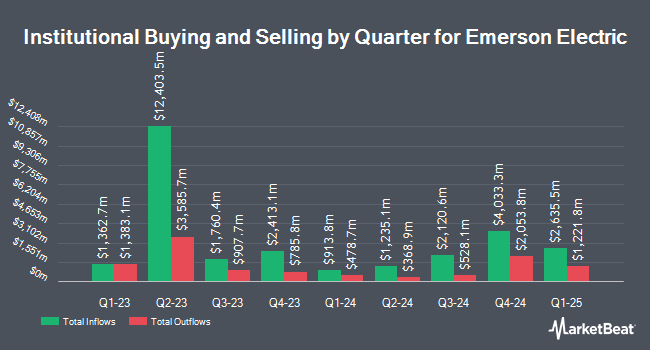

Sanctuary Advisors LLC lowered its holdings in shares of Emerson Electric Co. (NYSE:EMR - Free Report) by 1.9% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 234,174 shares of the industrial products company's stock after selling 4,479 shares during the period. Sanctuary Advisors LLC's holdings in Emerson Electric were worth $30,546,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds also recently made changes to their positions in EMR. GDS Wealth Management increased its position in shares of Emerson Electric by 2.0% in the fourth quarter. GDS Wealth Management now owns 3,965 shares of the industrial products company's stock worth $491,000 after purchasing an additional 79 shares during the period. Berkshire Bank increased its position in shares of Emerson Electric by 3.6% in the fourth quarter. Berkshire Bank now owns 2,588 shares of the industrial products company's stock worth $321,000 after purchasing an additional 89 shares during the period. Little House Capital LLC increased its position in shares of Emerson Electric by 0.5% in the fourth quarter. Little House Capital LLC now owns 17,009 shares of the industrial products company's stock worth $2,108,000 after purchasing an additional 89 shares during the period. Grove Bank & Trust increased its position in shares of Emerson Electric by 5.4% in the fourth quarter. Grove Bank & Trust now owns 1,749 shares of the industrial products company's stock worth $217,000 after purchasing an additional 90 shares during the period. Finally, Silver Lake Advisory LLC increased its position in shares of Emerson Electric by 0.4% in the fourth quarter. Silver Lake Advisory LLC now owns 24,249 shares of the industrial products company's stock worth $3,005,000 after purchasing an additional 90 shares during the period. Institutional investors and hedge funds own 74.30% of the company's stock.

Wall Street Analysts Forecast Growth

EMR has been the topic of several research analyst reports. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $138.00 price objective on shares of Emerson Electric in a research note on Thursday, February 6th. Deutsche Bank Aktiengesellschaft raised their price objective on Emerson Electric from $136.00 to $140.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. UBS Group initiated coverage on Emerson Electric in a research note on Wednesday, November 13th. They issued a "neutral" rating and a $135.00 price objective on the stock. Robert W. Baird raised their price objective on Emerson Electric from $117.00 to $118.00 and gave the company a "neutral" rating in a research note on Monday, November 4th. Finally, KeyCorp raised their price objective on Emerson Electric from $140.00 to $158.00 and gave the company an "overweight" rating in a research note on Monday, December 9th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, fifteen have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $136.90.

Check Out Our Latest Research Report on EMR

Emerson Electric Trading Down 0.7 %

Shares of Emerson Electric stock traded down $0.89 during midday trading on Wednesday, reaching $124.12. The company had a trading volume of 1,112,641 shares, compared to its average volume of 2,894,785. The stock has a fifty day moving average price of $125.51 and a 200 day moving average price of $117.30. The company has a debt-to-equity ratio of 0.25, a current ratio of 1.54 and a quick ratio of 1.17. The firm has a market cap of $69.99 billion, a PE ratio of 29.66, a P/E/G ratio of 2.46 and a beta of 1.34. Emerson Electric Co. has a fifty-two week low of $96.62 and a fifty-two week high of $134.85.

Emerson Electric (NYSE:EMR - Get Free Report) last posted its quarterly earnings data on Wednesday, February 5th. The industrial products company reported $1.38 EPS for the quarter, topping analysts' consensus estimates of $1.28 by $0.10. Emerson Electric had a return on equity of 12.08% and a net margin of 13.74%. On average, equities analysts anticipate that Emerson Electric Co. will post 5.96 earnings per share for the current year.

Emerson Electric Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, March 10th. Shareholders of record on Friday, February 14th will be issued a $0.5275 dividend. The ex-dividend date is Friday, February 14th. This represents a $2.11 dividend on an annualized basis and a yield of 1.70%. Emerson Electric's payout ratio is currently 50.36%.

About Emerson Electric

(

Free Report)

Emerson Electric Co, a technology and software company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe. It operates in six segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity.

Featured Stories

Before you consider Emerson Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emerson Electric wasn't on the list.

While Emerson Electric currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.