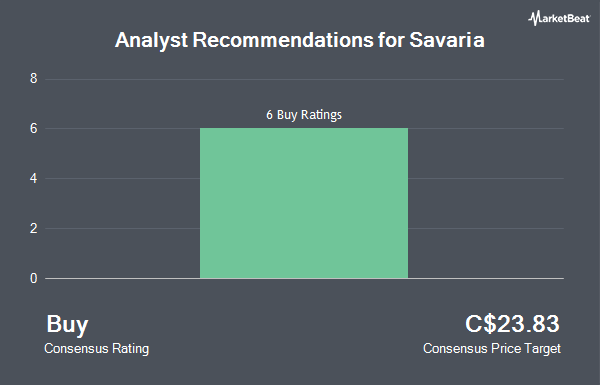

Savaria Co. (TSE:SIS - Get Free Report) has been assigned a consensus recommendation of "Buy" from the six ratings firms that are covering the company, MarketBeat reports. Six investment analysts have rated the stock with a buy rating. The average twelve-month price objective among brokerages that have updated their coverage on the stock in the last year is C$23.57.

A number of research analysts have commented on the stock. Cormark upgraded shares of Savaria from a "hold" rating to a "moderate buy" rating in a research note on Friday, March 7th. Raymond James cut their price objective on Savaria from C$27.50 to C$24.00 and set an "outperform" rating for the company in a research report on Friday, March 7th. National Bankshares decreased their price target on Savaria from C$27.00 to C$24.00 and set an "outperform" rating on the stock in a research note on Friday, March 7th. TD Securities decreased their price objective on shares of Savaria from C$25.00 to C$22.00 and set a "buy" rating on the stock in a research report on Friday, March 7th. Finally, Stifel Nicolaus cut their price target on Savaria from C$25.00 to C$24.00 and set a "buy" rating for the company in a report on Friday, March 7th.

Read Our Latest Analysis on Savaria

Savaria Stock Up 1.4 %

SIS traded up C$0.23 on Friday, reaching C$16.34. The company's stock had a trading volume of 5,913 shares, compared to its average volume of 138,333. The company has a market capitalization of C$1.18 billion, a price-to-earnings ratio of 25.57, a P/E/G ratio of 42.72 and a beta of 0.90. The company has a quick ratio of 0.91, a current ratio of 1.97 and a debt-to-equity ratio of 54.11. Savaria has a fifty-two week low of C$14.97 and a fifty-two week high of C$23.92. The stock has a 50 day moving average of C$16.96 and a two-hundred day moving average of C$19.67.

Savaria Company Profile

(

Get Free ReportSavaria Corp designs, engineers, and manufactures products for personal mobility. Its products include home elevators, wheelchair lifts, commercial elevators, ceiling lifts, stairlifts, and van conversions. The company's operating segments are the Accessibility, Adapted Vehicles, and Patient Handling, divisions.

Featured Stories

Before you consider Savaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Savaria wasn't on the list.

While Savaria currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.