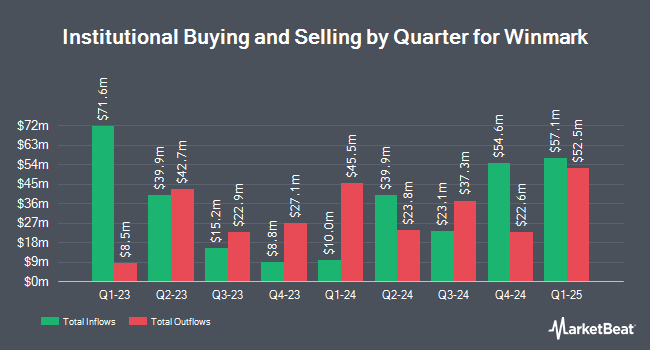

Russell Investments Group Ltd. lowered its stake in Winmark Co. (NASDAQ:WINA - Free Report) by 44.5% during the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,197 shares of the specialty retailer's stock after selling 961 shares during the period. Russell Investments Group Ltd.'s holdings in Winmark were worth $471,000 as of its most recent filing with the Securities & Exchange Commission.

Other large investors have also bought and sold shares of the company. Smartleaf Asset Management LLC boosted its stake in shares of Winmark by 145.4% in the 4th quarter. Smartleaf Asset Management LLC now owns 238 shares of the specialty retailer's stock worth $93,000 after buying an additional 141 shares during the last quarter. Dynamic Technology Lab Private Ltd purchased a new position in shares of Winmark during the fourth quarter valued at about $220,000. KLP Kapitalforvaltning AS purchased a new position in shares of Winmark in the fourth quarter valued at $236,000. Avantax Advisory Services Inc. increased its stake in Winmark by 6.8% during the fourth quarter. Avantax Advisory Services Inc. now owns 641 shares of the specialty retailer's stock worth $252,000 after acquiring an additional 41 shares during the last quarter. Finally, Seizert Capital Partners LLC purchased a new stake in shares of Winmark in the fourth quarter valued at $253,000. 73.32% of the stock is owned by hedge funds and other institutional investors.

Winmark Stock Up 1.9 %

WINA opened at $358.97 on Thursday. The stock has a market cap of $1.27 billion, a P/E ratio of 32.96 and a beta of 0.64. The business has a fifty day moving average of $330.03 and a 200 day moving average of $370.76. Winmark Co. has a 52-week low of $295.79 and a 52-week high of $431.67.

Winmark (NASDAQ:WINA - Get Free Report) last posted its earnings results on Wednesday, April 16th. The specialty retailer reported $2.71 earnings per share for the quarter, missing analysts' consensus estimates of $2.74 by ($0.03). Winmark had a negative return on equity of 93.24% and a net margin of 49.15%. The company had revenue of $21.92 million for the quarter, compared to analysts' expectations of $20.91 million. During the same quarter in the prior year, the company earned $2.41 EPS.

Winmark Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, June 2nd. Investors of record on Wednesday, May 14th will be given a $0.96 dividend. This is a positive change from Winmark's previous quarterly dividend of $0.90. This represents a $3.84 annualized dividend and a dividend yield of 1.07%. The ex-dividend date of this dividend is Wednesday, May 14th. Winmark's dividend payout ratio (DPR) is presently 34.32%.

Winmark Company Profile

(

Free Report)

Winmark Corporation, a resale company operates as a franchisor for small business in the United States and Canada. The company franchises retail stores concepts that buy, sell and trade merchandise. It also operates middle-market equipment leasing business. In addition, the company buys and sells used clothing and accessories geared toward the teenage and young adult market under Plato's Closet brand; and operates stores which buys and sells used and new children's clothing, toys, furniture, equipment, and accessories primarily to parents of children ages infant to 12 years under the Once Upon A Child brand.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Winmark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winmark wasn't on the list.

While Winmark currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.