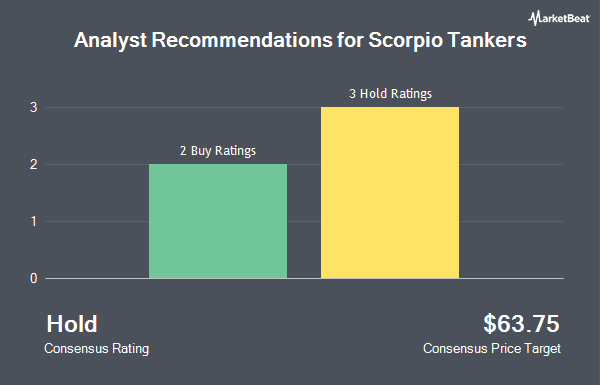

Scorpio Tankers Inc. (NYSE:STNG - Get Free Report) has earned an average rating of "Moderate Buy" from the six analysts that are covering the firm, MarketBeat Ratings reports. Three research analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average 12-month target price among analysts that have covered the stock in the last year is $75.40.

A number of equities research analysts have weighed in on STNG shares. Evercore ISI decreased their price target on shares of Scorpio Tankers from $84.00 to $80.00 and set an "outperform" rating on the stock in a research note on Wednesday, October 30th. Stifel Nicolaus downgraded Scorpio Tankers from a "buy" rating to a "hold" rating and decreased their price objective for the company from $90.00 to $65.00 in a report on Wednesday, October 23rd. Fearnley Fonds upgraded Scorpio Tankers to a "hold" rating in a research report on Friday, September 27th. Bank of America dropped their price objective on Scorpio Tankers from $73.00 to $71.00 and set a "neutral" rating for the company in a research note on Tuesday, October 22nd. Finally, Jefferies Financial Group dropped their target price on shares of Scorpio Tankers from $80.00 to $75.00 and set a "buy" rating for the company in a research report on Thursday.

Check Out Our Latest Stock Report on STNG

Scorpio Tankers Stock Performance

Shares of STNG traded up $1.08 during trading hours on Friday, reaching $48.31. 655,175 shares of the company traded hands, compared to its average volume of 788,459. The company has a debt-to-equity ratio of 0.27, a quick ratio of 2.18 and a current ratio of 2.21. The stock's fifty day moving average is $57.53 and its 200 day moving average is $68.81. Scorpio Tankers has a 1-year low of $46.66 and a 1-year high of $84.67. The stock has a market cap of $2.44 billion, a P/E ratio of 3.46 and a beta of 0.13.

Scorpio Tankers (NYSE:STNG - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The shipping company reported $1.75 EPS for the quarter, beating the consensus estimate of $1.61 by $0.14. Scorpio Tankers had a return on equity of 22.56% and a net margin of 52.40%. The firm had revenue of $267.99 million during the quarter, compared to analysts' expectations of $267.91 million. During the same quarter in the prior year, the firm posted $1.91 EPS. The company's revenue for the quarter was down 8.0% on a year-over-year basis. Equities research analysts anticipate that Scorpio Tankers will post 11.04 earnings per share for the current fiscal year.

Scorpio Tankers Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, December 13th. Stockholders of record on Friday, November 22nd were paid a dividend of $0.40 per share. The ex-dividend date of this dividend was Friday, November 22nd. This represents a $1.60 annualized dividend and a dividend yield of 3.31%. Scorpio Tankers's dividend payout ratio (DPR) is currently 11.47%.

Institutional Inflows and Outflows

A number of hedge funds have recently bought and sold shares of the company. Franklin Resources Inc. boosted its stake in shares of Scorpio Tankers by 8.3% in the 3rd quarter. Franklin Resources Inc. now owns 57,293 shares of the shipping company's stock valued at $3,985,000 after purchasing an additional 4,407 shares during the last quarter. Tidal Investments LLC lifted its holdings in Scorpio Tankers by 54.3% in the third quarter. Tidal Investments LLC now owns 54,816 shares of the shipping company's stock valued at $3,908,000 after buying an additional 19,298 shares during the period. Wilmington Savings Fund Society FSB acquired a new position in Scorpio Tankers in the third quarter valued at approximately $68,000. Geode Capital Management LLC boosted its stake in Scorpio Tankers by 5.3% in the third quarter. Geode Capital Management LLC now owns 768,129 shares of the shipping company's stock valued at $54,768,000 after acquiring an additional 38,599 shares during the last quarter. Finally, Barclays PLC grew its holdings in Scorpio Tankers by 873.6% during the 3rd quarter. Barclays PLC now owns 188,195 shares of the shipping company's stock worth $13,418,000 after acquiring an additional 168,866 shares during the period. 54.64% of the stock is currently owned by institutional investors.

About Scorpio Tankers

(

Get Free ReportScorpio Tankers Inc, together with its subsidiaries, engages in the seaborne transportation of crude oi and refined petroleum products in the shipping markets worldwide. As of March 21, 2024, its fleet consisted of 110 owned and leases financed tanker, including 39 LR2, 57 MR, and 14 Handymax with a weighted average age of approximately 8.1 years.

Further Reading

Before you consider Scorpio Tankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scorpio Tankers wasn't on the list.

While Scorpio Tankers currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.