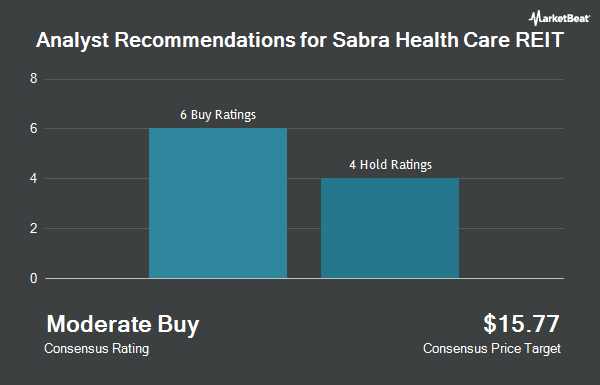

Shares of Sabra Health Care REIT, Inc. (NASDAQ:SBRA - Get Free Report) have been given a consensus rating of "Moderate Buy" by the seven ratings firms that are covering the firm, Marketbeat reports. One investment analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12-month target price among analysts that have covered the stock in the last year is $18.71.

SBRA has been the subject of several research reports. Citigroup raised shares of Sabra Health Care REIT from a "neutral" rating to a "buy" rating and upped their price target for the company from $17.00 to $20.00 in a research report on Friday, September 13th. Scotiabank upped their target price on shares of Sabra Health Care REIT from $17.00 to $18.00 and gave the company a "sector perform" rating in a report on Friday, October 11th. Wells Fargo & Company raised shares of Sabra Health Care REIT from an "equal weight" rating to an "overweight" rating and boosted their price objective for the company from $16.00 to $20.00 in a research report on Tuesday, October 1st. Finally, Truist Financial raised their target price on Sabra Health Care REIT from $16.00 to $18.00 and gave the stock a "buy" rating in a report on Wednesday, September 4th.

View Our Latest Stock Report on Sabra Health Care REIT

Sabra Health Care REIT Stock Performance

SBRA traded up $0.46 during midday trading on Tuesday, hitting $18.57. 1,675,222 shares of the company traded hands, compared to its average volume of 2,047,745. Sabra Health Care REIT has a 52 week low of $12.83 and a 52 week high of $20.03. The company has a quick ratio of 4.16, a current ratio of 4.16 and a debt-to-equity ratio of 0.90. The company's 50-day moving average is $18.63 and its 200 day moving average is $16.63. The firm has a market capitalization of $4.39 billion, a PE ratio of 45.29, a price-to-earnings-growth ratio of 2.28 and a beta of 1.25.

Sabra Health Care REIT (NASDAQ:SBRA - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The real estate investment trust reported $0.13 earnings per share for the quarter, missing the consensus estimate of $0.35 by ($0.22). Sabra Health Care REIT had a net margin of 14.20% and a return on equity of 3.51%. The firm had revenue of $178.00 million for the quarter, compared to the consensus estimate of $177.19 million. During the same period in the previous year, the company earned $0.34 earnings per share. On average, research analysts expect that Sabra Health Care REIT will post 1.39 EPS for the current year.

Sabra Health Care REIT Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be given a $0.30 dividend. The ex-dividend date is Friday, November 15th. This represents a $1.20 annualized dividend and a dividend yield of 6.46%. Sabra Health Care REIT's payout ratio is 292.69%.

Hedge Funds Weigh In On Sabra Health Care REIT

Several hedge funds have recently modified their holdings of SBRA. Sei Investments Co. boosted its holdings in shares of Sabra Health Care REIT by 1.4% during the 1st quarter. Sei Investments Co. now owns 109,558 shares of the real estate investment trust's stock valued at $1,618,000 after purchasing an additional 1,469 shares during the last quarter. US Bancorp DE boosted its stake in Sabra Health Care REIT by 8.3% during the first quarter. US Bancorp DE now owns 22,412 shares of the real estate investment trust's stock valued at $331,000 after buying an additional 1,713 shares during the last quarter. ProShare Advisors LLC boosted its stake in Sabra Health Care REIT by 4.7% during the first quarter. ProShare Advisors LLC now owns 52,900 shares of the real estate investment trust's stock valued at $781,000 after buying an additional 2,393 shares during the last quarter. Orion Portfolio Solutions LLC grew its holdings in Sabra Health Care REIT by 2.4% during the 1st quarter. Orion Portfolio Solutions LLC now owns 82,364 shares of the real estate investment trust's stock valued at $1,217,000 after buying an additional 1,962 shares in the last quarter. Finally, Mitsubishi UFJ Trust & Banking Corp increased its stake in Sabra Health Care REIT by 31.9% in the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 55,909 shares of the real estate investment trust's stock worth $822,000 after acquiring an additional 13,527 shares during the last quarter. Hedge funds and other institutional investors own 99.40% of the company's stock.

About Sabra Health Care REIT

(

Get Free ReportAs of September 30, 2023, Sabra's investment portfolio included 377 real estate properties held for investment (consisting of (i) 240 Skilled Nursing/Transitional Care facilities, (ii) 43 senior housing communities (Senior Housing - Leased), (iii) 61 senior housing communities operated by third-party property managers pursuant to property management agreements (Senior Housing - Managed), (iv) 18 Behavioral Health facilities and (v) 15 Specialty Hospitals and Other facilities), 12 investments in loans receivable (consisting of two mortgage loans and 10 other loans), five preferred equity investments and two investments in unconsolidated joint ventures.

See Also

Before you consider Sabra Health Care REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sabra Health Care REIT wasn't on the list.

While Sabra Health Care REIT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.