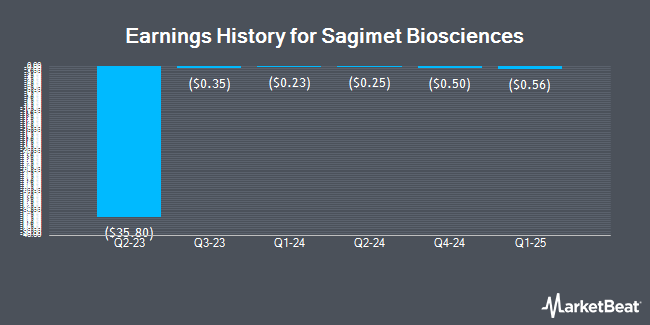

Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) is expected to post its quarterly earnings results before the market opens on Monday, March 24th. Analysts expect Sagimet Biosciences to post earnings of ($0.65) per share for the quarter.

Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) last released its earnings results on Wednesday, March 12th. The company reported ($0.50) EPS for the quarter, beating analysts' consensus estimates of ($0.65) by $0.15. On average, analysts expect Sagimet Biosciences to post $-2 EPS for the current fiscal year and $-4 EPS for the next fiscal year.

Sagimet Biosciences Stock Up 4.4 %

NASDAQ:SGMT traded up $0.17 during midday trading on Thursday, hitting $4.02. The stock had a trading volume of 259,982 shares, compared to its average volume of 860,055. The company has a market capitalization of $123.31 million, a price-to-earnings ratio of -2.81 and a beta of 2.57. The stock has a 50-day moving average of $4.15 and a 200 day moving average of $4.47. Sagimet Biosciences has a one year low of $2.39 and a one year high of $7.38.

Analyst Upgrades and Downgrades

A number of equities analysts recently issued reports on SGMT shares. Oppenheimer assumed coverage on Sagimet Biosciences in a research note on Friday, December 6th. They issued an "outperform" rating and a $30.00 target price for the company. HC Wainwright restated a "buy" rating and set a $32.00 target price on shares of Sagimet Biosciences in a research report on Tuesday, March 11th. One analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $23.00.

View Our Latest Report on SGMT

About Sagimet Biosciences

(

Get Free Report)

Sagimet Biosciences Inc, a clinical-stage biopharmaceutical company, develops therapeutics called fatty acid synthase (FASN) inhibitors for the treatment of diseases that result from dysfunctional metabolic pathways in the United States. The company's lead drug candidate is Denifanstat, a once-daily pill and selective FASN inhibitor for the treatment of metabolic dysfunction associated steatohepatitis.

Featured Stories

Before you consider Sagimet Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sagimet Biosciences wasn't on the list.

While Sagimet Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.