Sanctuary Advisors LLC reduced its holdings in Vail Resorts, Inc. (NYSE:MTN - Free Report) by 65.5% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 6,967 shares of the company's stock after selling 13,251 shares during the period. Sanctuary Advisors LLC's holdings in Vail Resorts were worth $1,284,000 as of its most recent filing with the Securities & Exchange Commission.

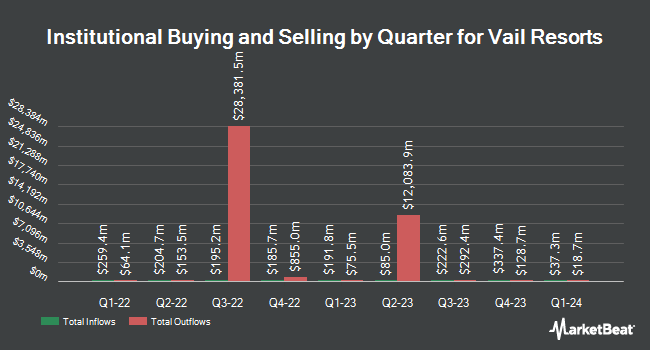

Other large investors have also recently made changes to their positions in the company. The Manufacturers Life Insurance Company boosted its stake in Vail Resorts by 673.1% during the second quarter. The Manufacturers Life Insurance Company now owns 635,546 shares of the company's stock worth $114,481,000 after buying an additional 553,337 shares during the period. First Pacific Advisors LP purchased a new position in shares of Vail Resorts during the 2nd quarter worth about $62,466,000. River Road Asset Management LLC grew its holdings in Vail Resorts by 606.6% during the 3rd quarter. River Road Asset Management LLC now owns 341,311 shares of the company's stock valued at $59,487,000 after purchasing an additional 293,006 shares during the last quarter. Point72 Asset Management L.P. bought a new position in Vail Resorts during the 3rd quarter valued at about $35,264,000. Finally, FMR LLC lifted its stake in Vail Resorts by 1,080.8% in the third quarter. FMR LLC now owns 207,809 shares of the company's stock worth $36,219,000 after purchasing an additional 190,210 shares during the last quarter. 94.94% of the stock is currently owned by institutional investors.

Insider Transactions at Vail Resorts

In other news, insider Robert A. Katz sold 9,296 shares of the stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $175.98, for a total transaction of $1,635,910.08. Following the completion of the sale, the insider now owns 245,961 shares in the company, valued at approximately $43,284,216.78. This represents a 3.64 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO Angela A. Korch bought 165 shares of the company's stock in a transaction that occurred on Thursday, October 3rd. The shares were acquired at an average price of $173.09 per share, for a total transaction of $28,559.85. Following the completion of the purchase, the chief financial officer now owns 2,187 shares in the company, valued at $378,547.83. The trade was a 8.16 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 1.20% of the company's stock.

Vail Resorts Stock Up 1.4 %

NYSE:MTN traded up $2.59 during trading hours on Friday, reaching $184.32. The company's stock had a trading volume of 1,006,909 shares, compared to its average volume of 532,595. The company has a debt-to-equity ratio of 3.64, a quick ratio of 0.71 and a current ratio of 0.63. The company has a market capitalization of $6.90 billion, a P/E ratio of 30.62, a price-to-earnings-growth ratio of 2.22 and a beta of 1.14. The stock has a 50 day moving average price of $178.77 and a two-hundred day moving average price of $178.75. Vail Resorts, Inc. has a 12 month low of $165.00 and a 12 month high of $236.92.

Vail Resorts (NYSE:MTN - Get Free Report) last issued its quarterly earnings data on Monday, December 9th. The company reported ($4.61) earnings per share for the quarter, topping analysts' consensus estimates of ($4.99) by $0.38. Vail Resorts had a return on equity of 21.90% and a net margin of 8.07%. The firm had revenue of $260.28 million during the quarter, compared to analysts' expectations of $251.45 million. During the same period in the prior year, the business posted ($4.60) EPS. The firm's quarterly revenue was up .7% on a year-over-year basis. Equities analysts predict that Vail Resorts, Inc. will post 7.49 EPS for the current fiscal year.

Vail Resorts Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Stockholders of record on Thursday, December 26th will be issued a $2.22 dividend. This represents a $8.88 dividend on an annualized basis and a dividend yield of 4.82%. The ex-dividend date of this dividend is Thursday, December 26th. Vail Resorts's dividend payout ratio is currently 147.51%.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on MTN shares. Morgan Stanley upped their target price on Vail Resorts from $182.00 to $197.00 and gave the company an "equal weight" rating in a research note on Tuesday, December 10th. Truist Financial cut their price objective on Vail Resorts from $250.00 to $247.00 and set a "buy" rating on the stock in a research report on Tuesday, December 10th. Macquarie lifted their target price on Vail Resorts from $180.00 to $195.00 and gave the stock a "neutral" rating in a research report on Wednesday, December 11th. Deutsche Bank Aktiengesellschaft upped their price target on shares of Vail Resorts from $185.00 to $196.00 and gave the stock a "hold" rating in a report on Monday, December 9th. Finally, UBS Group initiated coverage on shares of Vail Resorts in a research report on Thursday, November 14th. They issued a "neutral" rating and a $185.00 price objective for the company. Two research analysts have rated the stock with a sell rating, six have given a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $205.50.

Check Out Our Latest Analysis on Vail Resorts

Vail Resorts Profile

(

Free Report)

Vail Resorts, Inc, through its subsidiaries, operates mountain resorts and regional ski areas in the United States. It operates through three segments: Mountain, Lodging, and Real Estate. The Mountain segment operates 41 destination mountain resorts and regional ski areas. This segment is also involved in the ancillary activities, including ski school, dining, and retail/rental operations, as well as real estate brokerage activities.

Read More

Before you consider Vail Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vail Resorts wasn't on the list.

While Vail Resorts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.