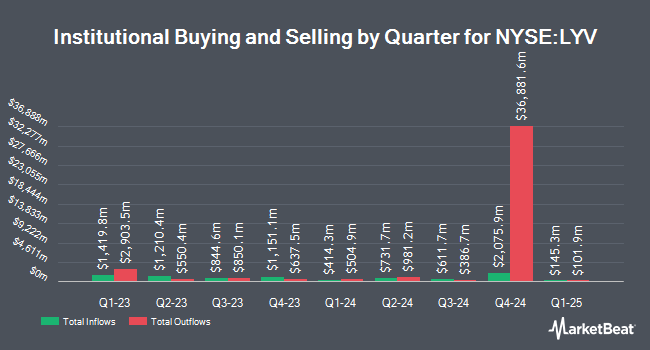

Sanctuary Advisors LLC reduced its position in shares of Live Nation Entertainment, Inc. (NYSE:LYV - Free Report) by 70.8% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 16,248 shares of the company's stock after selling 39,406 shares during the period. Sanctuary Advisors LLC's holdings in Live Nation Entertainment were worth $1,779,000 as of its most recent SEC filing.

A number of other institutional investors also recently modified their holdings of the company. Wealth Enhancement Advisory Services LLC boosted its holdings in Live Nation Entertainment by 4.6% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 3,108 shares of the company's stock valued at $291,000 after acquiring an additional 138 shares in the last quarter. Fifth Third Bancorp boosted its stake in shares of Live Nation Entertainment by 8.6% during the 2nd quarter. Fifth Third Bancorp now owns 3,794 shares of the company's stock valued at $356,000 after purchasing an additional 301 shares in the last quarter. &PARTNERS purchased a new position in shares of Live Nation Entertainment during the second quarter valued at about $279,000. Family Firm Inc. bought a new position in Live Nation Entertainment in the second quarter worth about $42,000. Finally, Rational Advisors LLC lifted its holdings in Live Nation Entertainment by 11.8% in the second quarter. Rational Advisors LLC now owns 37,850 shares of the company's stock worth $3,548,000 after buying an additional 4,000 shares during the period. 74.52% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on the company. Macquarie increased their target price on Live Nation Entertainment from $130.00 to $146.00 and gave the stock an "outperform" rating in a research report on Friday, November 15th. Bank of America upped their price target on Live Nation Entertainment from $125.00 to $149.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. Benchmark raised their price objective on Live Nation Entertainment from $144.00 to $160.00 and gave the company a "buy" rating in a research report on Thursday. The Goldman Sachs Group upped their target price on shares of Live Nation Entertainment from $132.00 to $148.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. Finally, Evercore ISI increased their price target on shares of Live Nation Entertainment from $110.00 to $150.00 and gave the stock an "outperform" rating in a research note on Tuesday, November 12th. Two equities research analysts have rated the stock with a hold rating and sixteen have given a buy rating to the company's stock. Based on data from MarketBeat.com, Live Nation Entertainment presently has an average rating of "Moderate Buy" and an average target price of $145.40.

Read Our Latest Stock Report on Live Nation Entertainment

Live Nation Entertainment Stock Up 0.8 %

LYV traded up $1.09 during trading on Friday, hitting $133.28. 4,148,333 shares of the company's stock traded hands, compared to its average volume of 2,207,588. Live Nation Entertainment, Inc. has a 12-month low of $86.67 and a 12-month high of $141.18. The company's 50 day simple moving average is $127.65 and its two-hundred day simple moving average is $107.49. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 6.10. The stock has a market capitalization of $30.97 billion, a price-to-earnings ratio of 141.79, a PEG ratio of 3.65 and a beta of 1.37.

Live Nation Entertainment (NYSE:LYV - Get Free Report) last released its quarterly earnings data on Monday, November 11th. The company reported $1.66 EPS for the quarter, topping the consensus estimate of $1.58 by $0.08. The company had revenue of $7.65 billion during the quarter, compared to the consensus estimate of $7.75 billion. Live Nation Entertainment had a return on equity of 77.62% and a net margin of 2.11%. Live Nation Entertainment's revenue for the quarter was down 6.2% on a year-over-year basis. During the same period last year, the company earned $1.78 EPS. Analysts predict that Live Nation Entertainment, Inc. will post 1.04 earnings per share for the current fiscal year.

Live Nation Entertainment Company Profile

(

Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

Further Reading

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.