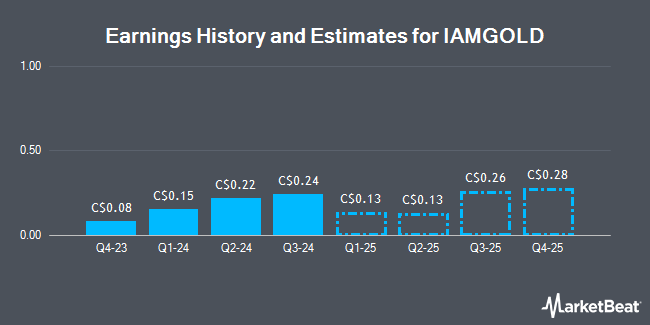

IAMGOLD Co. (TSE:IMG - Free Report) NYSE: IAG - Analysts at Scotiabank upped their FY2024 earnings per share estimates for IAMGOLD in a report released on Wednesday, January 8th. Scotiabank analyst T. Jakusconek now anticipates that the mining company will post earnings of $0.78 per share for the year, up from their prior estimate of $0.61. The consensus estimate for IAMGOLD's current full-year earnings is $1.11 per share. Scotiabank also issued estimates for IAMGOLD's FY2025 earnings at $0.92 EPS and FY2026 earnings at $0.78 EPS.

Other research analysts have also issued reports about the company. Canaccord Genuity Group upgraded IAMGOLD from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, October 22nd. National Bank Financial raised shares of IAMGOLD from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, October 9th. National Bankshares reduced their price target on shares of IAMGOLD from C$12.50 to C$12.00 and set an "outperform" rating on the stock in a research note on Thursday. Cibc World Mkts raised IAMGOLD from a "hold" rating to a "strong-buy" rating in a research report on Monday, December 2nd. Finally, Stifel Nicolaus raised their price target on IAMGOLD from C$6.00 to C$9.00 in a research report on Monday, October 21st. Two investment analysts have rated the stock with a hold rating, one has given a buy rating and three have assigned a strong buy rating to the stock. According to MarketBeat.com, IAMGOLD has a consensus rating of "Buy" and an average target price of C$8.30.

View Our Latest Analysis on IAMGOLD

IAMGOLD Trading Down 3.2 %

Shares of IMG traded down C$0.26 during mid-day trading on Monday, reaching C$7.92. The stock had a trading volume of 907,168 shares, compared to its average volume of 1,268,451. IAMGOLD has a 52-week low of C$3.00 and a 52-week high of C$8.80. The firm has a market cap of C$4.52 billion, a price-to-earnings ratio of 24.75, a P/E/G ratio of -0.28 and a beta of 1.47. The business's fifty day moving average is C$7.60 and its 200 day moving average is C$6.87. The company has a debt-to-equity ratio of 35.17, a current ratio of 1.34 and a quick ratio of 1.19.

Insider Buying and Selling at IAMGOLD

In related news, Senior Officer Timothy Bradburn sold 16,800 shares of the company's stock in a transaction that occurred on Monday, December 9th. The stock was sold at an average price of C$8.10, for a total value of C$136,080.00. Also, Senior Officer Stephen Eddy sold 16,100 shares of the firm's stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of C$7.80, for a total transaction of C$125,580.00. 0.10% of the stock is owned by corporate insiders.

About IAMGOLD

(

Get Free Report)

IAMGOLD Corporation, through its subsidiaries, operates as an intermediate gold producer and developer in Canada and Burkina Faso. It owns 100% interest in the Westwood project that covers an area of 1,925 hectare and located in Quebec; a 60% interest in the Côté gold project, which covers an area of 596 square kilometer located in Ontario, Canada; and a 90% interests in the Essakane project that covers an area of 274,000 square kilometer situated in Burkina Faso.

Read More

Before you consider IAMGOLD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAMGOLD wasn't on the list.

While IAMGOLD currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.