Schrum Private Wealth Management LLC boosted its stake in General Mills, Inc. (NYSE:GIS - Free Report) by 96.4% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 23,862 shares of the company's stock after purchasing an additional 11,714 shares during the quarter. Schrum Private Wealth Management LLC's holdings in General Mills were worth $1,762,000 as of its most recent filing with the SEC.

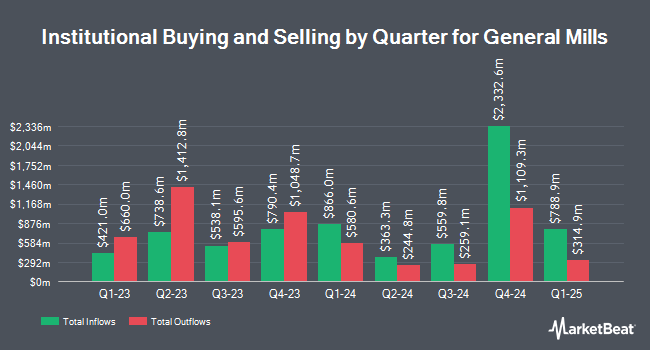

Other institutional investors have also recently bought and sold shares of the company. Values First Advisors Inc. purchased a new stake in General Mills during the third quarter worth approximately $27,000. RFP Financial Group LLC grew its stake in General Mills by 66.3% during the first quarter. RFP Financial Group LLC now owns 434 shares of the company's stock worth $30,000 after buying an additional 173 shares during the period. First Foundation Advisors grew its stake in General Mills by 400.0% during the second quarter. First Foundation Advisors now owns 500 shares of the company's stock worth $32,000 after buying an additional 400 shares during the period. Beacon Capital Management LLC grew its stake in General Mills by 47.5% during the first quarter. Beacon Capital Management LLC now owns 559 shares of the company's stock worth $39,000 after buying an additional 180 shares during the period. Finally, Catalyst Capital Advisors LLC purchased a new stake in General Mills during the third quarter worth approximately $44,000. 75.71% of the stock is currently owned by hedge funds and other institutional investors.

General Mills Stock Up 1.5 %

GIS traded up $0.98 during trading on Wednesday, hitting $65.24. The company had a trading volume of 3,232,049 shares, compared to its average volume of 3,893,674. The company has a market cap of $36.22 billion, a PE ratio of 15.49, a P/E/G ratio of 3.30 and a beta of 0.11. General Mills, Inc. has a 1-year low of $61.47 and a 1-year high of $75.90. The business has a 50-day moving average of $71.27 and a 200-day moving average of $68.96. The company has a debt-to-equity ratio of 1.20, a current ratio of 0.66 and a quick ratio of 0.39.

General Mills (NYSE:GIS - Get Free Report) last posted its quarterly earnings results on Wednesday, September 18th. The company reported $1.07 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.06 by $0.01. General Mills had a net margin of 12.14% and a return on equity of 26.85%. The company had revenue of $4.85 billion for the quarter, compared to the consensus estimate of $4.80 billion. During the same period last year, the firm posted $1.09 EPS. The company's revenue for the quarter was down 1.2% on a year-over-year basis. As a group, analysts forecast that General Mills, Inc. will post 4.51 earnings per share for the current year.

General Mills Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Thursday, October 10th were given a $0.60 dividend. The ex-dividend date of this dividend was Thursday, October 10th. This represents a $2.40 dividend on an annualized basis and a dividend yield of 3.68%. General Mills's payout ratio is currently 57.14%.

Insider Transactions at General Mills

In other news, CEO Jeffrey L. Harmening sold 46,500 shares of the firm's stock in a transaction dated Wednesday, October 23rd. The shares were sold at an average price of $68.61, for a total value of $3,190,365.00. Following the transaction, the chief executive officer now directly owns 355,328 shares in the company, valued at approximately $24,379,054.08. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, insider Pankaj Mn Sharma sold 2,325 shares of the stock in a transaction dated Friday, September 20th. The shares were sold at an average price of $74.63, for a total value of $173,514.75. Following the sale, the insider now owns 36,184 shares of the company's stock, valued at $2,700,411.92. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Jeffrey L. Harmening sold 46,500 shares of the stock in a transaction dated Wednesday, October 23rd. The stock was sold at an average price of $68.61, for a total transaction of $3,190,365.00. Following the completion of the sale, the chief executive officer now directly owns 355,328 shares in the company, valued at approximately $24,379,054.08. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 66,555 shares of company stock worth $4,657,676. 0.26% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

Several research firms have issued reports on GIS. JPMorgan Chase & Co. boosted their price objective on shares of General Mills from $63.00 to $67.00 and gave the stock a "neutral" rating in a research note on Monday, October 14th. Argus reissued a "hold" rating on shares of General Mills in a research report on Tuesday, July 16th. Wells Fargo & Company boosted their target price on shares of General Mills from $67.00 to $75.00 and gave the stock an "equal weight" rating in a research report on Friday, September 13th. Royal Bank of Canada reissued a "sector perform" rating and set a $70.00 target price on shares of General Mills in a research report on Thursday, September 19th. Finally, Citigroup boosted their target price on shares of General Mills from $68.00 to $76.00 and gave the stock a "neutral" rating in a research report on Monday, September 16th. One research analyst has rated the stock with a sell rating, twelve have given a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $73.00.

Read Our Latest Stock Report on General Mills

About General Mills

(

Free Report)

General Mills, Inc manufactures and markets branded consumer foods worldwide. The company operates through four segments: North America Retail; International; Pet; and North America Foodservice. It offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and savory snacks, ice cream and frozen desserts, unbaked and fully baked frozen dough products, frozen hot snacks, ethnic meals, side dish mixes, frozen breakfast and entrees, nutrition bars, and frozen and shelf-stable vegetables.

Featured Articles

Before you consider General Mills, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Mills wasn't on the list.

While General Mills currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report