Saputo (TSE:SAP - Get Free Report) had its price objective dropped by research analysts at TD Securities from C$38.00 to C$37.00 in a research note issued to investors on Monday,BayStreet.CA reports. TD Securities' price target would indicate a potential upside of 40.58% from the stock's previous close.

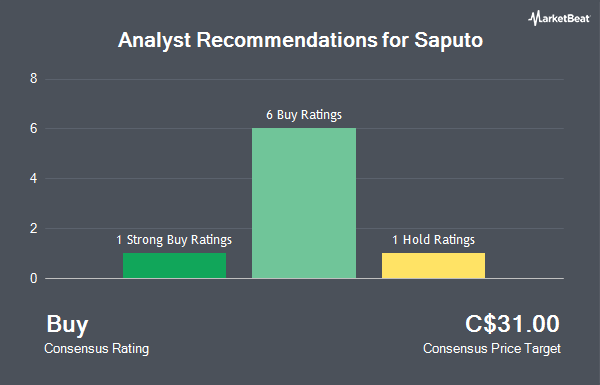

A number of other research firms have also recently commented on SAP. National Bankshares reduced their price target on Saputo from C$36.00 to C$35.00 and set an "outperform" rating for the company in a report on Monday, August 12th. BMO Capital Markets lowered shares of Saputo from an "outperform" rating to a "market perform" rating and dropped their price objective for the company from C$35.00 to C$30.00 in a report on Tuesday, October 15th. Royal Bank of Canada reduced their price objective on shares of Saputo from C$39.00 to C$38.00 and set an "outperform" rating for the company in a research report on Tuesday, October 29th. Finally, CIBC lowered their target price on shares of Saputo from C$37.00 to C$35.00 and set an "outperform" rating on the stock in a research note on Monday, August 12th. One investment analyst has rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of C$34.50.

View Our Latest Stock Analysis on SAP

Saputo Stock Down 1.5 %

Shares of SAP stock traded down C$0.39 during trading hours on Monday, reaching C$26.32. The company had a trading volume of 124,727 shares, compared to its average volume of 438,849. The company has a debt-to-equity ratio of 53.17, a quick ratio of 0.67 and a current ratio of 1.59. The stock's fifty day simple moving average is C$28.46 and its 200 day simple moving average is C$29.08. Saputo has a twelve month low of C$25.28 and a twelve month high of C$32.15. The company has a market capitalization of C$11.17 billion, a P/E ratio of 41.86, a price-to-earnings-growth ratio of 0.56 and a beta of 0.32.

Saputo (TSE:SAP - Get Free Report) last released its quarterly earnings data on Thursday, August 8th. The company reported C$0.39 earnings per share for the quarter, topping the consensus estimate of C$0.37 by C$0.02. Saputo had a return on equity of 3.72% and a net margin of 1.50%. The business had revenue of C$4.61 billion during the quarter, compared to analyst estimates of C$4.44 billion. As a group, sell-side analysts expect that Saputo will post 1.7735369 earnings per share for the current fiscal year.

Insider Buying and Selling at Saputo

In other Saputo news, Senior Officer Martin Gagnon bought 2,000 shares of the business's stock in a transaction on Tuesday, August 20th. The shares were bought at an average cost of C$29.73 per share, with a total value of C$59,450.00. In other Saputo news, Senior Officer Carl Colizza acquired 6,800 shares of the business's stock in a transaction on Tuesday, August 13th. The stock was purchased at an average price of C$29.43 per share, for a total transaction of C$200,124.00. Also, Senior Officer Martin Gagnon acquired 2,000 shares of the company's stock in a transaction that occurred on Tuesday, August 20th. The stock was bought at an average price of C$29.73 per share, with a total value of C$59,450.00. 40.45% of the stock is owned by company insiders.

Saputo Company Profile

(

Get Free Report)

Saputo Inc produces, markets, and distributes dairy products in Canada, the United States, Argentina, Australia, and the United Kingdom. The company offers cheeses, including mozzarella and cheddar; specialty cheeses, such as ricotta, provolone, blue, parmesan, goat cheese, feta, romano, and havarti; fine cheeses comprising brie and camembert; and other cheeses that include brick, colby, farmer, munster, monterey jack, fresh curd, and processed cheeses.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Saputo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saputo wasn't on the list.

While Saputo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.