Scotiabank upgraded shares of ServiceNow (NYSE:NOW - Free Report) to a strong-buy rating in a report published on Monday,Zacks.com reports.

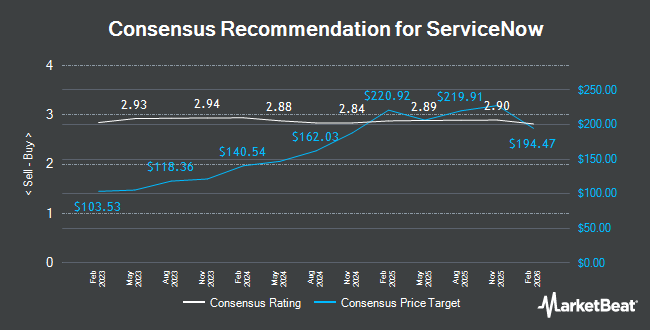

A number of other brokerages have also commented on NOW. Deutsche Bank Aktiengesellschaft upped their price target on ServiceNow from $875.00 to $900.00 and gave the stock a "buy" rating in a report on Thursday, July 25th. JMP Securities increased their price target on shares of ServiceNow from $850.00 to $1,000.00 and gave the company a "market outperform" rating in a report on Thursday, October 17th. Mizuho boosted their price objective on shares of ServiceNow from $980.00 to $1,070.00 and gave the stock an "outperform" rating in a report on Tuesday. Truist Financial increased their target price on shares of ServiceNow from $780.00 to $900.00 and gave the company a "hold" rating in a research note on Wednesday, October 23rd. Finally, UBS Group upped their price target on ServiceNow from $900.00 to $1,055.00 and gave the company a "buy" rating in a report on Tuesday, October 8th. One analyst has rated the stock with a sell rating, two have given a hold rating, twenty-six have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $986.39.

View Our Latest Report on NOW

ServiceNow Stock Performance

NOW traded up $0.88 on Monday, hitting $1,022.98. The company had a trading volume of 1,105,096 shares, compared to its average volume of 1,285,041. The stock has a market cap of $210.73 billion, a price-to-earnings ratio of 159.10, a price-to-earnings-growth ratio of 5.80 and a beta of 0.98. The company has a debt-to-equity ratio of 0.16, a current ratio of 1.13 and a quick ratio of 1.13. The company's fifty day moving average price is $941.65 and its 200 day moving average price is $830.81. ServiceNow has a 1-year low of $637.99 and a 1-year high of $1,061.66.

ServiceNow (NYSE:NOW - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The information technology services provider reported $3.72 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.46 by $0.26. The company had revenue of $2.80 billion during the quarter, compared to analysts' expectations of $2.75 billion. ServiceNow had a net margin of 12.77% and a return on equity of 16.03%. The business's quarterly revenue was up 22.2% compared to the same quarter last year. During the same period in the prior year, the company earned $1.21 earnings per share. Equities analysts predict that ServiceNow will post 7.07 earnings per share for the current fiscal year.

Insider Buying and Selling at ServiceNow

In other news, Director Jeffrey A. Miller sold 2,879 shares of the business's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $1,019.12, for a total transaction of $2,934,046.48. Following the completion of the transaction, the director now directly owns 42,920 shares in the company, valued at approximately $43,740,630.40. The trade was a 6.29 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Jacqueline P. Canney sold 94 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $1,016.54, for a total transaction of $95,554.76. Following the completion of the sale, the insider now owns 3,027 shares in the company, valued at $3,077,066.58. This represents a 3.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 7,373 shares of company stock valued at $7,139,335. 0.25% of the stock is currently owned by insiders.

Institutional Trading of ServiceNow

Several hedge funds have recently added to or reduced their stakes in NOW. Creekmur Asset Management LLC bought a new stake in shares of ServiceNow in the first quarter worth about $25,000. Versant Capital Management Inc raised its holdings in ServiceNow by 466.7% during the 2nd quarter. Versant Capital Management Inc now owns 34 shares of the information technology services provider's stock worth $27,000 after buying an additional 28 shares during the period. EntryPoint Capital LLC boosted its holdings in shares of ServiceNow by 3,900.0% in the first quarter. EntryPoint Capital LLC now owns 40 shares of the information technology services provider's stock valued at $30,000 after buying an additional 39 shares during the period. Truvestments Capital LLC bought a new stake in shares of ServiceNow during the third quarter worth $30,000. Finally, Ridgewood Investments LLC bought a new stake in ServiceNow in the 2nd quarter valued at $32,000. Institutional investors and hedge funds own 87.18% of the company's stock.

ServiceNow Company Profile

(

Get Free Report)

ServiceNow, Inc provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally. The company operates the Now platform for end-to-end digital transformation, artificial intelligence, machine learning, robotic process automation, process mining, performance analytics, and collaboration and development tools.

Featured Articles

Before you consider ServiceNow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceNow wasn't on the list.

While ServiceNow currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.