Thrivent Financial for Lutherans raised its holdings in Sanofi (NASDAQ:SNY - Free Report) by 28,890.2% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 1,429,219 shares of the company's stock after acquiring an additional 1,424,289 shares during the period. Thrivent Financial for Lutherans owned approximately 0.06% of Sanofi worth $82,366,000 at the end of the most recent quarter.

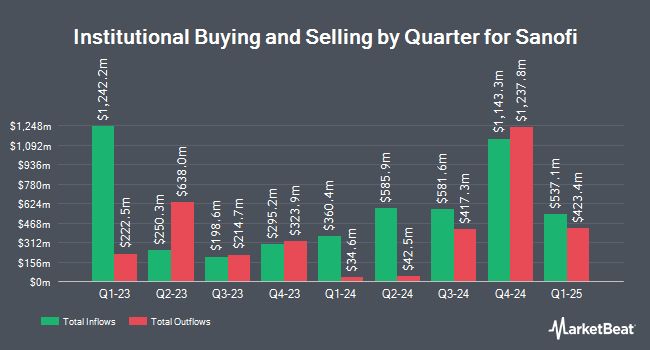

Other hedge funds also recently bought and sold shares of the company. POM Investment Strategies LLC purchased a new stake in shares of Sanofi in the 2nd quarter valued at approximately $25,000. Northwest Investment Counselors LLC purchased a new position in shares of Sanofi during the 3rd quarter worth approximately $29,000. Concord Wealth Partners boosted its position in shares of Sanofi by 157.8% during the 3rd quarter. Concord Wealth Partners now owns 593 shares of the company's stock worth $34,000 after purchasing an additional 363 shares during the period. Arrow Financial Corp purchased a new position in shares of Sanofi during the 2nd quarter worth approximately $35,000. Finally, Fortitude Family Office LLC boosted its position in shares of Sanofi by 708.6% during the 3rd quarter. Fortitude Family Office LLC now owns 752 shares of the company's stock worth $43,000 after purchasing an additional 659 shares during the period. Institutional investors and hedge funds own 10.04% of the company's stock.

Sanofi Stock Up 1.1 %

SNY stock traded up $0.54 during midday trading on Monday, hitting $48.51. The company's stock had a trading volume of 2,613,919 shares, compared to its average volume of 2,040,932. The company has a quick ratio of 0.65, a current ratio of 1.00 and a debt-to-equity ratio of 0.17. Sanofi has a 52-week low of $45.22 and a 52-week high of $58.97. The firm has a market capitalization of $123.11 billion, a P/E ratio of 24.47, a PEG ratio of 1.22 and a beta of 0.61. The firm has a 50-day simple moving average of $54.65 and a 200-day simple moving average of $52.23.

Sanofi (NASDAQ:SNY - Get Free Report) last issued its quarterly earnings results on Friday, October 25th. The company reported $1.57 EPS for the quarter, beating the consensus estimate of $0.22 by $1.35. Sanofi had a net margin of 9.96% and a return on equity of 27.45%. The company had revenue of $13.44 billion during the quarter, compared to analysts' expectations of $16.59 billion. During the same quarter last year, the company posted $2.55 EPS. The firm's revenue was up 12.3% compared to the same quarter last year. As a group, equities analysts forecast that Sanofi will post 4.29 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities analysts recently weighed in on the stock. StockNews.com cut shares of Sanofi from a "strong-buy" rating to a "buy" rating in a research report on Thursday, November 7th. Citigroup raised shares of Sanofi to a "strong-buy" rating in a research report on Tuesday, September 17th. Finally, Argus increased their price objective on shares of Sanofi from $55.00 to $60.00 and gave the stock a "buy" rating in a research report on Friday, July 26th. Two investment analysts have rated the stock with a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Sanofi currently has a consensus rating of "Moderate Buy" and an average price target of $57.50.

Check Out Our Latest Research Report on Sanofi

Sanofi Company Profile

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

See Also

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.