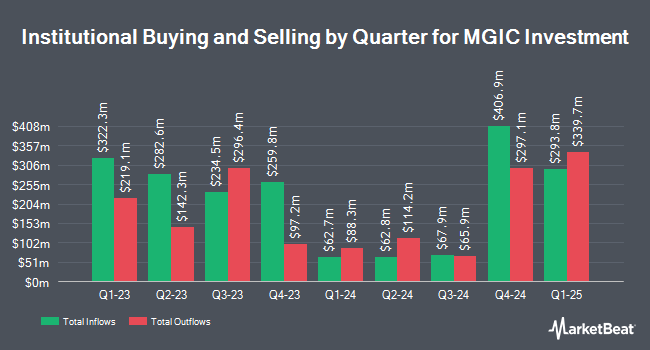

Sanctuary Advisors LLC lifted its holdings in shares of MGIC Investment Co. (NYSE:MTG - Free Report) by 395.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 150,637 shares of the insurance provider's stock after buying an additional 120,257 shares during the quarter. Sanctuary Advisors LLC owned about 0.06% of MGIC Investment worth $3,841,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds have also modified their holdings of MTG. Dimensional Fund Advisors LP increased its position in shares of MGIC Investment by 3.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 15,145,206 shares of the insurance provider's stock worth $326,375,000 after purchasing an additional 556,859 shares during the last quarter. State Street Corp raised its position in MGIC Investment by 0.8% during the third quarter. State Street Corp now owns 9,092,453 shares of the insurance provider's stock worth $232,767,000 after acquiring an additional 73,851 shares in the last quarter. American Century Companies Inc. lifted its stake in MGIC Investment by 1.5% in the second quarter. American Century Companies Inc. now owns 3,395,208 shares of the insurance provider's stock valued at $73,167,000 after acquiring an additional 50,307 shares during the last quarter. Los Angeles Capital Management LLC increased its stake in shares of MGIC Investment by 0.3% during the 2nd quarter. Los Angeles Capital Management LLC now owns 1,438,727 shares of the insurance provider's stock worth $31,005,000 after purchasing an additional 4,602 shares during the last quarter. Finally, Vest Financial LLC raised its holdings in shares of MGIC Investment by 3.7% in the 3rd quarter. Vest Financial LLC now owns 1,113,258 shares of the insurance provider's stock valued at $28,499,000 after purchasing an additional 39,502 shares during the period. 95.58% of the stock is owned by institutional investors.

Analysts Set New Price Targets

MTG has been the topic of several research analyst reports. Keefe, Bruyette & Woods restated a "market perform" rating and issued a $29.00 price objective on shares of MGIC Investment in a research note on Tuesday, December 10th. Barclays raised their price target on MGIC Investment from $23.00 to $24.00 and gave the company an "equal weight" rating in a report on Tuesday, October 8th. Royal Bank of Canada decreased their price objective on shares of MGIC Investment from $28.00 to $27.00 and set a "sector perform" rating on the stock in a report on Wednesday, November 6th. Finally, Bank of America lowered shares of MGIC Investment from a "buy" rating to an "underperform" rating and decreased their price target for the company from $26.00 to $25.00 in a research note on Monday, December 9th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, MGIC Investment currently has a consensus rating of "Hold" and an average target price of $26.00.

Read Our Latest Stock Report on MGIC Investment

MGIC Investment Stock Performance

Shares of NYSE:MTG traded down $0.41 on Tuesday, reaching $24.29. 1,282,797 shares of the company's stock were exchanged, compared to its average volume of 1,730,999. MGIC Investment Co. has a twelve month low of $18.68 and a twelve month high of $26.56. The company has a fifty day moving average of $25.21 and a 200-day moving average of $24.08. The company has a market capitalization of $6.15 billion, a price-to-earnings ratio of 8.70, a PEG ratio of 1.77 and a beta of 1.27. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 0.12.

MGIC Investment (NYSE:MTG - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The insurance provider reported $0.77 EPS for the quarter, topping analysts' consensus estimates of $0.66 by $0.11. The firm had revenue of $306.65 million for the quarter, compared to analyst estimates of $306.03 million. MGIC Investment had a return on equity of 14.99% and a net margin of 64.09%. The company's revenue was up 3.4% on a year-over-year basis. During the same quarter last year, the company earned $0.64 EPS. On average, research analysts predict that MGIC Investment Co. will post 2.85 EPS for the current fiscal year.

MGIC Investment Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, November 21st. Investors of record on Thursday, November 7th were given a dividend of $0.13 per share. The ex-dividend date of this dividend was Thursday, November 7th. This represents a $0.52 annualized dividend and a yield of 2.14%. MGIC Investment's dividend payout ratio is 18.31%.

MGIC Investment Company Profile

(

Free Report)

MGIC Investment Corporation, through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services to lenders and government sponsored entities in the United States, the District of Columbia, Puerto Rico, and Guam. The company offers primary mortgage insurance that provides mortgage default protection on individual loans, as well as covers unpaid loan principal, delinquent interest, and various expenses associated with the default and subsequent foreclosure.

Featured Articles

Before you consider MGIC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGIC Investment wasn't on the list.

While MGIC Investment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.