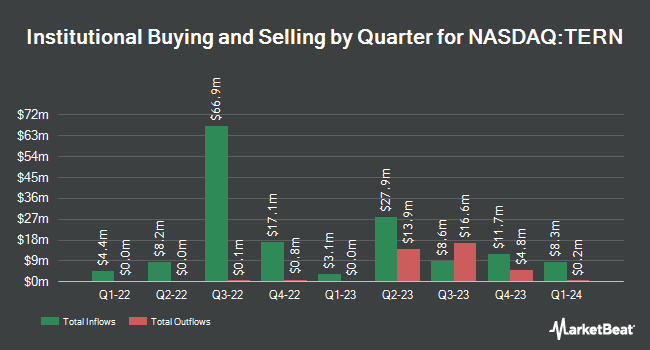

Russell Investments Group Ltd. cut its holdings in shares of Terns Pharmaceuticals, Inc. (NASDAQ:TERN - Free Report) by 15.6% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 628,395 shares of the company's stock after selling 116,292 shares during the period. Russell Investments Group Ltd. owned about 0.74% of Terns Pharmaceuticals worth $3,481,000 at the end of the most recent quarter.

Other large investors have also recently modified their holdings of the company. Charles Schwab Investment Management Inc. lifted its position in shares of Terns Pharmaceuticals by 1.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 154,714 shares of the company's stock worth $1,290,000 after buying an additional 1,994 shares during the last quarter. XTX Topco Ltd acquired a new stake in shares of Terns Pharmaceuticals in the 3rd quarter valued at approximately $148,000. Geode Capital Management LLC grew its holdings in shares of Terns Pharmaceuticals by 7.6% during the 3rd quarter. Geode Capital Management LLC now owns 1,207,479 shares of the company's stock valued at $10,072,000 after purchasing an additional 85,617 shares during the last quarter. Virtu Financial LLC increased its position in Terns Pharmaceuticals by 110.2% during the 3rd quarter. Virtu Financial LLC now owns 62,216 shares of the company's stock worth $519,000 after purchasing an additional 32,624 shares in the last quarter. Finally, SG Americas Securities LLC lifted its stake in Terns Pharmaceuticals by 40.0% in the 4th quarter. SG Americas Securities LLC now owns 33,333 shares of the company's stock valued at $185,000 after purchasing an additional 9,523 shares during the last quarter. Institutional investors and hedge funds own 98.26% of the company's stock.

Terns Pharmaceuticals Trading Up 7.4 %

NASDAQ:TERN traded up $0.17 on Friday, reaching $2.41. 891,657 shares of the stock traded hands, compared to its average volume of 1,516,793. Terns Pharmaceuticals, Inc. has a 1-year low of $1.87 and a 1-year high of $11.40. The company's 50 day moving average is $3.15 and its 200-day moving average is $5.07. The firm has a market capitalization of $209.95 million, a price-to-earnings ratio of -2.04 and a beta of -0.13.

Terns Pharmaceuticals (NASDAQ:TERN - Get Free Report) last announced its earnings results on Thursday, March 20th. The company reported ($0.24) earnings per share for the quarter, topping analysts' consensus estimates of ($0.30) by $0.06. On average, equities research analysts forecast that Terns Pharmaceuticals, Inc. will post -1.19 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, William Blair reissued a "market perform" rating on shares of Terns Pharmaceuticals in a report on Friday, March 21st. Two investment analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $18.38.

Read Our Latest Report on Terns Pharmaceuticals

Terns Pharmaceuticals Company Profile

(

Free Report)

Terns Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, develops small-molecule product candidates for the treatment of oncology, metabolic dysfunction-associated steatohepatitis (MASH), and obesity. The company develops TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor (TKI) that is in phase 1 clinical trial for chronic myeloid leukemia (CML), a form of cancer that starts in bone marrow.

Read More

Before you consider Terns Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terns Pharmaceuticals wasn't on the list.

While Terns Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.