Avidian Wealth Enterprises LLC lessened its holdings in Sable Offshore Corp. (NYSE:SOC - Free Report) by 33.2% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 45,707 shares of the company's stock after selling 22,698 shares during the quarter. Avidian Wealth Enterprises LLC owned approximately 0.08% of Sable Offshore worth $1,080,000 as of its most recent filing with the Securities & Exchange Commission.

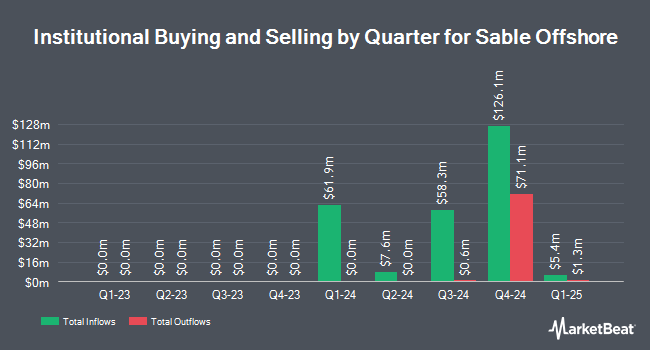

Other hedge funds and other institutional investors have also bought and sold shares of the company. GM Advisory Group LLC bought a new stake in shares of Sable Offshore during the second quarter valued at approximately $1,634,000. Bank of New York Mellon Corp bought a new stake in Sable Offshore during the 2nd quarter valued at $2,154,000. Sentry Investment Management LLC purchased a new stake in shares of Sable Offshore in the 3rd quarter worth $575,000. Allspring Global Investments Holdings LLC bought a new position in shares of Sable Offshore during the 3rd quarter worth $406,000. Finally, Amalgamated Bank purchased a new position in shares of Sable Offshore during the second quarter valued at $26,000. Hedge funds and other institutional investors own 26.19% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on the stock. Johnson Rice began coverage on shares of Sable Offshore in a research note on Tuesday. They issued a "buy" rating and a $30.00 price objective for the company. BWS Financial began coverage on shares of Sable Offshore in a research note on Tuesday, October 8th. They set a "sell" rating and a $6.00 price objective on the stock. Jefferies Financial Group boosted their price objective on shares of Sable Offshore from $19.00 to $32.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. Finally, Benchmark reaffirmed a "buy" rating and set a $37.00 target price on shares of Sable Offshore in a research report on Monday, October 7th. One investment analyst has rated the stock with a sell rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, Sable Offshore currently has an average rating of "Moderate Buy" and an average price target of $25.00.

Check Out Our Latest Report on Sable Offshore

Sable Offshore Stock Performance

NYSE SOC traded down $0.44 on Thursday, hitting $23.64. The stock had a trading volume of 1,227,755 shares, compared to its average volume of 550,913. Sable Offshore Corp. has a 52-week low of $10.11 and a 52-week high of $28.67. The business's fifty day moving average price is $22.10 and its 200 day moving average price is $17.01. The company has a debt-to-equity ratio of 6.48, a current ratio of 2.73 and a quick ratio of 2.46.

Sable Offshore (NYSE:SOC - Get Free Report) last announced its earnings results on Tuesday, August 13th. The company reported ($2.75) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.39) by ($2.36). Sell-side analysts anticipate that Sable Offshore Corp. will post -3.95 EPS for the current fiscal year.

Insider Activity at Sable Offshore

In related news, major shareholder Global Icav Pilgrim purchased 750,000 shares of the business's stock in a transaction on Thursday, September 19th. The shares were acquired at an average price of $20.00 per share, for a total transaction of $15,000,000.00. Following the purchase, the insider now owns 8,791,001 shares of the company's stock, valued at $175,820,020. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 14.30% of the stock is currently owned by insiders.

Sable Offshore Company Profile

(

Free Report)

Sable Offshore Corp. engages in the oil and gas exploration and development activities in the United States. The company operates through three platforms located in federal waters offshore California. It owns and operates 16 federal leases across approximately 76,000 acres and subsea pipelines, which transport crude oil, natural gas, and produced water from the platforms to the onshore processing facilities.

Featured Stories

Before you consider Sable Offshore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sable Offshore wasn't on the list.

While Sable Offshore currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.