Camden Property Trust (NYSE:CPT - Get Free Report) had its target price cut by investment analysts at Scotiabank from $132.00 to $130.00 in a research note issued on Thursday,Benzinga reports. The brokerage currently has a "sector perform" rating on the real estate investment trust's stock. Scotiabank's target price points to a potential upside of 8.01% from the company's previous close.

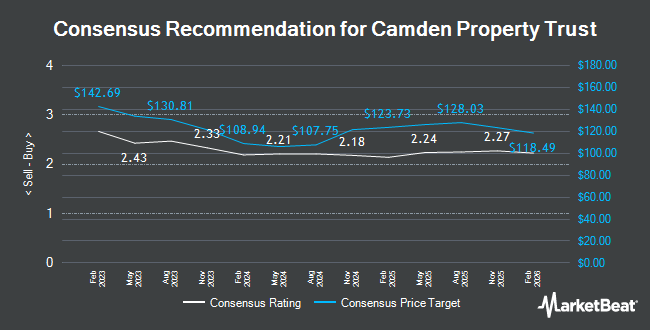

Several other equities analysts have also commented on the stock. StockNews.com lowered shares of Camden Property Trust from a "hold" rating to a "sell" rating in a report on Friday, November 1st. Stifel Nicolaus downgraded shares of Camden Property Trust from a "buy" rating to a "hold" rating and upped their price objective for the company from $120.00 to $121.00 in a research note on Wednesday. JPMorgan Chase & Co. raised their target price on Camden Property Trust from $112.00 to $129.00 and gave the stock a "neutral" rating in a research note on Monday, September 16th. UBS Group increased their price objective on Camden Property Trust from $109.00 to $117.00 and gave the stock a "neutral" rating in a report on Thursday, July 18th. Finally, Wedbush raised their price target on Camden Property Trust from $118.00 to $131.00 and gave the stock an "outperform" rating in a research note on Monday, August 5th. One research analyst has rated the stock with a sell rating, fifteen have issued a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat, Camden Property Trust has an average rating of "Hold" and an average target price of $122.50.

Check Out Our Latest Analysis on CPT

Camden Property Trust Price Performance

Shares of Camden Property Trust stock traded down $2.92 during trading on Thursday, hitting $120.36. The stock had a trading volume of 877,885 shares, compared to its average volume of 990,521. The firm has a market cap of $12.84 billion, a price-to-earnings ratio of 38.09, a P/E/G ratio of 4.40 and a beta of 0.91. The company has a current ratio of 0.15, a quick ratio of 0.15 and a debt-to-equity ratio of 0.72. The business's 50-day moving average is $121.15 and its 200 day moving average is $114.64. Camden Property Trust has a 12 month low of $86.50 and a 12 month high of $127.69.

Hedge Funds Weigh In On Camden Property Trust

Hedge funds and other institutional investors have recently made changes to their positions in the company. Security National Bank grew its holdings in shares of Camden Property Trust by 1.2% in the second quarter. Security National Bank now owns 8,267 shares of the real estate investment trust's stock valued at $902,000 after purchasing an additional 101 shares during the period. Verdence Capital Advisors LLC lifted its position in shares of Camden Property Trust by 5.0% during the third quarter. Verdence Capital Advisors LLC now owns 2,379 shares of the real estate investment trust's stock worth $294,000 after purchasing an additional 113 shares in the last quarter. American Capital Advisory LLC increased its position in shares of Camden Property Trust by 42.7% during the third quarter. American Capital Advisory LLC now owns 428 shares of the real estate investment trust's stock worth $53,000 after acquiring an additional 128 shares during the period. Raymond James Trust N.A. raised its position in Camden Property Trust by 6.1% in the 2nd quarter. Raymond James Trust N.A. now owns 2,516 shares of the real estate investment trust's stock valued at $275,000 after purchasing an additional 144 shares in the last quarter. Finally, ProShare Advisors LLC lifted its stake in Camden Property Trust by 0.5% in the second quarter. ProShare Advisors LLC now owns 31,349 shares of the real estate investment trust's stock worth $3,420,000 after acquiring an additional 146 shares during the last quarter. Hedge funds and other institutional investors own 97.22% of the company's stock.

About Camden Property Trust

(

Get Free Report)

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States.

Further Reading

Before you consider Camden Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camden Property Trust wasn't on the list.

While Camden Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.