Simplify Asset Management Inc. boosted its holdings in Sarepta Therapeutics, Inc. (NASDAQ:SRPT - Free Report) by 84.6% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 193,010 shares of the biotechnology company's stock after purchasing an additional 88,474 shares during the quarter. Sarepta Therapeutics accounts for about 1.1% of Simplify Asset Management Inc.'s portfolio, making the stock its 12th largest holding. Simplify Asset Management Inc. owned approximately 0.20% of Sarepta Therapeutics worth $24,105,000 at the end of the most recent quarter.

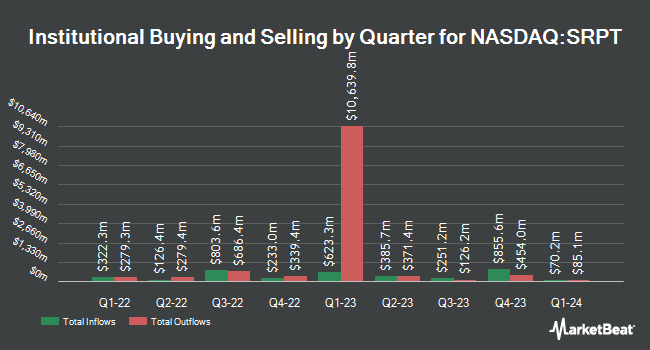

Other institutional investors and hedge funds have also recently made changes to their positions in the company. Capital International Investors lifted its stake in Sarepta Therapeutics by 1.6% in the 1st quarter. Capital International Investors now owns 4,817,517 shares of the biotechnology company's stock valued at $623,676,000 after purchasing an additional 76,032 shares during the last quarter. Farallon Capital Management LLC lifted its stake in Sarepta Therapeutics by 102.8% in the 1st quarter. Farallon Capital Management LLC now owns 2,453,500 shares of the biotechnology company's stock valued at $317,630,000 after purchasing an additional 1,243,427 shares during the last quarter. Thrivent Financial for Lutherans lifted its stake in Sarepta Therapeutics by 6.3% in the 2nd quarter. Thrivent Financial for Lutherans now owns 644,675 shares of the biotechnology company's stock valued at $101,858,000 after purchasing an additional 37,940 shares during the last quarter. Jacobs Levy Equity Management Inc. lifted its stake in Sarepta Therapeutics by 26.3% in the 1st quarter. Jacobs Levy Equity Management Inc. now owns 579,637 shares of the biotechnology company's stock valued at $75,040,000 after purchasing an additional 120,535 shares during the last quarter. Finally, abrdn plc lifted its stake in Sarepta Therapeutics by 30.7% in the 3rd quarter. abrdn plc now owns 431,098 shares of the biotechnology company's stock valued at $53,935,000 after purchasing an additional 101,253 shares during the last quarter. Institutional investors and hedge funds own 86.68% of the company's stock.

Insiders Place Their Bets

In other news, CFO Ian Michael Estepan sold 5,985 shares of the company's stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $137.36, for a total value of $822,099.60. Following the sale, the chief financial officer now directly owns 33,946 shares of the company's stock, valued at $4,662,822.56. This represents a 14.99 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 7.70% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on SRPT shares. Robert W. Baird dropped their price objective on shares of Sarepta Therapeutics from $200.00 to $193.00 and set an "outperform" rating for the company in a research note on Thursday, November 7th. Needham & Company LLC reiterated a "buy" rating and set a $205.00 price objective on shares of Sarepta Therapeutics in a research report on Thursday, November 7th. Guggenheim raised their price target on shares of Sarepta Therapeutics from $148.00 to $150.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Evercore ISI reduced their price objective on shares of Sarepta Therapeutics from $179.00 to $170.00 and set an "outperform" rating for the company in a report on Thursday, November 7th. Finally, Barclays reduced their price objective on shares of Sarepta Therapeutics from $226.00 to $203.00 and set an "overweight" rating for the company in a report on Thursday, August 8th. One investment analyst has rated the stock with a hold rating, twenty-one have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Buy" and a consensus price target of $181.33.

Get Our Latest Stock Report on Sarepta Therapeutics

Sarepta Therapeutics Trading Down 4.2 %

NASDAQ SRPT traded down $4.57 during trading on Friday, hitting $104.54. The company had a trading volume of 1,570,447 shares, compared to its average volume of 1,234,834. The company has a current ratio of 3.84, a quick ratio of 3.03 and a debt-to-equity ratio of 0.93. Sarepta Therapeutics, Inc. has a one year low of $78.67 and a one year high of $173.25. The company has a market cap of $9.99 billion, a price-to-earnings ratio of 83.63 and a beta of 0.81. The company's fifty day moving average is $123.72 and its 200-day moving average is $132.33.

Sarepta Therapeutics Company Profile

(

Free Report)

Sarepta Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases. It offers EXONDYS 51 injection to treat duchenne muscular dystrophy (duchenne) in patients with confirmed mutation of the dystrophin gene that is amenable to exon 51 skipping; VYONDYS 53 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene that is amenable to exon 53 skipping; AMONDYS 45 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene; and ELEVIDYS, an adeno-associated virus based gene therapy for the treatment of ambulatory pediatric patients aged 4 through 5 years with duchenne with a confirmed mutation in the duchenne gene.

Read More

Before you consider Sarepta Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sarepta Therapeutics wasn't on the list.

While Sarepta Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.