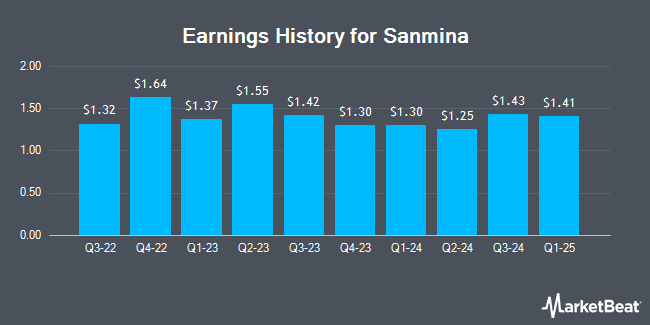

Sanmina (NASDAQ:SANM - Get Free Report) will likely be releasing its Q2 2025 earnings data before the market opens on Monday, April 28th. Analysts expect Sanmina to post earnings of $1.38 per share and revenue of $1.97 billion for the quarter.

Sanmina Stock Up 2.0 %

SANM stock opened at $74.50 on Wednesday. The company has a market capitalization of $4.05 billion, a P/E ratio of 18.22, a price-to-earnings-growth ratio of 1.29 and a beta of 1.00. Sanmina has a 12 month low of $57.52 and a 12 month high of $91.12. The firm's fifty day simple moving average is $77.85 and its 200-day simple moving average is $77.74. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.06 and a quick ratio of 1.30.

Sanmina announced that its board has approved a stock repurchase plan on Monday, January 27th that allows the company to repurchase $300.00 million in outstanding shares. This repurchase authorization allows the electronics maker to repurchase up to 7.1% of its shares through open market purchases. Shares repurchase plans are usually an indication that the company's board believes its shares are undervalued.

Analyst Ratings Changes

Several research analysts recently weighed in on the company. StockNews.com cut Sanmina from a "strong-buy" rating to a "buy" rating in a research report on Thursday, February 6th. Bank of America raised shares of Sanmina from an "underperform" rating to a "neutral" rating and lifted their target price for the company from $58.00 to $92.00 in a report on Wednesday, January 29th.

Get Our Latest Analysis on SANM

Insider Transactions at Sanmina

In other Sanmina news, Director Eugene A. Delaney sold 10,000 shares of the stock in a transaction that occurred on Thursday, January 30th. The stock was sold at an average price of $83.50, for a total transaction of $835,000.00. Following the completion of the transaction, the director now owns 77,120 shares of the company's stock, valued at $6,439,520. This represents a 11.48 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Mario M. Rosati sold 11,391 shares of the firm's stock in a transaction that occurred on Friday, February 21st. The shares were sold at an average price of $86.02, for a total value of $979,853.82. Following the completion of the transaction, the director now owns 80,295 shares in the company, valued at approximately $6,906,975.90. This trade represents a 12.42 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 33,405 shares of company stock valued at $2,821,682 in the last three months. 3.22% of the stock is currently owned by company insiders.

About Sanmina

(

Get Free Report)

Sanmina Corporation provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services worldwide. It operates in two businesses, Integrated Manufacturing Solutions; and Components, Products and Services. The company offers product design and engineering, including concept development, detailed design, prototyping, validation, preproduction, manufacturing design release, and product industrialization; assembly and test services; direct order fulfillment and logistics services; after-market product service and support; and supply chain management services, as well as engages in the manufacturing of components, subassemblies, and complete systems.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sanmina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanmina wasn't on the list.

While Sanmina currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.