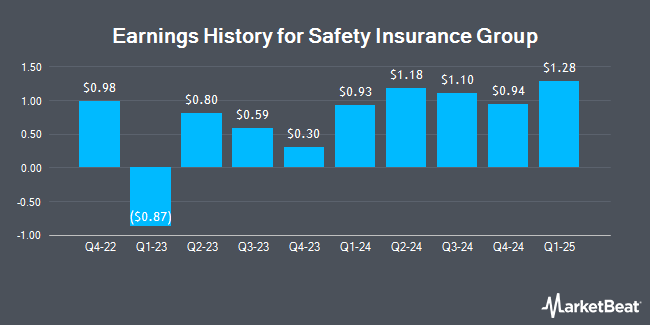

Safety Insurance Group (NASDAQ:SAFT - Get Free Report) will likely be announcing its earnings results before the market opens on Tuesday, February 25th. Analysts expect the company to announce earnings of $1.17 per share for the quarter.

Safety Insurance Group Price Performance

Shares of NASDAQ:SAFT traded up $0.14 on Friday, reaching $77.75. 42,929 shares of the company traded hands, compared to its average volume of 41,092. Safety Insurance Group has a fifty-two week low of $73.38 and a fifty-two week high of $90.00. The company's 50 day moving average is $79.89 and its 200-day moving average is $81.88. The stock has a market capitalization of $1.15 billion, a PE ratio of 15.40 and a beta of 0.20.

Safety Insurance Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, March 14th. Shareholders of record on Monday, March 3rd will be paid a dividend of $0.90 per share. This represents a $3.60 annualized dividend and a yield of 4.63%. The ex-dividend date is Monday, March 3rd. Safety Insurance Group's dividend payout ratio (DPR) is currently 71.29%.

Analyst Ratings Changes

Separately, StockNews.com raised shares of Safety Insurance Group from a "hold" rating to a "buy" rating in a research note on Thursday, November 14th.

Read Our Latest Analysis on Safety Insurance Group

About Safety Insurance Group

(

Get Free Report)

Safety Insurance Group, Inc provides private passenger and commercial automobile, and homeowner insurance in the United States. The company's private passenger automobile policies offer coverage for bodily injury and property damage to others, no-fault personal injury coverage for the insured/insured's car occupants, and physical damage coverage for an insured's own vehicle for collision or other perils.

Further Reading

Before you consider Safety Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Safety Insurance Group wasn't on the list.

While Safety Insurance Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.