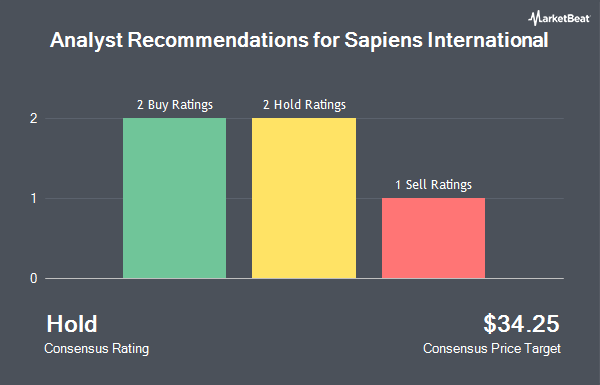

Shares of Sapiens International Co. (NASDAQ:SPNS - Get Free Report) have received an average recommendation of "Hold" from the five analysts that are covering the company, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and two have given a buy rating to the company. The average 12-month price target among analysts that have covered the stock in the last year is $34.00.

A number of analysts recently commented on the stock. Jefferies Financial Group downgraded shares of Sapiens International from a "buy" rating to a "hold" rating and decreased their price objective for the stock from $36.00 to $28.00 in a report on Monday. StockNews.com downgraded shares of Sapiens International from a "strong-buy" rating to a "buy" rating in a report on Tuesday, November 19th. Barclays decreased their price objective on shares of Sapiens International from $38.00 to $30.00 and set an "underweight" rating on the stock in a report on Tuesday, November 12th. William Blair reissued a "market perform" rating on shares of Sapiens International in a report on Friday, December 6th. Finally, Needham & Company LLC decreased their price objective on shares of Sapiens International from $44.00 to $35.00 and set a "buy" rating on the stock in a report on Tuesday, November 12th.

View Our Latest Stock Analysis on SPNS

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the business. National Bank of Canada FI purchased a new position in Sapiens International in the third quarter valued at approximately $26,000. Blue Trust Inc. raised its holdings in Sapiens International by 171.2% in the fourth quarter. Blue Trust Inc. now owns 1,356 shares of the technology company's stock valued at $36,000 after buying an additional 856 shares during the period. Financial Management Professionals Inc. raised its holdings in Sapiens International by 57.9% in the third quarter. Financial Management Professionals Inc. now owns 1,945 shares of the technology company's stock valued at $72,000 after buying an additional 713 shares during the period. Morgan Dempsey Capital Management LLC raised its holdings in Sapiens International by 8.8% in the fourth quarter. Morgan Dempsey Capital Management LLC now owns 6,635 shares of the technology company's stock valued at $178,000 after buying an additional 539 shares during the period. Finally, MQS Management LLC purchased a new position in Sapiens International in the third quarter valued at approximately $230,000. Hedge funds and other institutional investors own 30.73% of the company's stock.

Sapiens International Stock Performance

Shares of NASDAQ:SPNS traded up $0.41 during trading on Monday, reaching $27.46. The company had a trading volume of 261,635 shares, compared to its average volume of 234,306. The company has a debt-to-equity ratio of 0.04, a current ratio of 2.18 and a quick ratio of 2.18. The stock's fifty day moving average price is $26.97 and its 200 day moving average price is $32.37. Sapiens International has a fifty-two week low of $25.01 and a fifty-two week high of $41.22. The firm has a market capitalization of $1.53 billion, a price-to-earnings ratio of 21.62 and a beta of 1.16.

Sapiens International (NASDAQ:SPNS - Get Free Report) last announced its quarterly earnings data on Monday, November 11th. The technology company reported $0.37 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.38 by ($0.01). Sapiens International had a net margin of 13.23% and a return on equity of 17.61%. The firm had revenue of $137.00 million during the quarter, compared to analyst estimates of $140.10 million. During the same period in the prior year, the firm posted $0.32 earnings per share. The business's quarterly revenue was up 4.8% compared to the same quarter last year. As a group, equities research analysts predict that Sapiens International will post 1.42 EPS for the current year.

About Sapiens International

(

Get Free ReportSapiens International Corporation N.V. provides software solutions for the insurance industry in North America, the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company provides various solutions for property and casualty commercial and personal lines, life and pensions, and reinsurance fields.

Read More

Before you consider Sapiens International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sapiens International wasn't on the list.

While Sapiens International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.