Sanctuary Advisors LLC reduced its position in shares of Fiserv, Inc. (NYSE:FI - Free Report) by 29.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 41,355 shares of the business services provider's stock after selling 16,910 shares during the quarter. Sanctuary Advisors LLC's holdings in Fiserv were worth $7,429,000 at the end of the most recent reporting period.

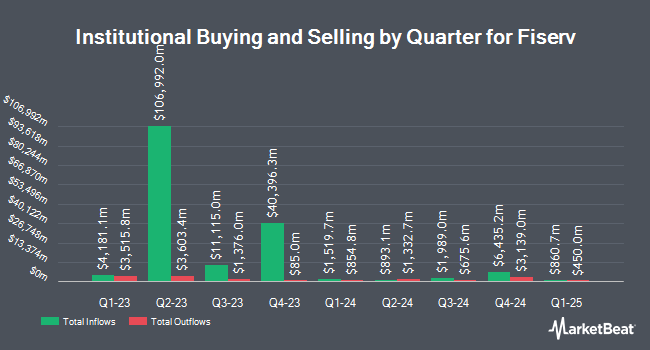

Other large investors also recently modified their holdings of the company. Waypoint Capital Advisors LLC increased its position in Fiserv by 1.7% during the 3rd quarter. Waypoint Capital Advisors LLC now owns 3,118 shares of the business services provider's stock valued at $560,000 after purchasing an additional 51 shares during the period. Optas LLC lifted its stake in Fiserv by 1.7% in the third quarter. Optas LLC now owns 3,216 shares of the business services provider's stock valued at $578,000 after purchasing an additional 54 shares during the last quarter. Cedar Mountain Advisors LLC grew its stake in Fiserv by 42.5% in the 3rd quarter. Cedar Mountain Advisors LLC now owns 191 shares of the business services provider's stock valued at $34,000 after buying an additional 57 shares in the last quarter. Covestor Ltd lifted its holdings in shares of Fiserv by 7.6% in the third quarter. Covestor Ltd now owns 832 shares of the business services provider's stock worth $150,000 after buying an additional 59 shares in the last quarter. Finally, West Bancorporation Inc. grew its position in Fiserv by 3.8% during the third quarter. West Bancorporation Inc. now owns 1,648 shares of the business services provider's stock worth $296,000 after buying an additional 61 shares in the last quarter. 90.98% of the stock is owned by institutional investors.

Insider Transactions at Fiserv

In other Fiserv news, Director Heidi Miller sold 30,000 shares of the stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $201.13, for a total transaction of $6,033,900.00. Following the completion of the transaction, the director now owns 33,235 shares of the company's stock, valued at $6,684,555.55. This trade represents a 47.44 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CAO Kenneth Best sold 20,821 shares of the company's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $214.61, for a total transaction of $4,468,394.81. Following the sale, the chief accounting officer now directly owns 38,771 shares in the company, valued at approximately $8,320,644.31. The trade was a 34.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 235,821 shares of company stock valued at $44,299,745. 0.75% of the stock is currently owned by corporate insiders.

Fiserv Trading Down 0.1 %

FI stock traded down $0.19 during trading on Friday, reaching $204.66. The company had a trading volume of 2,536,167 shares, compared to its average volume of 2,530,050. The business has a 50 day moving average of $205.80 and a 200 day moving average of $177.16. The company has a debt-to-equity ratio of 0.85, a current ratio of 1.07 and a quick ratio of 1.07. The company has a market cap of $116.43 billion, a P/E ratio of 39.36, a PEG ratio of 1.56 and a beta of 0.93. Fiserv, Inc. has a 52 week low of $131.41 and a 52 week high of $223.23.

Fiserv (NYSE:FI - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The business services provider reported $2.30 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.26 by $0.04. Fiserv had a return on equity of 17.10% and a net margin of 15.22%. The business had revenue of $5.22 billion for the quarter, compared to analysts' expectations of $4.90 billion. During the same period last year, the firm posted $1.96 earnings per share. The business's revenue for the quarter was up 7.0% on a year-over-year basis. As a group, sell-side analysts forecast that Fiserv, Inc. will post 8.77 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on FI. TD Cowen lifted their price target on Fiserv from $200.00 to $230.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Keefe, Bruyette & Woods lifted their price target on shares of Fiserv from $225.00 to $238.00 and gave the stock an "outperform" rating in a research note on Monday, December 9th. BTIG Research started coverage on shares of Fiserv in a research report on Wednesday, August 28th. They set a "buy" rating and a $200.00 target price for the company. Robert W. Baird lifted their price target on Fiserv from $186.00 to $200.00 and gave the stock an "outperform" rating in a research report on Monday, September 23rd. Finally, UBS Group raised their price target on shares of Fiserv from $185.00 to $240.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Four investment analysts have rated the stock with a hold rating, twenty-one have issued a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Fiserv currently has an average rating of "Moderate Buy" and a consensus price target of $217.50.

Check Out Our Latest Stock Report on Fiserv

Fiserv Company Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Recommended Stories

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.