SBA Communications (NASDAQ:SBAC - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "hold" rating to a "buy" rating in a research report issued on Thursday.

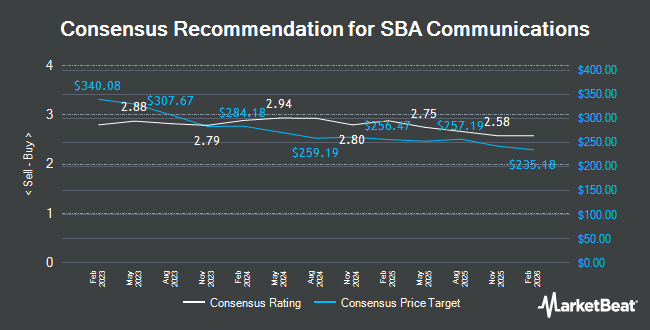

Other analysts also recently issued research reports about the stock. BMO Capital Markets raised their price objective on shares of SBA Communications from $255.00 to $260.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 29th. TD Cowen raised their price objective on shares of SBA Communications from $251.00 to $261.00 and gave the stock a "buy" rating in a research note on Tuesday, October 29th. The Goldman Sachs Group raised their price objective on shares of SBA Communications from $212.00 to $240.00 and gave the stock a "neutral" rating in a research note on Thursday, September 26th. Wells Fargo & Company raised their price objective on shares of SBA Communications from $220.00 to $240.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 10th. Finally, Morgan Stanley raised their target price on shares of SBA Communications from $232.00 to $252.00 and gave the stock an "overweight" rating in a research report on Wednesday, September 18th. Three equities research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, SBA Communications has a consensus rating of "Moderate Buy" and a consensus target price of $257.23.

Check Out Our Latest Stock Report on SBA Communications

SBA Communications Trading Up 1.3 %

Shares of NASDAQ:SBAC traded up $2.83 during trading on Thursday, reaching $221.58. The company's stock had a trading volume of 1,860,230 shares, compared to its average volume of 925,292. SBA Communications has a 12 month low of $183.64 and a 12 month high of $258.76. The firm's 50 day simple moving average is $237.80 and its two-hundred day simple moving average is $215.20. The stock has a market capitalization of $23.81 billion, a PE ratio of 34.96, a price-to-earnings-growth ratio of 0.68 and a beta of 0.68.

SBA Communications (NASDAQ:SBAC - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The technology company reported $2.40 EPS for the quarter, missing analysts' consensus estimates of $3.17 by ($0.77). The business had revenue of $667.60 million during the quarter, compared to the consensus estimate of $669.29 million. SBA Communications had a net margin of 25.76% and a negative return on equity of 13.13%. The firm's revenue was down 2.2% on a year-over-year basis. During the same period in the previous year, the business posted $3.34 EPS. Research analysts anticipate that SBA Communications will post 12.56 EPS for the current fiscal year.

Insider Activity at SBA Communications

In other SBA Communications news, Director George R. Krouse, Jr. sold 325 shares of the firm's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $219.58, for a total value of $71,363.50. Following the completion of the sale, the director now directly owns 8,084 shares in the company, valued at $1,775,084.72. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, EVP Donald Day sold 1,500 shares of SBA Communications stock in a transaction on Friday, September 13th. The shares were sold at an average price of $242.86, for a total transaction of $364,290.00. Following the completion of the sale, the executive vice president now directly owns 4,998 shares in the company, valued at approximately $1,213,814.28. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director George R. Krouse, Jr. sold 325 shares of SBA Communications stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $219.58, for a total transaction of $71,363.50. Following the sale, the director now owns 8,084 shares of the company's stock, valued at $1,775,084.72. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.30% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On SBA Communications

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Napa Wealth Management lifted its stake in shares of SBA Communications by 21.0% during the third quarter. Napa Wealth Management now owns 1,444 shares of the technology company's stock worth $348,000 after buying an additional 251 shares during the period. Thrivent Financial for Lutherans lifted its position in SBA Communications by 9.0% during the third quarter. Thrivent Financial for Lutherans now owns 874,945 shares of the technology company's stock valued at $210,600,000 after purchasing an additional 72,255 shares during the period. Atlanta Consulting Group Advisors LLC acquired a new position in SBA Communications during the third quarter valued at $204,000. Natixis Advisors LLC lifted its position in SBA Communications by 46.4% during the third quarter. Natixis Advisors LLC now owns 74,835 shares of the technology company's stock valued at $18,013,000 after purchasing an additional 23,715 shares during the period. Finally, Mizuho Securities USA LLC increased its holdings in SBA Communications by 1,011.1% in the third quarter. Mizuho Securities USA LLC now owns 92,079 shares of the technology company's stock valued at $22,163,000 after buying an additional 83,792 shares in the last quarter. 97.35% of the stock is currently owned by institutional investors and hedge funds.

About SBA Communications

(

Get Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

See Also

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.