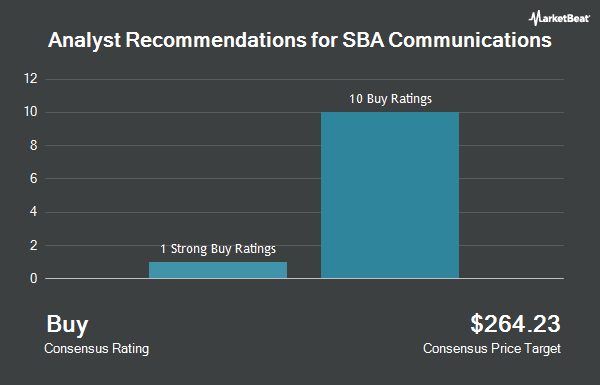

Shares of SBA Communications Co. (NASDAQ:SBAC - Get Free Report) have earned a consensus rating of "Moderate Buy" from the thirteen analysts that are presently covering the company, Marketbeat Ratings reports. Three analysts have rated the stock with a hold recommendation, nine have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12 month price target among brokers that have issued ratings on the stock in the last year is $257.23.

A number of equities analysts have recently commented on SBAC shares. StockNews.com raised shares of SBA Communications from a "hold" rating to a "buy" rating in a research note on Thursday, November 7th. BMO Capital Markets boosted their price objective on SBA Communications from $255.00 to $260.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 29th. TD Cowen upped their target price on SBA Communications from $251.00 to $261.00 and gave the stock a "buy" rating in a research report on Tuesday, October 29th. KeyCorp raised their target price on SBA Communications from $230.00 to $280.00 and gave the company an "overweight" rating in a report on Monday, October 14th. Finally, The Goldman Sachs Group upped their price target on SBA Communications from $212.00 to $240.00 and gave the stock a "neutral" rating in a report on Thursday, September 26th.

Get Our Latest Analysis on SBA Communications

SBA Communications Stock Performance

SBA Communications stock traded down $1.20 during midday trading on Friday, reaching $220.38. The stock had a trading volume of 1,072,271 shares, compared to its average volume of 809,914. The stock's 50-day simple moving average is $231.02 and its 200 day simple moving average is $219.26. SBA Communications has a twelve month low of $183.64 and a twelve month high of $258.76. The stock has a market capitalization of $23.70 billion, a PE ratio of 34.76, a price-to-earnings-growth ratio of 0.75 and a beta of 0.67.

SBA Communications (NASDAQ:SBAC - Get Free Report) last issued its earnings results on Monday, October 28th. The technology company reported $2.40 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.17 by ($0.77). SBA Communications had a negative return on equity of 13.13% and a net margin of 25.76%. The firm had revenue of $667.60 million for the quarter, compared to analysts' expectations of $669.29 million. During the same quarter in the previous year, the firm posted $3.34 EPS. The firm's revenue for the quarter was down 2.2% compared to the same quarter last year. Equities analysts predict that SBA Communications will post 12.56 earnings per share for the current fiscal year.

SBA Communications Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Thursday, November 14th will be issued a dividend of $0.98 per share. This represents a $3.92 annualized dividend and a yield of 1.78%. The ex-dividend date of this dividend is Thursday, November 14th. SBA Communications's dividend payout ratio is currently 61.83%.

Insider Buying and Selling at SBA Communications

In other news, EVP Donald Day sold 1,500 shares of the firm's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $242.86, for a total value of $364,290.00. Following the transaction, the executive vice president now directly owns 4,998 shares in the company, valued at approximately $1,213,814.28. This trade represents a 23.08 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. 1.30% of the stock is currently owned by insiders.

Hedge Funds Weigh In On SBA Communications

A number of hedge funds and other institutional investors have recently bought and sold shares of the stock. Ashton Thomas Securities LLC bought a new position in shares of SBA Communications during the third quarter worth about $26,000. Capital Performance Advisors LLP acquired a new position in SBA Communications during the 3rd quarter valued at about $35,000. Ridgewood Investments LLC bought a new position in SBA Communications in the 2nd quarter worth about $32,000. Family Firm Inc. acquired a new stake in shares of SBA Communications in the second quarter valued at approximately $36,000. Finally, Friedenthal Financial bought a new stake in shares of SBA Communications during the third quarter valued at approximately $50,000. 97.35% of the stock is currently owned by institutional investors and hedge funds.

SBA Communications Company Profile

(

Get Free ReportSBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Further Reading

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.