Analysts at Sanford C. Bernstein started coverage on shares of Tandem Diabetes Care (NASDAQ:TNDM - Get Free Report) in a research note issued to investors on Wednesday, MarketBeat Ratings reports. The firm set an "outperform" rating and a $42.00 price target on the medical device company's stock. Sanford C. Bernstein's price objective would suggest a potential upside of 22.66% from the stock's current price.

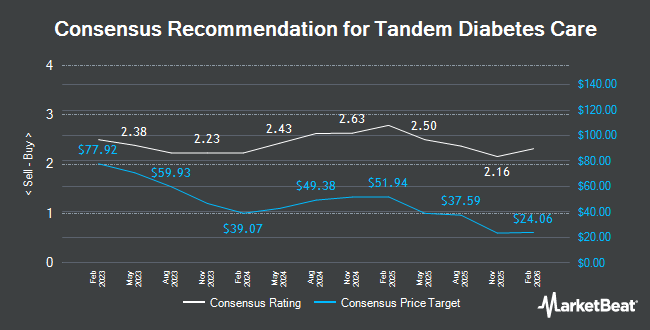

A number of other analysts also recently weighed in on TNDM. Royal Bank of Canada initiated coverage on shares of Tandem Diabetes Care in a research report on Wednesday, October 2nd. They issued an "outperform" rating and a $65.00 target price on the stock. Morgan Stanley reaffirmed an "equal weight" rating and set a $45.00 target price on shares of Tandem Diabetes Care in a research note on Monday, September 23rd. UBS Group upgraded shares of Tandem Diabetes Care to a "hold" rating in a report on Friday, August 2nd. Robert W. Baird upped their price target on Tandem Diabetes Care from $36.00 to $39.00 and gave the stock a "neutral" rating in a research note on Friday, August 2nd. Finally, The Goldman Sachs Group started coverage on Tandem Diabetes Care in a research note on Friday, October 4th. They set a "neutral" rating and a $46.00 price objective for the company. Five investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $54.31.

Check Out Our Latest Research Report on TNDM

Tandem Diabetes Care Stock Up 3.4 %

Shares of NASDAQ TNDM traded up $1.13 during mid-day trading on Wednesday, hitting $34.24. 3,165,392 shares of the stock traded hands, compared to its average volume of 1,587,168. The company has a market cap of $2.24 billion, a price-to-earnings ratio of -16.38 and a beta of 1.36. The stock has a fifty day moving average price of $39.21 and a 200-day moving average price of $41.88. Tandem Diabetes Care has a 52 week low of $13.82 and a 52 week high of $53.69. The company has a debt-to-equity ratio of 1.31, a quick ratio of 2.38 and a current ratio of 3.05.

Hedge Funds Weigh In On Tandem Diabetes Care

Institutional investors and hedge funds have recently modified their holdings of the company. BNP Paribas Financial Markets raised its position in Tandem Diabetes Care by 1,481.5% in the first quarter. BNP Paribas Financial Markets now owns 145,812 shares of the medical device company's stock worth $5,163,000 after acquiring an additional 136,592 shares during the period. Healthcare of Ontario Pension Plan Trust Fund bought a new stake in shares of Tandem Diabetes Care during the 1st quarter valued at $540,000. Vanguard Group Inc. lifted its position in shares of Tandem Diabetes Care by 0.4% in the first quarter. Vanguard Group Inc. now owns 7,052,570 shares of the medical device company's stock valued at $249,732,000 after acquiring an additional 30,664 shares in the last quarter. SG Americas Securities LLC purchased a new position in Tandem Diabetes Care in the 1st quarter worth approximately $5,227,000. Finally, Quantbot Technologies LP purchased a new position in shares of Tandem Diabetes Care in the first quarter worth $710,000.

Tandem Diabetes Care Company Profile

(

Get Free Report)

Tandem Diabetes Care, Inc, a medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally. The company's flagship product is the t:slim X2 insulin delivery system, a pump platform for managing insulin delivery and display continuous glucose monitoring sensor information directly on the pump home screen; and Tandem Mobi insulin pump, an automated insulin delivery system.

Featured Stories

Before you consider Tandem Diabetes Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tandem Diabetes Care wasn't on the list.

While Tandem Diabetes Care currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.