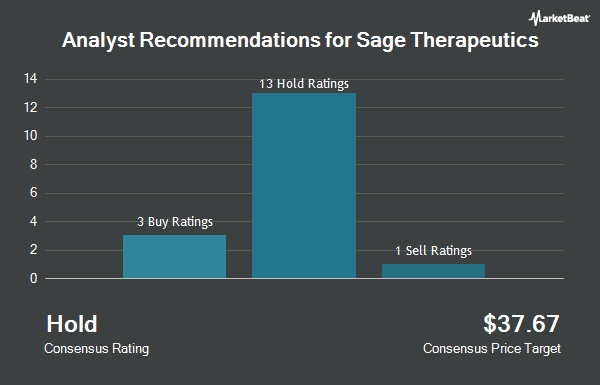

Shares of Sage Therapeutics, Inc. (NASDAQ:SAGE - Get Free Report) have been assigned a consensus rating of "Hold" from the twenty analysts that are covering the firm, MarketBeat Ratings reports. Two research analysts have rated the stock with a sell rating, sixteen have issued a hold rating and two have issued a buy rating on the company. The average 12-month price target among analysts that have issued a report on the stock in the last year is $11.53.

A number of brokerages have recently commented on SAGE. Bank of America cut their price objective on shares of Sage Therapeutics from $11.00 to $6.00 and set an "underperform" rating on the stock in a research report on Wednesday, October 9th. StockNews.com cut Sage Therapeutics from a "hold" rating to a "sell" rating in a report on Thursday, October 31st. HC Wainwright reiterated a "neutral" rating and set a $14.00 target price on shares of Sage Therapeutics in a report on Wednesday, November 20th. Wedbush decreased their price target on Sage Therapeutics from $9.00 to $8.00 and set a "neutral" rating for the company in a research note on Wednesday, October 9th. Finally, Piper Sandler reiterated an "overweight" rating and set a $26.00 price objective (down previously from $52.00) on shares of Sage Therapeutics in a research note on Wednesday, October 30th.

Get Our Latest Analysis on Sage Therapeutics

Sage Therapeutics Stock Down 1.4 %

Shares of NASDAQ:SAGE opened at $5.27 on Wednesday. The company's fifty day simple moving average is $6.15 and its 200 day simple moving average is $8.26. The firm has a market cap of $322.38 million, a price-to-earnings ratio of -0.94 and a beta of 0.87. Sage Therapeutics has a 12 month low of $4.62 and a 12 month high of $28.26.

Sage Therapeutics (NASDAQ:SAGE - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The biopharmaceutical company reported ($1.53) earnings per share for the quarter, missing the consensus estimate of ($1.52) by ($0.01). The firm had revenue of $11.87 million for the quarter, compared to analyst estimates of $10.80 million. Sage Therapeutics had a negative return on equity of 50.29% and a negative net margin of 317.29%. The firm's quarterly revenue was up 337.1% on a year-over-year basis. During the same period in the prior year, the company earned ($2.81) earnings per share. Research analysts expect that Sage Therapeutics will post -6.53 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Sage Therapeutics

Institutional investors have recently modified their holdings of the business. Federated Hermes Inc. acquired a new stake in Sage Therapeutics in the 2nd quarter worth about $7,281,000. Renaissance Technologies LLC raised its position in shares of Sage Therapeutics by 1,476.6% in the second quarter. Renaissance Technologies LLC now owns 553,396 shares of the biopharmaceutical company's stock valued at $6,010,000 after buying an additional 518,296 shares in the last quarter. State Street Corp boosted its stake in shares of Sage Therapeutics by 18.2% in the third quarter. State Street Corp now owns 2,926,239 shares of the biopharmaceutical company's stock valued at $21,127,000 after buying an additional 451,377 shares during the period. Cubist Systematic Strategies LLC grew its position in Sage Therapeutics by 831.2% during the second quarter. Cubist Systematic Strategies LLC now owns 489,089 shares of the biopharmaceutical company's stock worth $5,312,000 after buying an additional 436,566 shares in the last quarter. Finally, Squarepoint Ops LLC increased its stake in Sage Therapeutics by 1,112.0% during the 2nd quarter. Squarepoint Ops LLC now owns 313,407 shares of the biopharmaceutical company's stock worth $3,404,000 after acquiring an additional 287,549 shares during the period. Institutional investors own 99.22% of the company's stock.

About Sage Therapeutics

(

Get Free ReportSage Therapeutics, Inc, a biopharmaceutical company, develops and commercializes brain health medicines. Its product candidates include ZULRESSO, a CIV injection for the treatment of postpartum depression (PPD) in adults; and ZURZUVAE, a neuroactive steroid, a positive allosteric modulator of GABAA receptors, targeting both synaptic and extrasynaptic GABAA receptors, for the treatment of postpartum depression.

Recommended Stories

Before you consider Sage Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sage Therapeutics wasn't on the list.

While Sage Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.