Schwarz Dygos Wheeler Investment Advisors LLC decreased its holdings in shares of Medtronic plc (NYSE:MDT - Free Report) by 54.1% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 4,902 shares of the medical technology company's stock after selling 5,775 shares during the quarter. Schwarz Dygos Wheeler Investment Advisors LLC's holdings in Medtronic were worth $392,000 at the end of the most recent quarter.

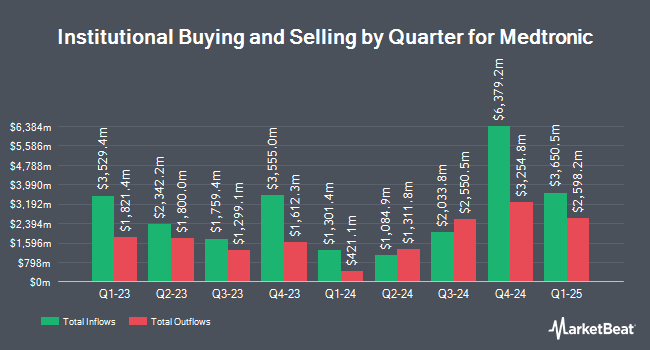

Several other large investors have also modified their holdings of the business. Mainstream Capital Management LLC purchased a new stake in Medtronic in the fourth quarter valued at approximately $26,000. Darwin Wealth Management LLC purchased a new stake in shares of Medtronic in the 3rd quarter valued at $27,000. Stephens Consulting LLC lifted its stake in Medtronic by 145.7% during the 4th quarter. Stephens Consulting LLC now owns 344 shares of the medical technology company's stock worth $27,000 after acquiring an additional 204 shares in the last quarter. J. Stern & Co. LLP purchased a new position in Medtronic during the 3rd quarter valued at about $30,000. Finally, Fiduciary Advisors Inc. acquired a new position in Medtronic in the 4th quarter valued at about $36,000. Institutional investors and hedge funds own 82.06% of the company's stock.

Insider Transactions at Medtronic

In related news, EVP Brett A. Wall sold 9,850 shares of the stock in a transaction on Wednesday, January 8th. The shares were sold at an average price of $80.41, for a total transaction of $792,038.50. Following the completion of the sale, the executive vice president now owns 40,708 shares in the company, valued at $3,273,330.28. This represents a 19.48 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 0.20% of the company's stock.

Medtronic Stock Down 2.1 %

Shares of NYSE MDT traded down $1.99 during mid-day trading on Wednesday, reaching $91.29. The company had a trading volume of 1,813,819 shares, compared to its average volume of 6,038,159. Medtronic plc has a 52-week low of $75.96 and a 52-week high of $96.25. The stock has a market cap of $117.08 billion, a P/E ratio of 27.75, a PEG ratio of 2.22 and a beta of 0.80. The company has a current ratio of 1.90, a quick ratio of 1.39 and a debt-to-equity ratio of 0.48. The firm has a 50 day simple moving average of $88.89 and a two-hundred day simple moving average of $87.88.

Medtronic (NYSE:MDT - Get Free Report) last posted its earnings results on Tuesday, February 18th. The medical technology company reported $1.39 EPS for the quarter, topping analysts' consensus estimates of $1.36 by $0.03. The business had revenue of $8.29 billion for the quarter, compared to analysts' expectations of $8.33 billion. Medtronic had a return on equity of 14.07% and a net margin of 12.83%. Sell-side analysts predict that Medtronic plc will post 5.46 earnings per share for the current year.

Medtronic Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, April 11th. Stockholders of record on Friday, March 28th will be issued a $0.70 dividend. This represents a $2.80 annualized dividend and a dividend yield of 3.07%. The ex-dividend date is Friday, March 28th. Medtronic's payout ratio is currently 85.11%.

Analyst Upgrades and Downgrades

MDT has been the subject of several recent research reports. Royal Bank of Canada reissued an "outperform" rating and issued a $105.00 price objective on shares of Medtronic in a research note on Wednesday, February 19th. JPMorgan Chase & Co. dropped their price target on shares of Medtronic from $99.00 to $96.00 and set a "neutral" rating for the company in a research note on Friday, November 15th. Truist Financial reduced their price objective on Medtronic from $93.00 to $89.00 and set a "hold" rating on the stock in a research note on Wednesday, December 18th. UBS Group boosted their target price on Medtronic from $85.00 to $95.00 and gave the stock a "neutral" rating in a research note on Wednesday, February 19th. Finally, Sanford C. Bernstein increased their price target on Medtronic from $96.00 to $97.00 and gave the company an "outperform" rating in a research report on Wednesday, November 20th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $96.07.

Get Our Latest Stock Analysis on MDT

Medtronic Company Profile

(

Free Report)

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software.

Featured Stories

Before you consider Medtronic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medtronic wasn't on the list.

While Medtronic currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.