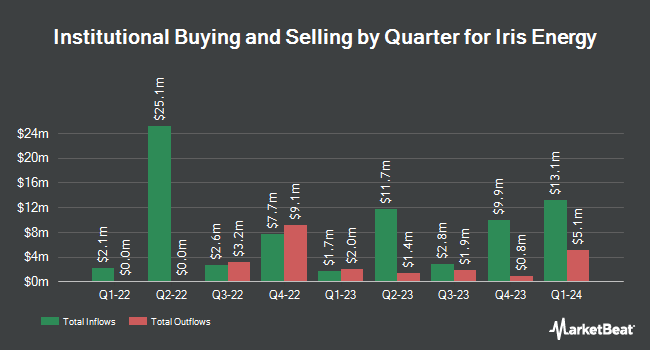

Rush Island Management LP bought a new position in shares of Iris Energy Limited (NASDAQ:IREN - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 566,744 shares of the company's stock, valued at approximately $4,783,000. Iris Energy makes up 0.4% of Rush Island Management LP's portfolio, making the stock its 17th largest position. Rush Island Management LP owned 0.30% of Iris Energy at the end of the most recent reporting period.

A number of other large investors have also recently made changes to their positions in the stock. AFG Fiduciary Services Limited Partnership purchased a new position in Iris Energy during the third quarter valued at approximately $77,000. Covestor Ltd purchased a new position in shares of Iris Energy during the 3rd quarter valued at $87,000. Sippican Capital Advisors bought a new position in shares of Iris Energy in the third quarter worth $94,000. Bluefin Capital Management LLC purchased a new stake in shares of Iris Energy in the second quarter worth $113,000. Finally, Seven Eight Capital LP bought a new stake in Iris Energy during the second quarter valued at $146,000. 41.08% of the stock is owned by institutional investors.

Iris Energy Price Performance

NASDAQ:IREN traded down $0.12 during trading hours on Thursday, reaching $14.15. The company's stock had a trading volume of 25,868,946 shares, compared to its average volume of 13,726,151. The firm has a 50-day simple moving average of $10.01 and a 200-day simple moving average of $9.79. Iris Energy Limited has a 1 year low of $3.56 and a 1 year high of $15.75.

Wall Street Analyst Weigh In

IREN has been the topic of several recent analyst reports. Canaccord Genuity Group raised their price target on Iris Energy from $15.00 to $17.00 and gave the company a "buy" rating in a report on Wednesday, November 27th. Needham & Company LLC reaffirmed a "hold" rating on shares of Iris Energy in a research note on Wednesday, November 27th. HC Wainwright boosted their price target on shares of Iris Energy from $13.00 to $16.00 and gave the stock a "buy" rating in a research note on Wednesday, November 27th. Cantor Fitzgerald increased their price target on shares of Iris Energy from $20.00 to $23.00 and gave the stock an "overweight" rating in a report on Wednesday, November 27th. Finally, B. Riley dropped their price objective on shares of Iris Energy from $17.00 to $12.00 and set a "buy" rating for the company in a report on Friday, September 13th. One investment analyst has rated the stock with a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $16.94.

Check Out Our Latest Analysis on Iris Energy

About Iris Energy

(

Free Report)

Iris Energy Limited owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Further Reading

Before you consider Iris Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iris Energy wasn't on the list.

While Iris Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.