Trillium Asset Management LLC lowered its holdings in SBA Communications Co. (NASDAQ:SBAC - Free Report) by 2.0% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 55,455 shares of the technology company's stock after selling 1,128 shares during the quarter. Trillium Asset Management LLC owned approximately 0.05% of SBA Communications worth $11,302,000 at the end of the most recent reporting period.

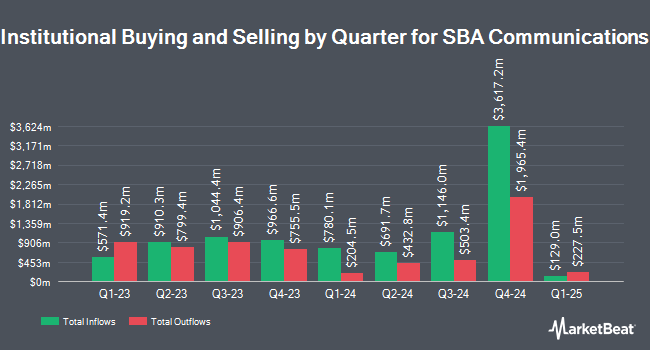

Several other large investors have also modified their holdings of SBAC. Signaturefd LLC raised its stake in shares of SBA Communications by 16.4% during the 4th quarter. Signaturefd LLC now owns 894 shares of the technology company's stock worth $182,000 after acquiring an additional 126 shares in the last quarter. Cibc World Markets Corp raised its stake in shares of SBA Communications by 12.3% during the 4th quarter. Cibc World Markets Corp now owns 48,249 shares of the technology company's stock worth $9,833,000 after acquiring an additional 5,293 shares in the last quarter. Gitterman Wealth Management LLC raised its stake in shares of SBA Communications by 14.1% during the 4th quarter. Gitterman Wealth Management LLC now owns 1,310 shares of the technology company's stock worth $267,000 after acquiring an additional 162 shares in the last quarter. Ninepoint Partners LP raised its stake in shares of SBA Communications by 21.0% during the 4th quarter. Ninepoint Partners LP now owns 6,508 shares of the technology company's stock worth $1,326,000 after acquiring an additional 1,128 shares in the last quarter. Finally, Envestnet Portfolio Solutions Inc. raised its stake in shares of SBA Communications by 36.3% during the 4th quarter. Envestnet Portfolio Solutions Inc. now owns 5,731 shares of the technology company's stock worth $1,168,000 after acquiring an additional 1,527 shares in the last quarter. Institutional investors own 97.35% of the company's stock.

Insider Activity

In related news, VP Joshua Koenig sold 2,209 shares of the stock in a transaction on Friday, March 7th. The shares were sold at an average price of $224.18, for a total transaction of $495,213.62. Following the sale, the vice president now directly owns 6,079 shares of the company's stock, valued at approximately $1,362,790.22. This represents a 26.65 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Insiders own 1.30% of the company's stock.

Wall Street Analyst Weigh In

SBAC has been the subject of several recent analyst reports. JMP Securities initiated coverage on shares of SBA Communications in a research note on Monday, January 27th. They set an "outperform" rating and a $250.00 price objective for the company. Royal Bank of Canada reiterated an "outperform" rating and set a $255.00 price objective on shares of SBA Communications in a research note on Monday, February 24th. StockNews.com downgraded shares of SBA Communications from a "buy" rating to a "hold" rating in a research report on Thursday, February 20th. Citizens Jmp raised shares of SBA Communications to a "strong-buy" rating in a research report on Monday, January 27th. Finally, BMO Capital Markets reissued a "market perform" rating and set a $230.00 target price (down previously from $260.00) on shares of SBA Communications in a research report on Wednesday, December 18th. Five research analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, SBA Communications presently has a consensus rating of "Moderate Buy" and an average price target of $252.85.

Read Our Latest Analysis on SBAC

SBA Communications Trading Up 0.3 %

Shares of SBAC stock traded up $0.67 during trading hours on Friday, hitting $221.64. The company's stock had a trading volume of 1,208,595 shares, compared to its average volume of 849,287. The company has a 50 day moving average of $209.59 and a 200 day moving average of $220.10. The stock has a market cap of $23.85 billion, a PE ratio of 34.96, a price-to-earnings-growth ratio of 0.74 and a beta of 0.74. SBA Communications Co. has a 12-month low of $183.64 and a 12-month high of $252.64.

SBA Communications Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, March 27th. Stockholders of record on Thursday, March 13th will be issued a $1.11 dividend. This is an increase from SBA Communications's previous quarterly dividend of $0.98. This represents a $4.44 annualized dividend and a dividend yield of 2.00%. The ex-dividend date is Thursday, March 13th. SBA Communications's dividend payout ratio is 63.98%.

SBA Communications Profile

(

Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Further Reading

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.