxim Group initiated coverage on Rumble in a research note on Wednesday, January 15th. They issued a "buy" rating and a $20.00 price objective for the company.

View Our Latest Research Report on RUM

Institutional Investors Weigh In On Rumble

Institutional investors and hedge funds have recently modified their holdings of the business. IFP Advisors Inc increased its stake in Rumble by 70.9% in the fourth quarter. IFP Advisors Inc now owns 2,000 shares of the company's stock worth $26,000 after purchasing an additional 830 shares during the period. Coppell Advisory Solutions LLC purchased a new position in Rumble in the 4th quarter worth about $35,000. Steward Partners Investment Advisory LLC increased its stake in Rumble by 50.2% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 2,933 shares of the company's stock worth $38,000 after buying an additional 980 shares during the period. Virtu Financial LLC bought a new stake in Rumble during the 3rd quarter valued at about $70,000. Finally, Barclays PLC boosted its position in Rumble by 663.9% in the 3rd quarter. Barclays PLC now owns 13,559 shares of the company's stock valued at $72,000 after buying an additional 11,784 shares during the period. 26.15% of the stock is owned by institutional investors.

About Rumble

(

Get Free Report)

Rumble Inc operates video sharing platforms in the United States, Canada, and internationally. The company operates rumble.com, a free-to-use video sharing and livestreaming platform where users can subscribe to channels to stay in touch with creators, and access video on-demand (VOD) and live content streamed by creators.

Read More

Before you consider Rumble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rumble wasn't on the list.

While Rumble currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.