Rush Island Management LP cut its holdings in shares of Ventas, Inc. (NYSE:VTR - Free Report) by 27.1% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,343,336 shares of the real estate investment trust's stock after selling 499,385 shares during the period. Ventas accounts for approximately 6.7% of Rush Island Management LP's investment portfolio, making the stock its 6th biggest holding. Rush Island Management LP owned about 0.32% of Ventas worth $86,148,000 at the end of the most recent quarter.

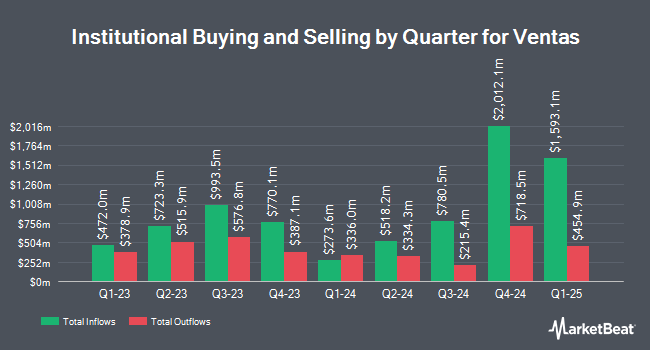

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. FMR LLC boosted its stake in Ventas by 4.4% in the 3rd quarter. FMR LLC now owns 23,364,810 shares of the real estate investment trust's stock worth $1,498,385,000 after purchasing an additional 982,795 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in shares of Ventas by 1.7% in the second quarter. Dimensional Fund Advisors LP now owns 5,931,538 shares of the real estate investment trust's stock worth $304,047,000 after buying an additional 96,482 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in shares of Ventas by 105.2% during the third quarter. Massachusetts Financial Services Co. MA now owns 5,420,322 shares of the real estate investment trust's stock worth $347,605,000 after buying an additional 2,778,408 shares during the period. Charles Schwab Investment Management Inc. grew its holdings in shares of Ventas by 5.0% during the third quarter. Charles Schwab Investment Management Inc. now owns 4,904,078 shares of the real estate investment trust's stock valued at $314,499,000 after buying an additional 231,352 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of Ventas by 862.7% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,932,017 shares of the real estate investment trust's stock valued at $252,160,000 after acquiring an additional 3,523,594 shares during the period. Hedge funds and other institutional investors own 94.18% of the company's stock.

Insider Transactions at Ventas

In other news, CEO Debra A. Cafaro sold 121,248 shares of the business's stock in a transaction that occurred on Tuesday, October 29th. The stock was sold at an average price of $66.17, for a total value of $8,022,980.16. Following the completion of the sale, the chief executive officer now directly owns 986,717 shares in the company, valued at $65,291,063.89. The trade was a 10.94 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CEO Peter J. Bulgarelli sold 6,000 shares of the stock in a transaction that occurred on Tuesday, September 10th. The shares were sold at an average price of $64.99, for a total value of $389,940.00. Following the transaction, the chief executive officer now owns 90,795 shares in the company, valued at $5,900,767.05. This trade represents a 6.20 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 133,252 shares of company stock valued at $8,809,845 in the last ninety days. 1.00% of the stock is currently owned by corporate insiders.

Ventas Stock Performance

Shares of VTR traded up $0.02 during trading hours on Thursday, hitting $62.15. The stock had a trading volume of 2,094,937 shares, compared to its average volume of 2,410,913. The firm has a 50-day moving average price of $64.02 and a 200 day moving average price of $58.38. Ventas, Inc. has a fifty-two week low of $41.45 and a fifty-two week high of $67.61. The firm has a market capitalization of $26.07 billion, a price-to-earnings ratio of -365.57, a PEG ratio of 2.90 and a beta of 1.36. The company has a debt-to-equity ratio of 1.39, a quick ratio of 1.04 and a current ratio of 1.04.

Ventas Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 17th. Shareholders of record on Tuesday, October 1st were given a $0.45 dividend. The ex-dividend date was Tuesday, October 1st. This represents a $1.80 dividend on an annualized basis and a dividend yield of 2.90%. Ventas's dividend payout ratio (DPR) is currently -1,058.76%.

Analysts Set New Price Targets

VTR has been the subject of a number of research reports. StockNews.com raised Ventas from a "sell" rating to a "hold" rating in a research report on Friday, November 1st. Wedbush reiterated an "outperform" rating and issued a $75.00 target price on shares of Ventas in a research report on Tuesday. Royal Bank of Canada increased their price target on shares of Ventas from $52.00 to $63.00 and gave the stock an "outperform" rating in a report on Friday, August 9th. Wells Fargo & Company upgraded shares of Ventas from an "equal weight" rating to an "overweight" rating and lifted their price objective for the company from $61.00 to $71.00 in a research note on Tuesday, October 1st. Finally, Scotiabank increased their price objective on shares of Ventas from $59.00 to $65.00 and gave the stock a "sector perform" rating in a research note on Friday, October 11th. Two equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $65.63.

Check Out Our Latest Analysis on VTR

Ventas Company Profile

(

Free Report)

Ventas Inc NYSE: VTR is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. The Company's growth is fueled by its senior housing communities, which provide valuable services to residents and enable them to thrive in supported environments.

See Also

Before you consider Ventas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ventas wasn't on the list.

While Ventas currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.