Salesforce (NYSE:CRM - Get Free Report)'s stock had its "outperform" rating reiterated by analysts at Wedbush in a research report issued on Wednesday,Benzinga reports. They currently have a $425.00 target price on the CRM provider's stock. Wedbush's target price suggests a potential upside of 26.03% from the stock's current price.

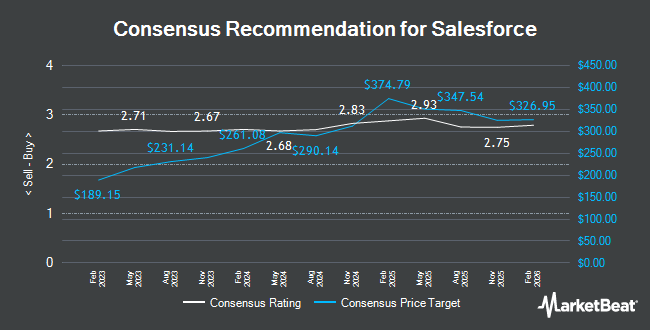

Several other equities analysts have also issued reports on CRM. Robert W. Baird boosted their price target on shares of Salesforce from $340.00 to $430.00 and gave the company an "outperform" rating in a report on Wednesday, December 4th. UBS Group upped their target price on shares of Salesforce from $275.00 to $360.00 and gave the stock a "neutral" rating in a research note on Friday, November 22nd. Barclays upped their target price on shares of Salesforce from $415.00 to $425.00 and gave the stock an "overweight" rating in a research note on Wednesday, December 4th. Evercore ISI reaffirmed an "outperform" rating and issued a $300.00 target price on shares of Salesforce in a research note on Monday, August 26th. Finally, KeyCorp raised shares of Salesforce from a "sector weight" rating to an "overweight" rating and set a $440.00 target price for the company in a research note on Friday, December 13th. Eight analysts have rated the stock with a hold rating, thirty have given a buy rating and four have assigned a strong buy rating to the stock. Based on data from MarketBeat, Salesforce currently has an average rating of "Moderate Buy" and a consensus target price of $378.86.

Read Our Latest Stock Analysis on Salesforce

Salesforce Trading Down 3.9 %

CRM stock traded down $13.74 during trading on Wednesday, hitting $337.23. The company had a trading volume of 8,357,266 shares, compared to its average volume of 6,413,732. The company has a quick ratio of 1.11, a current ratio of 1.11 and a debt-to-equity ratio of 0.14. The firm has a 50-day moving average price of $320.12 and a 200-day moving average price of $277.44. Salesforce has a 12 month low of $212.00 and a 12 month high of $369.00. The stock has a market cap of $322.73 billion, a price-to-earnings ratio of 55.47, a PEG ratio of 3.21 and a beta of 1.30.

Salesforce (NYSE:CRM - Get Free Report) last posted its quarterly earnings data on Tuesday, December 3rd. The CRM provider reported $2.41 earnings per share for the quarter, missing the consensus estimate of $2.44 by ($0.03). The company had revenue of $9.44 billion during the quarter, compared to the consensus estimate of $9.35 billion. Salesforce had a return on equity of 12.34% and a net margin of 15.96%. The business's revenue for the quarter was up 8.3% on a year-over-year basis. During the same quarter last year, the firm earned $1.62 EPS. As a group, analysts predict that Salesforce will post 7.48 earnings per share for the current year.

Insider Transactions at Salesforce

In other news, insider Miguel Milano sold 719 shares of the company's stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $342.81, for a total transaction of $246,480.39. Following the sale, the insider now directly owns 4,659 shares in the company, valued at $1,597,151.79. This represents a 13.37 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, COO Brian Millham sold 14,808 shares of the company's stock in a transaction dated Friday, November 22nd. The shares were sold at an average price of $338.95, for a total value of $5,019,171.60. The disclosure for this sale can be found here. Insiders have sold 134,298 shares of company stock worth $39,903,781 in the last ninety days. Company insiders own 3.20% of the company's stock.

Institutional Investors Weigh In On Salesforce

Several hedge funds have recently bought and sold shares of the stock. Aviance Capital Partners LLC boosted its stake in Salesforce by 0.5% during the third quarter. Aviance Capital Partners LLC now owns 6,797 shares of the CRM provider's stock worth $1,860,000 after buying an additional 33 shares during the last quarter. EWA LLC lifted its stake in shares of Salesforce by 1.7% in the 3rd quarter. EWA LLC now owns 2,001 shares of the CRM provider's stock valued at $548,000 after purchasing an additional 33 shares during the last quarter. Umpqua Bank raised its holdings in shares of Salesforce by 0.4% in the 3rd quarter. Umpqua Bank now owns 7,708 shares of the CRM provider's stock valued at $2,110,000 after buying an additional 34 shares during the period. Principal Street Partners LLC raised its holdings in shares of Salesforce by 1.0% in the 3rd quarter. Principal Street Partners LLC now owns 3,297 shares of the CRM provider's stock valued at $891,000 after buying an additional 34 shares during the period. Finally, Nvwm LLC raised its holdings in shares of Salesforce by 1.4% in the 3rd quarter. Nvwm LLC now owns 2,565 shares of the CRM provider's stock valued at $667,000 after buying an additional 36 shares during the period. 80.43% of the stock is currently owned by institutional investors.

About Salesforce

(

Get Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Featured Stories

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.