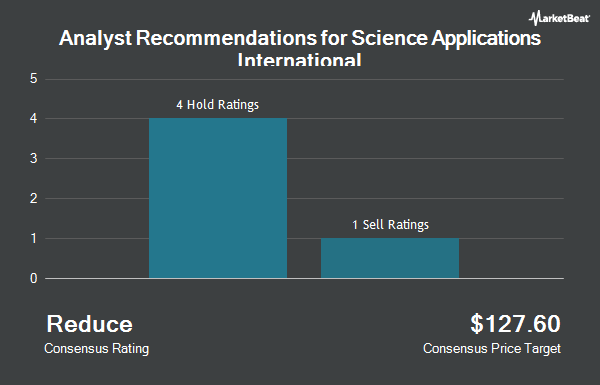

Shares of Science Applications International Co. (NYSE:SAIC - Get Free Report) have received an average rating of "Moderate Buy" from the eight ratings firms that are presently covering the company, Marketbeat.com reports. One analyst has rated the stock with a sell rating, three have issued a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $144.38.

Several research firms recently commented on SAIC. StockNews.com upgraded shares of Science Applications International from a "buy" rating to a "strong-buy" rating in a research note on Wednesday. UBS Group started coverage on shares of Science Applications International in a report on Monday, December 2nd. They set a "neutral" rating and a $134.00 price objective on the stock. TD Cowen raised shares of Science Applications International to a "strong-buy" rating in a research report on Thursday. JPMorgan Chase & Co. lowered their price objective on shares of Science Applications International from $170.00 to $148.00 and set an "overweight" rating for the company in a research note on Friday, December 6th. Finally, Truist Financial upped their target price on Science Applications International from $125.00 to $135.00 and gave the company a "hold" rating in a research report on Friday, September 6th.

Get Our Latest Analysis on Science Applications International

Insider Buying and Selling at Science Applications International

In related news, EVP Barbara Supplee acquired 425 shares of the stock in a transaction on Wednesday, December 11th. The shares were bought at an average price of $116.36 per share, with a total value of $49,453.00. Following the completion of the purchase, the executive vice president now owns 3,579 shares of the company's stock, valued at approximately $416,452.44. This represents a 13.47 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 0.67% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Science Applications International

Institutional investors have recently bought and sold shares of the company. Wealth Enhancement Advisory Services LLC increased its stake in Science Applications International by 4.2% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 4,129 shares of the information technology services provider's stock worth $485,000 after buying an additional 167 shares during the period. Envestnet Portfolio Solutions Inc. acquired a new stake in Science Applications International during the 2nd quarter worth $201,000. Sumitomo Mitsui Trust Holdings Inc. acquired a new stake in shares of Science Applications International in the 2nd quarter valued at about $266,000. Raymond James & Associates boosted its holdings in shares of Science Applications International by 8.3% in the second quarter. Raymond James & Associates now owns 73,275 shares of the information technology services provider's stock valued at $8,613,000 after acquiring an additional 5,603 shares during the period. Finally, Fifth Third Bancorp grew its position in Science Applications International by 30.4% during the 2nd quarter. Fifth Third Bancorp now owns 360 shares of the information technology services provider's stock worth $42,000 after purchasing an additional 84 shares during the last quarter. 76.00% of the stock is owned by hedge funds and other institutional investors.

Science Applications International Trading Up 1.2 %

Science Applications International stock traded up $1.31 during trading hours on Friday, hitting $111.42. The company had a trading volume of 1,878,095 shares, compared to its average volume of 339,433. The firm has a market cap of $5.45 billion, a P/E ratio of 18.79 and a beta of 0.64. The company has a 50-day moving average price of $132.15 and a two-hundred day moving average price of $128.05. Science Applications International has a 1 year low of $108.90 and a 1 year high of $156.34. The company has a debt-to-equity ratio of 1.20, a quick ratio of 0.87 and a current ratio of 0.87.

Science Applications International Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 24th. Shareholders of record on Friday, January 10th will be given a $0.37 dividend. The ex-dividend date of this dividend is Friday, January 10th. This represents a $1.48 dividend on an annualized basis and a dividend yield of 1.33%. Science Applications International's dividend payout ratio (DPR) is currently 24.96%.

About Science Applications International

(

Get Free ReportScience Applications International Corporation provides technical, engineering, and enterprise information technology (IT) services primarily in the United States. The company's offerings include IT modernization; digital engineering; artificial intelligence; Weapon systems support design, build, modify, integrate, and sustain weapon systems; and end-to-end services, such as design, development, integration, deployment, management and operations, sustainment, and security of its customers' IT infrastructure, as well as training and simulation and ground vehicles support which integrates, modify, upgrades, and sustains ground vehicles for nation's armed forces.

Further Reading

Before you consider Science Applications International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Science Applications International wasn't on the list.

While Science Applications International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.