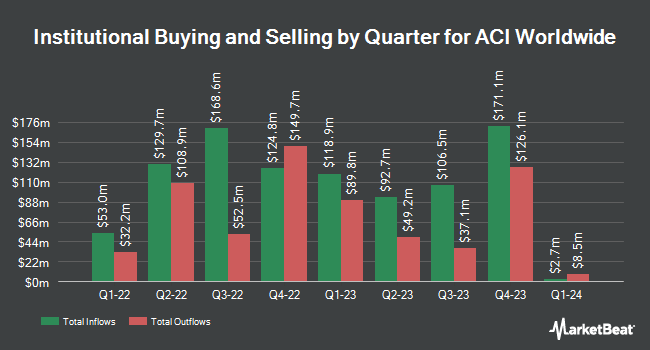

Scotia Capital Inc. purchased a new stake in ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The firm purchased 48,971 shares of the technology company's stock, valued at approximately $2,542,000.

Other institutional investors have also recently added to or reduced their stakes in the company. FMR LLC boosted its stake in shares of ACI Worldwide by 173.0% during the 3rd quarter. FMR LLC now owns 13,668 shares of the technology company's stock worth $696,000 after acquiring an additional 8,661 shares in the last quarter. Wolverine Trading LLC purchased a new stake in ACI Worldwide during the third quarter worth $258,000. XTX Topco Ltd purchased a new stake in ACI Worldwide during the third quarter worth $304,000. Barclays PLC grew its holdings in ACI Worldwide by 244.0% in the third quarter. Barclays PLC now owns 226,173 shares of the technology company's stock valued at $11,513,000 after purchasing an additional 160,425 shares during the last quarter. Finally, Geode Capital Management LLC increased its position in shares of ACI Worldwide by 1.3% in the third quarter. Geode Capital Management LLC now owns 2,502,628 shares of the technology company's stock valued at $127,407,000 after buying an additional 31,561 shares in the last quarter. Hedge funds and other institutional investors own 94.74% of the company's stock.

ACI Worldwide Price Performance

Shares of ACI Worldwide stock traded up $0.09 on Tuesday, hitting $52.22. The company's stock had a trading volume of 541,410 shares, compared to its average volume of 704,312. The company has a market capitalization of $5.50 billion, a P/E ratio of 24.75 and a beta of 1.13. ACI Worldwide, Inc. has a 52-week low of $31.19 and a 52-week high of $59.71. The firm has a fifty day moving average price of $52.75 and a 200-day moving average price of $53.03. The company has a quick ratio of 1.56, a current ratio of 1.56 and a debt-to-equity ratio of 0.72.

Insider Buying and Selling at ACI Worldwide

In other news, Director Charles E. Peters, Jr. sold 12,940 shares of the firm's stock in a transaction that occurred on Monday, March 3rd. The shares were sold at an average price of $57.57, for a total transaction of $744,955.80. Following the completion of the transaction, the director now directly owns 80,842 shares of the company's stock, valued at $4,654,073.94. This trade represents a 13.80 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders own 1.00% of the company's stock.

ACI Worldwide Company Profile

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Featured Stories

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.