Sagimet Biosciences (NASDAQ:SGMT - Get Free Report)'s stock had its "buy" rating restated by stock analysts at HC Wainwright in a research report issued to clients and investors on Friday,Benzinga reports. They presently have a $32.00 target price on the stock.

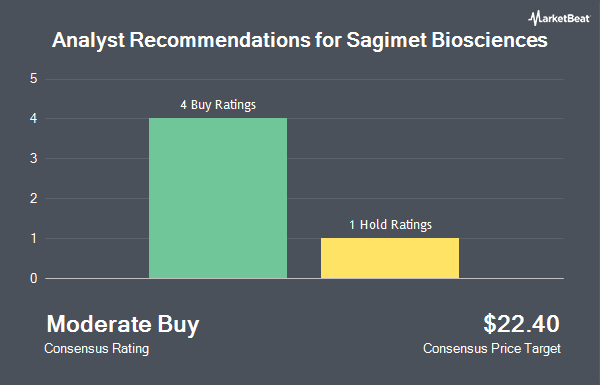

A number of other equities research analysts have also weighed in on the company. JMP Securities cut their price objective on Sagimet Biosciences from $48.00 to $32.00 and set a "market outperform" rating on the stock in a research report on Thursday, August 15th. UBS Group assumed coverage on shares of Sagimet Biosciences in a report on Tuesday. They issued a "buy" rating and a $12.00 price target on the stock. One analyst has rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $21.60.

Get Our Latest Research Report on SGMT

Sagimet Biosciences Trading Down 8.7 %

SGMT traded down $0.45 during trading on Friday, hitting $4.73. 837,486 shares of the stock traded hands, compared to its average volume of 1,113,555. Sagimet Biosciences has a 12-month low of $2.25 and a 12-month high of $20.71. The firm has a 50-day moving average of $4.52 and a 200 day moving average of $4.01.

Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) last posted its earnings results on Wednesday, August 14th. The company reported ($0.25) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.34) by $0.09. On average, research analysts anticipate that Sagimet Biosciences will post -1.56 EPS for the current year.

Institutional Investors Weigh In On Sagimet Biosciences

Several hedge funds have recently made changes to their positions in SGMT. Barclays PLC grew its stake in Sagimet Biosciences by 14.3% in the third quarter. Barclays PLC now owns 57,230 shares of the company's stock worth $159,000 after purchasing an additional 7,178 shares during the period. American International Group Inc. grew its position in shares of Sagimet Biosciences by 312.0% in the 1st quarter. American International Group Inc. now owns 11,372 shares of the company's stock worth $62,000 after buying an additional 8,612 shares during the period. O Shaughnessy Asset Management LLC bought a new position in shares of Sagimet Biosciences in the 1st quarter worth about $72,000. ORG Partners LLC purchased a new position in Sagimet Biosciences during the 2nd quarter valued at about $43,000. Finally, Federated Hermes Inc. boosted its stake in Sagimet Biosciences by 25.9% during the second quarter. Federated Hermes Inc. now owns 68,000 shares of the company's stock worth $233,000 after acquiring an additional 14,000 shares in the last quarter. 87.86% of the stock is currently owned by institutional investors.

Sagimet Biosciences Company Profile

(

Get Free Report)

Sagimet Biosciences Inc, a clinical-stage biopharmaceutical company, develops therapeutics called fatty acid synthase (FASN) inhibitors for the treatment of diseases that result from dysfunctional metabolic pathways in the United States. The company's lead drug candidate is Denifanstat, a once-daily pill and selective FASN inhibitor for the treatment of metabolic dysfunction associated steatohepatitis.

Recommended Stories

Before you consider Sagimet Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sagimet Biosciences wasn't on the list.

While Sagimet Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.