Legacy Capital Wealth Partners LLC grew its position in shares of Sanofi (NASDAQ:SNY - Free Report) by 114.2% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 24,274 shares of the company's stock after acquiring an additional 12,942 shares during the quarter. Legacy Capital Wealth Partners LLC's holdings in Sanofi were worth $1,399,000 at the end of the most recent quarter.

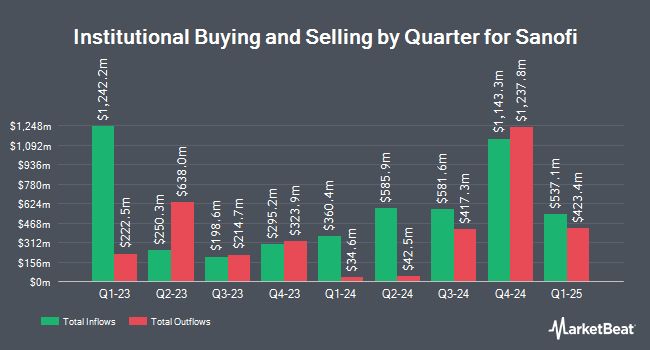

Other large investors have also modified their holdings of the company. Stablepoint Partners LLC boosted its holdings in Sanofi by 0.8% in the third quarter. Stablepoint Partners LLC now owns 23,893 shares of the company's stock valued at $1,377,000 after purchasing an additional 189 shares during the last quarter. PDS Planning Inc boosted its holdings in Sanofi by 3.1% in the third quarter. PDS Planning Inc now owns 6,643 shares of the company's stock valued at $383,000 after purchasing an additional 200 shares during the last quarter. Eagle Ridge Investment Management boosted its holdings in Sanofi by 3.8% in the third quarter. Eagle Ridge Investment Management now owns 5,571 shares of the company's stock valued at $321,000 after purchasing an additional 203 shares during the last quarter. Financial Advocates Investment Management boosted its holdings in Sanofi by 3.4% in the third quarter. Financial Advocates Investment Management now owns 6,327 shares of the company's stock valued at $365,000 after purchasing an additional 206 shares during the last quarter. Finally, TCTC Holdings LLC boosted its holdings in Sanofi by 28.0% in the first quarter. TCTC Holdings LLC now owns 960 shares of the company's stock valued at $47,000 after purchasing an additional 210 shares during the last quarter. Institutional investors and hedge funds own 10.04% of the company's stock.

Sanofi Stock Performance

Shares of NASDAQ SNY traded down $0.41 during mid-day trading on Friday, hitting $51.32. The company had a trading volume of 1,283,694 shares, compared to its average volume of 1,983,084. The stock has a market cap of $130.24 billion, a price-to-earnings ratio of 26.18, a PEG ratio of 1.31 and a beta of 0.61. Sanofi has a 12 month low of $45.13 and a 12 month high of $58.97. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.00 and a quick ratio of 0.65. The firm's 50 day simple moving average is $55.49 and its two-hundred day simple moving average is $52.20.

Sanofi (NASDAQ:SNY - Get Free Report) last announced its quarterly earnings results on Friday, October 25th. The company reported $1.57 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.22 by $1.35. The business had revenue of $13.44 billion for the quarter, compared to the consensus estimate of $16.59 billion. Sanofi had a return on equity of 27.45% and a net margin of 9.96%. The business's revenue was up 12.3% on a year-over-year basis. During the same quarter last year, the business posted $2.55 EPS. As a group, equities research analysts forecast that Sanofi will post 4.27 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on the company. Citigroup raised Sanofi to a "strong-buy" rating in a report on Tuesday, September 17th. StockNews.com downgraded Sanofi from a "strong-buy" rating to a "buy" rating in a report on Thursday. Finally, Argus increased their target price on Sanofi from $55.00 to $60.00 and gave the stock a "buy" rating in a report on Friday, July 26th. Two investment analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $57.50.

Read Our Latest Stock Analysis on SNY

About Sanofi

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Featured Stories

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.