S&CO Inc. grew its position in shares of PayPal Holdings, Inc. (NASDAQ:PYPL - Free Report) by 5.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 180,179 shares of the credit services provider's stock after acquiring an additional 8,882 shares during the quarter. PayPal comprises 0.9% of S&CO Inc.'s holdings, making the stock its 29th largest holding. S&CO Inc.'s holdings in PayPal were worth $14,059,000 at the end of the most recent reporting period.

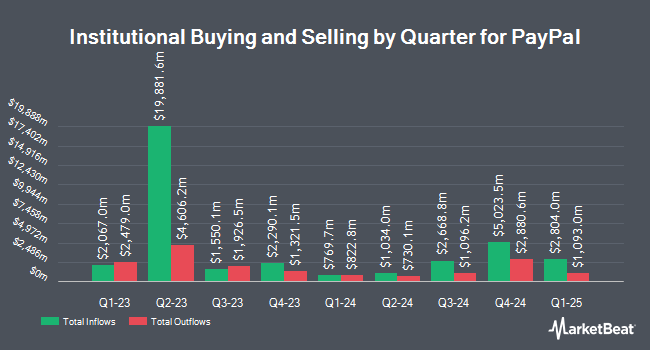

A number of other institutional investors also recently modified their holdings of the company. Mizuho Securities USA LLC lifted its holdings in shares of PayPal by 12,919.4% in the third quarter. Mizuho Securities USA LLC now owns 10,500,000 shares of the credit services provider's stock valued at $819,315,000 after purchasing an additional 10,419,351 shares in the last quarter. Legal & General Group Plc boosted its holdings in PayPal by 3.3% during the 2nd quarter. Legal & General Group Plc now owns 8,636,644 shares of the credit services provider's stock worth $501,184,000 after acquiring an additional 276,287 shares during the last quarter. Clearbridge Investments LLC grew its stake in shares of PayPal by 28.1% in the 2nd quarter. Clearbridge Investments LLC now owns 8,511,242 shares of the credit services provider's stock worth $493,907,000 after acquiring an additional 1,866,925 shares in the last quarter. Primecap Management Co. CA raised its holdings in shares of PayPal by 180.7% in the second quarter. Primecap Management Co. CA now owns 4,946,460 shares of the credit services provider's stock valued at $287,043,000 after purchasing an additional 3,184,160 shares during the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. lifted its position in shares of PayPal by 12.9% during the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 3,189,947 shares of the credit services provider's stock valued at $248,912,000 after purchasing an additional 364,851 shares in the last quarter. 68.32% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

PYPL has been the subject of several analyst reports. StockNews.com upgraded shares of PayPal from a "hold" rating to a "buy" rating in a research note on Sunday, November 3rd. Keefe, Bruyette & Woods reaffirmed an "outperform" rating and set a $78.00 price target on shares of PayPal in a research report on Wednesday, September 18th. Oppenheimer assumed coverage on PayPal in a research note on Tuesday, October 1st. They issued a "market perform" rating for the company. Jefferies Financial Group lowered their target price on PayPal from $70.00 to $65.00 in a research note on Monday, July 29th. Finally, Daiwa America upgraded shares of PayPal from a "moderate buy" rating to a "strong-buy" rating in a research report on Friday, August 9th. Fifteen investment analysts have rated the stock with a hold rating, nineteen have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $83.45.

View Our Latest Stock Analysis on PYPL

PayPal Trading Up 0.0 %

Shares of PYPL traded up $0.04 during mid-day trading on Friday, reaching $85.83. The company's stock had a trading volume of 8,083,167 shares, compared to its average volume of 11,479,406. PayPal Holdings, Inc. has a 52 week low of $55.28 and a 52 week high of $87.92. The stock has a market cap of $86.05 billion, a PE ratio of 20.48, a P/E/G ratio of 1.53 and a beta of 1.43. The company's fifty day moving average price is $78.86 and its two-hundred day moving average price is $69.04. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 0.49.

PayPal (NASDAQ:PYPL - Get Free Report) last issued its earnings results on Tuesday, October 29th. The credit services provider reported $1.20 earnings per share for the quarter, beating the consensus estimate of $1.07 by $0.13. The company had revenue of $7.85 billion during the quarter, compared to analysts' expectations of $7.88 billion. PayPal had a return on equity of 23.44% and a net margin of 14.08%. PayPal's quarterly revenue was up 6.0% compared to the same quarter last year. During the same period in the prior year, the business posted $0.97 EPS. On average, analysts predict that PayPal Holdings, Inc. will post 4.56 earnings per share for the current fiscal year.

PayPal Profile

(

Free Report)

PayPal Holdings, Inc operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising its installment products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards.

See Also

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.