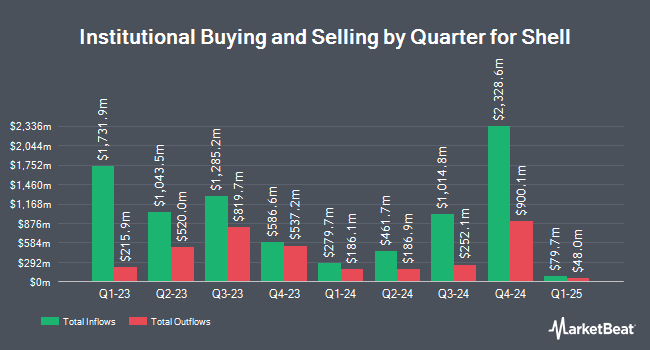

Sanctuary Advisors LLC grew its stake in Shell plc (NYSE:SHEL - Free Report) by 5.9% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 151,868 shares of the energy company's stock after buying an additional 8,499 shares during the period. Sanctuary Advisors LLC's holdings in Shell were worth $10,028,000 as of its most recent SEC filing.

Other large investors also recently made changes to their positions in the company. First Horizon Advisors Inc. raised its holdings in Shell by 1.3% in the 2nd quarter. First Horizon Advisors Inc. now owns 11,097 shares of the energy company's stock worth $801,000 after acquiring an additional 142 shares during the period. Lester Murray Antman dba SimplyRich lifted its position in shares of Shell by 0.6% during the 2nd quarter. Lester Murray Antman dba SimplyRich now owns 26,901 shares of the energy company's stock worth $1,941,000 after purchasing an additional 158 shares during the last quarter. Procyon Advisors LLC boosted its stake in Shell by 3.2% during the 3rd quarter. Procyon Advisors LLC now owns 5,074 shares of the energy company's stock valued at $335,000 after purchasing an additional 159 shares during the period. GHP Investment Advisors Inc. increased its position in Shell by 40.8% in the 3rd quarter. GHP Investment Advisors Inc. now owns 563 shares of the energy company's stock worth $37,000 after buying an additional 163 shares during the period. Finally, Waldron Private Wealth LLC lifted its holdings in shares of Shell by 4.1% during the second quarter. Waldron Private Wealth LLC now owns 4,169 shares of the energy company's stock worth $301,000 after buying an additional 165 shares during the last quarter. Institutional investors own 28.60% of the company's stock.

Shell Price Performance

Shares of Shell stock traded down $0.46 during midday trading on Friday, hitting $63.54. 4,470,658 shares of the company were exchanged, compared to its average volume of 4,204,738. The firm has a 50 day simple moving average of $66.23 and a 200-day simple moving average of $69.13. Shell plc has a 52 week low of $60.34 and a 52 week high of $74.61. The firm has a market cap of $196.68 billion, a P/E ratio of 13.07, a PEG ratio of 4.92 and a beta of 0.55. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.40 and a quick ratio of 1.13.

Shell Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Friday, November 15th will be issued a $0.688 dividend. This represents a $2.75 annualized dividend and a dividend yield of 4.33%. The ex-dividend date is Friday, November 15th. Shell's payout ratio is 56.58%.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on the stock. Citigroup raised shares of Shell to a "hold" rating in a research report on Wednesday, October 2nd. Wells Fargo & Company cut their price objective on shares of Shell from $88.00 to $87.00 and set an "overweight" rating for the company in a research report on Monday, December 9th. Barclays raised Shell to a "strong-buy" rating in a research report on Wednesday, October 2nd. Sanford C. Bernstein raised Shell to a "strong-buy" rating in a report on Friday, October 11th. Finally, Scotiabank lowered their price objective on Shell from $90.00 to $80.00 and set a "sector outperform" rating on the stock in a research report on Thursday, October 10th. Two research analysts have rated the stock with a hold rating, four have assigned a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Buy" and an average target price of $81.75.

Check Out Our Latest Research Report on SHEL

Shell Profile

(

Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

See Also

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.