Manulife Financial (TSE:MFC - Get Free Report) NYSE: MFC had its price objective hoisted by research analysts at Scotiabank from C$48.00 to C$49.00 in a note issued to investors on Friday,BayStreet.CA reports. Scotiabank's price target points to a potential upside of 10.81% from the stock's previous close.

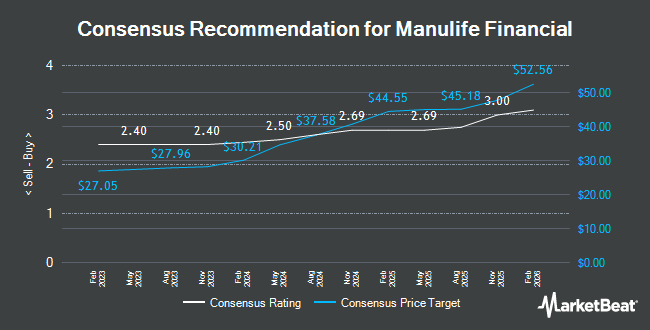

MFC has been the subject of a number of other research reports. Jefferies Financial Group lifted their target price on Manulife Financial from C$42.00 to C$47.00 and gave the stock a "buy" rating in a report on Wednesday, October 16th. Barclays set a C$39.00 price target on shares of Manulife Financial and gave the stock an "equal weight" rating in a report on Thursday, September 5th. Royal Bank of Canada raised their price objective on Manulife Financial from C$38.00 to C$39.00 in a report on Friday, August 9th. Dbs Bank raised Manulife Financial to a "strong-buy" rating in a research note on Thursday, August 8th. Finally, CIBC increased their price objective on Manulife Financial from C$36.00 to C$42.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 30th. One analyst has rated the stock with a sell rating, three have issued a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, Manulife Financial presently has a consensus rating of "Moderate Buy" and an average price target of C$42.27.

View Our Latest Stock Report on MFC

Manulife Financial Trading Down 1.2 %

MFC stock traded down C$0.54 during midday trading on Friday, reaching C$44.22. The company's stock had a trading volume of 852,346 shares, compared to its average volume of 6,369,308. The firm has a market capitalization of C$78.27 billion, a price-to-earnings ratio of 18.76, a PEG ratio of 1.01 and a beta of 1.06. The company has a debt-to-equity ratio of 49.60, a quick ratio of 2.58 and a current ratio of 36.68. Manulife Financial has a 1 year low of C$25.39 and a 1 year high of C$45.68. The stock has a fifty day simple moving average of C$39.84 and a two-hundred day simple moving average of C$36.88.

Manulife Financial (TSE:MFC - Get Free Report) NYSE: MFC last issued its quarterly earnings data on Wednesday, August 7th. The financial services provider reported C$0.91 EPS for the quarter, topping analysts' consensus estimates of C$0.88 by C$0.03. Manulife Financial had a net margin of 17.34% and a return on equity of 10.41%. The company had revenue of C$12.88 billion during the quarter, compared to the consensus estimate of C$12.27 billion. On average, equities research analysts predict that Manulife Financial will post 3.6104452 EPS for the current year.

Insiders Place Their Bets

In related news, Director Matthew Lyman Macinnis sold 6,708 shares of the company's stock in a transaction that occurred on Tuesday, August 13th. The stock was sold at an average price of C$34.67, for a total value of C$232,566.36. In other news, Director Rocco Gori sold 48,345 shares of Manulife Financial stock in a transaction dated Thursday, August 15th. The stock was sold at an average price of C$35.73, for a total transaction of C$1,727,395.86. Also, Director Matthew Lyman Macinnis sold 6,708 shares of the business's stock in a transaction dated Tuesday, August 13th. The stock was sold at an average price of C$34.67, for a total transaction of C$232,566.36. Over the last three months, insiders have sold 68,821 shares of company stock worth $2,455,596. 0.03% of the stock is owned by company insiders.

About Manulife Financial

(

Get Free Report)

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Manulife Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manulife Financial wasn't on the list.

While Manulife Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.