Sanctuary Advisors LLC lifted its stake in shares of Howmet Aerospace Inc. (NYSE:HWM - Free Report) by 49.1% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 29,460 shares of the company's stock after buying an additional 9,707 shares during the quarter. Sanctuary Advisors LLC's holdings in Howmet Aerospace were worth $2,953,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

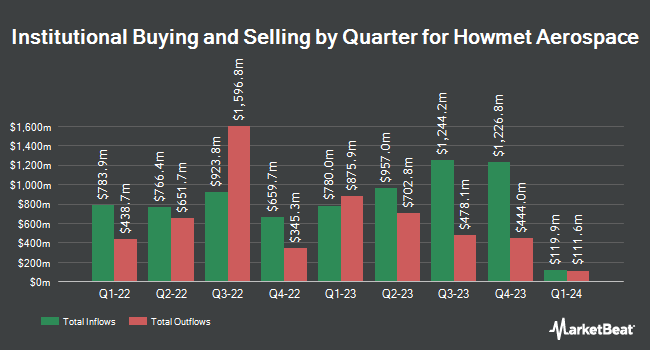

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Neo Ivy Capital Management purchased a new position in shares of Howmet Aerospace during the third quarter valued at about $2,420,000. Coldstream Capital Management Inc. increased its position in shares of Howmet Aerospace by 11.5% during the third quarter. Coldstream Capital Management Inc. now owns 6,746 shares of the company's stock valued at $686,000 after buying an additional 695 shares during the period. Geode Capital Management LLC increased its position in shares of Howmet Aerospace by 5.0% during the third quarter. Geode Capital Management LLC now owns 9,502,223 shares of the company's stock valued at $949,382,000 after buying an additional 453,275 shares during the period. M&T Bank Corp grew its holdings in Howmet Aerospace by 16.4% in the third quarter. M&T Bank Corp now owns 31,695 shares of the company's stock worth $3,177,000 after purchasing an additional 4,461 shares during the period. Finally, LRI Investments LLC grew its holdings in Howmet Aerospace by 57.3% in the third quarter. LRI Investments LLC now owns 2,505 shares of the company's stock worth $251,000 after purchasing an additional 913 shares during the period. Hedge funds and other institutional investors own 90.46% of the company's stock.

Howmet Aerospace Stock Performance

Howmet Aerospace stock traded down $4.24 during midday trading on Wednesday, reaching $107.69. 2,447,633 shares of the company traded hands, compared to its average volume of 2,891,179. The firm has a market capitalization of $43.75 billion, a price-to-earnings ratio of 41.10, a price-to-earnings-growth ratio of 1.56 and a beta of 1.48. The business has a 50 day moving average of $110.50 and a two-hundred day moving average of $96.63. Howmet Aerospace Inc. has a 12 month low of $52.56 and a 12 month high of $120.71. The company has a debt-to-equity ratio of 0.76, a current ratio of 2.24 and a quick ratio of 0.98.

Howmet Aerospace Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, November 25th. Investors of record on Friday, November 8th were given a dividend of $0.08 per share. The ex-dividend date was Friday, November 8th. This represents a $0.32 dividend on an annualized basis and a yield of 0.30%. Howmet Aerospace's dividend payout ratio (DPR) is 12.21%.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on HWM. Deutsche Bank Aktiengesellschaft upped their price objective on shares of Howmet Aerospace from $106.00 to $125.00 and gave the stock a "buy" rating in a report on Thursday, October 3rd. Susquehanna upped their price objective on shares of Howmet Aerospace from $120.00 to $132.00 and gave the stock a "positive" rating in a report on Thursday, November 7th. Barclays upped their price objective on shares of Howmet Aerospace from $100.00 to $130.00 and gave the stock an "overweight" rating in a report on Monday, November 11th. Bank of America upped their price objective on shares of Howmet Aerospace from $100.00 to $135.00 and gave the stock a "buy" rating in a report on Wednesday, November 13th. Finally, KeyCorp cut shares of Howmet Aerospace from an "overweight" rating to a "sector weight" rating in a report on Thursday, October 24th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and fourteen have issued a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $115.59.

Get Our Latest Research Report on Howmet Aerospace

Howmet Aerospace Company Profile

(

Free Report)

Howmet Aerospace Inc provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally. It operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

Featured Stories

Before you consider Howmet Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howmet Aerospace wasn't on the list.

While Howmet Aerospace currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.