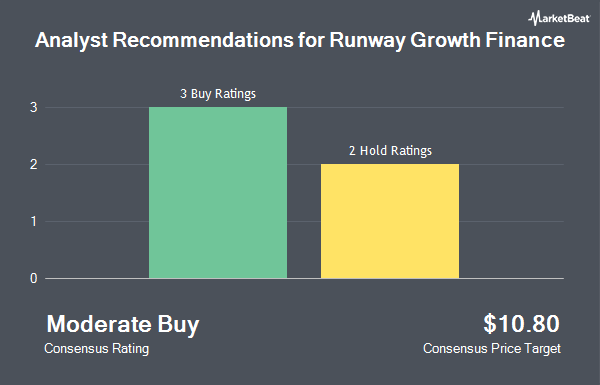

Shares of Runway Growth Finance Corp. (NASDAQ:RWAY - Get Free Report) have been assigned a consensus rating of "Hold" from the eight research firms that are currently covering the firm, Marketbeat reports. Five analysts have rated the stock with a hold recommendation and three have issued a buy recommendation on the company. The average 1-year target price among analysts that have covered the stock in the last year is $11.96.

A number of research analysts have recently commented on the company. Compass Point raised Runway Growth Finance from a "neutral" rating to a "buy" rating and dropped their price target for the company from $12.75 to $11.25 in a research report on Thursday, August 15th. Wells Fargo & Company raised shares of Runway Growth Finance from an "equal weight" rating to an "overweight" rating and set a $11.00 price objective on the stock in a report on Monday, December 2nd.

View Our Latest Research Report on RWAY

Institutional Investors Weigh In On Runway Growth Finance

Several large investors have recently added to or reduced their stakes in the business. Quarry LP bought a new stake in Runway Growth Finance during the second quarter valued at approximately $53,000. Quest Partners LLC purchased a new position in Runway Growth Finance in the third quarter worth $92,000. Quantbot Technologies LP grew its position in Runway Growth Finance by 640.1% in the third quarter. Quantbot Technologies LP now owns 15,593 shares of the company's stock worth $160,000 after acquiring an additional 13,486 shares in the last quarter. Verition Fund Management LLC purchased a new stake in Runway Growth Finance during the third quarter valued at about $165,000. Finally, XTX Topco Ltd bought a new stake in Runway Growth Finance during the third quarter worth about $226,000. Institutional investors own 64.61% of the company's stock.

Runway Growth Finance Stock Performance

Shares of NASDAQ:RWAY traded up $0.32 during mid-day trading on Friday, reaching $10.56. The company had a trading volume of 322,374 shares, compared to its average volume of 293,771. Runway Growth Finance has a one year low of $9.87 and a one year high of $13.74. The company has a current ratio of 0.36, a quick ratio of 0.36 and a debt-to-equity ratio of 1.07. The company's 50-day moving average price is $10.37 and its 200-day moving average price is $10.93. The firm has a market cap of $394.94 million, a price-to-earnings ratio of 10.15 and a beta of 0.60.

Runway Growth Finance Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Monday, November 18th were issued a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 15.15%. The ex-dividend date was Monday, November 18th. Runway Growth Finance's dividend payout ratio (DPR) is presently 153.85%.

Runway Growth Finance Company Profile

(

Get Free ReportRunway Growth Finance Corp. is a business development company specializing investments in senior-secured loans to late stage and growth companies. It prefers to make investments in companies engaged in the technology, life sciences, healthcare and information services, business services and select consumer services and products sectors.

Featured Stories

Before you consider Runway Growth Finance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Runway Growth Finance wasn't on the list.

While Runway Growth Finance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.