Sanctuary Advisors LLC lifted its stake in Aon plc (NYSE:AON - Free Report) by 14.2% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 19,507 shares of the financial services provider's stock after buying an additional 2,432 shares during the quarter. Sanctuary Advisors LLC's holdings in AON were worth $6,749,000 as of its most recent filing with the Securities & Exchange Commission.

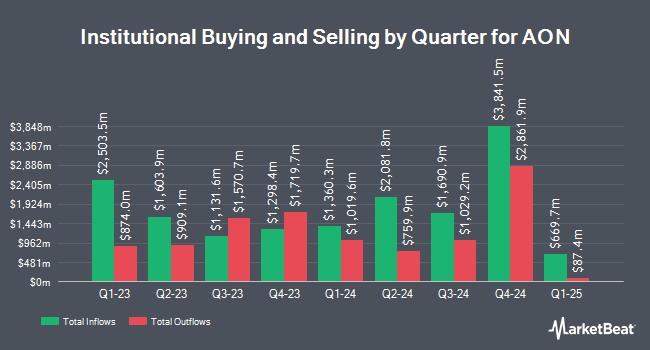

Other hedge funds also recently made changes to their positions in the company. Massachusetts Financial Services Co. MA lifted its position in shares of AON by 2.5% in the second quarter. Massachusetts Financial Services Co. MA now owns 12,552,569 shares of the financial services provider's stock valued at $3,685,183,000 after acquiring an additional 309,702 shares in the last quarter. State Street Corp lifted its holdings in AON by 0.4% in the 3rd quarter. State Street Corp now owns 8,844,121 shares of the financial services provider's stock worth $3,059,977,000 after purchasing an additional 32,417 shares in the last quarter. Mawer Investment Management Ltd. boosted its stake in AON by 1.2% in the 2nd quarter. Mawer Investment Management Ltd. now owns 4,405,780 shares of the financial services provider's stock worth $1,293,449,000 after purchasing an additional 52,099 shares during the period. Geode Capital Management LLC raised its position in shares of AON by 0.9% during the third quarter. Geode Capital Management LLC now owns 4,322,177 shares of the financial services provider's stock valued at $1,489,690,000 after buying an additional 38,447 shares during the last quarter. Finally, Veritas Asset Management LLP lifted its holdings in shares of AON by 41.6% in the third quarter. Veritas Asset Management LLP now owns 3,010,557 shares of the financial services provider's stock worth $1,041,623,000 after buying an additional 883,761 shares in the last quarter. 86.14% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other AON news, insider Lisa Stevens sold 1,275 shares of the firm's stock in a transaction on Tuesday, November 26th. The shares were sold at an average price of $387.68, for a total value of $494,292.00. Following the sale, the insider now directly owns 8,077 shares in the company, valued at $3,131,291.36. This trade represents a 13.63 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, COO Mindy F. Simon sold 650 shares of the business's stock in a transaction that occurred on Wednesday, November 27th. The shares were sold at an average price of $394.34, for a total value of $256,321.00. Following the sale, the chief operating officer now owns 1,816 shares in the company, valued at approximately $716,121.44. This represents a 26.36 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 1.30% of the company's stock.

Wall Street Analyst Weigh In

AON has been the topic of a number of research reports. Bank of America lifted their price target on shares of AON from $345.00 to $375.00 and gave the company an "underperform" rating in a report on Thursday, October 10th. Wells Fargo & Company upgraded AON from an "underweight" rating to an "equal weight" rating and boosted their target price for the stock from $315.00 to $377.00 in a research report on Monday, October 28th. BMO Capital Markets raised their price target on AON from $325.00 to $380.00 and gave the company a "market perform" rating in a report on Monday, November 4th. TD Cowen upped their price objective on AON from $413.00 to $432.00 in a report on Thursday, October 24th. Finally, Barclays raised their target price on shares of AON from $394.00 to $440.00 and gave the company an "overweight" rating in a report on Thursday, November 21st. One analyst has rated the stock with a sell rating, eleven have given a hold rating and four have given a buy rating to the company's stock. According to MarketBeat, AON presently has an average rating of "Hold" and a consensus target price of $362.06.

Get Our Latest Analysis on AON

AON Stock Performance

NYSE:AON traded down $1.53 during trading hours on Friday, reaching $361.19. 1,083,030 shares of the stock were exchanged, compared to its average volume of 1,069,203. The firm has a 50 day simple moving average of $371.79 and a 200-day simple moving average of $337.32. The company has a quick ratio of 2.05, a current ratio of 2.05 and a debt-to-equity ratio of 2.66. Aon plc has a 52 week low of $268.06 and a 52 week high of $395.33. The stock has a market capitalization of $78.11 billion, a P/E ratio of 30.48, a P/E/G ratio of 2.27 and a beta of 0.91.

AON Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Friday, November 1st were issued a $0.675 dividend. This represents a $2.70 dividend on an annualized basis and a yield of 0.75%. The ex-dividend date of this dividend was Friday, November 1st. AON's payout ratio is 22.78%.

AON Company Profile

(

Free Report)

Aon plc, a professional services firm, provides a range of risk and human capital solutions worldwide. It offers commercial risk solutions, including retail brokerage, specialty solutions, global risk consulting and captives management, and affinity programs; and health solutions, such as health and benefits brokerages, and health care exchanges.

Featured Stories

Before you consider AON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AON wasn't on the list.

While AON currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.