Samlyn Capital LLC cut its position in Microsoft Co. (NASDAQ:MSFT - Free Report) by 12.7% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 516,141 shares of the software giant's stock after selling 75,258 shares during the quarter. Microsoft accounts for about 3.8% of Samlyn Capital LLC's portfolio, making the stock its 4th largest holding. Samlyn Capital LLC's holdings in Microsoft were worth $230,689,000 at the end of the most recent reporting period.

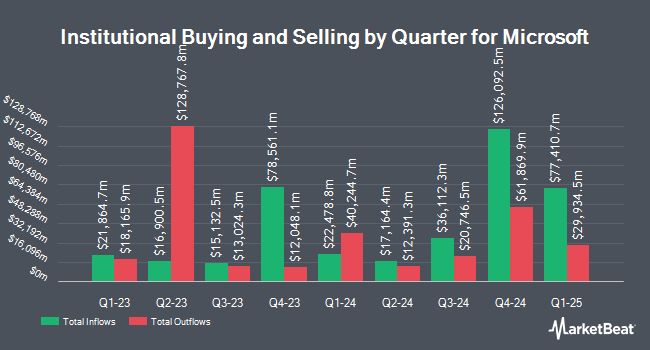

Other institutional investors and hedge funds also recently made changes to their positions in the company. Stanley Capital Management LLC acquired a new stake in shares of Microsoft during the 2nd quarter valued at $6,568,000. Morse Asset Management Inc grew its holdings in shares of Microsoft by 5.5% during the second quarter. Morse Asset Management Inc now owns 47,343 shares of the software giant's stock worth $21,160,000 after purchasing an additional 2,473 shares during the last quarter. Interval Partners LP increased its stake in shares of Microsoft by 14,401.7% in the second quarter. Interval Partners LP now owns 8,701 shares of the software giant's stock valued at $3,889,000 after buying an additional 8,641 shares during the period. American Investment Services Inc. raised its holdings in Microsoft by 43.4% in the 2nd quarter. American Investment Services Inc. now owns 1,057 shares of the software giant's stock valued at $472,000 after buying an additional 320 shares during the last quarter. Finally, Tairen Capital Ltd boosted its position in Microsoft by 557.8% during the 2nd quarter. Tairen Capital Ltd now owns 1,079,109 shares of the software giant's stock worth $482,308,000 after buying an additional 915,058 shares during the period. Institutional investors own 71.13% of the company's stock.

Insider Activity at Microsoft

In other news, CEO Satya Nadella sold 14,398 shares of Microsoft stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $417.41, for a total transaction of $6,009,869.18. Following the completion of the sale, the chief executive officer now directly owns 786,933 shares of the company's stock, valued at approximately $328,473,703.53. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In related news, insider Bradford L. Smith sold 40,000 shares of the stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $402.59, for a total transaction of $16,103,600.00. Following the completion of the sale, the insider now directly owns 544,847 shares in the company, valued at $219,349,953.73. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO Satya Nadella sold 14,398 shares of the stock in a transaction that occurred on Friday, August 23rd. The shares were sold at an average price of $417.41, for a total value of $6,009,869.18. Following the sale, the chief executive officer now directly owns 786,933 shares of the company's stock, valued at approximately $328,473,703.53. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 190,629 shares of company stock valued at $77,916,485 over the last three months. 0.03% of the stock is owned by corporate insiders.

Analyst Ratings Changes

MSFT has been the topic of a number of recent research reports. UBS Group cut their price target on shares of Microsoft from $510.00 to $500.00 and set a "buy" rating on the stock in a report on Thursday, October 31st. Mizuho increased their price objective on shares of Microsoft from $450.00 to $480.00 and gave the stock an "outperform" rating in a research report on Tuesday, July 16th. Piper Sandler reaffirmed an "overweight" rating and set a $470.00 price target on shares of Microsoft in a research report on Thursday, October 31st. BMO Capital Markets lowered their price objective on Microsoft from $500.00 to $495.00 and set an "outperform" rating for the company in a research report on Thursday, October 31st. Finally, Morgan Stanley raised their target price on Microsoft from $506.00 to $548.00 and gave the stock an "overweight" rating in a research note on Thursday, October 31st. One investment analyst has rated the stock with a sell rating, three have given a hold rating and twenty-six have issued a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $503.03.

Check Out Our Latest Stock Analysis on MSFT

Microsoft Stock Performance

Shares of NASDAQ MSFT traded down $2.89 during mid-day trading on Friday, hitting $422.54. The company had a trading volume of 16,891,414 shares, compared to its average volume of 20,265,076. The company has a current ratio of 1.30, a quick ratio of 1.29 and a debt-to-equity ratio of 0.15. Microsoft Co. has a 1 year low of $360.36 and a 1 year high of $468.35. The company has a market capitalization of $3.14 trillion, a price-to-earnings ratio of 34.86, a P/E/G ratio of 2.23 and a beta of 0.91. The stock's 50-day moving average price is $421.09 and its 200-day moving average price is $425.07.

Microsoft (NASDAQ:MSFT - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The software giant reported $3.30 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.10 by $0.20. Microsoft had a net margin of 35.61% and a return on equity of 34.56%. The firm had revenue of $65.59 billion for the quarter, compared to the consensus estimate of $64.57 billion. During the same period in the prior year, the firm posted $2.99 earnings per share. The company's revenue for the quarter was up 16.0% on a year-over-year basis. On average, sell-side analysts forecast that Microsoft Co. will post 12.94 earnings per share for the current year.

Microsoft announced that its Board of Directors has initiated a share repurchase program on Monday, September 16th that permits the company to repurchase $60.00 billion in outstanding shares. This repurchase authorization permits the software giant to buy up to 1.9% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's leadership believes its shares are undervalued.

Microsoft Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Thursday, November 21st will be paid a $0.83 dividend. This is a positive change from Microsoft's previous quarterly dividend of $0.75. This represents a $3.32 dividend on an annualized basis and a yield of 0.79%. The ex-dividend date of this dividend is Thursday, November 21st. Microsoft's dividend payout ratio is currently 24.75%.

Microsoft Company Profile

(

Free Report)

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

Featured Articles

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report