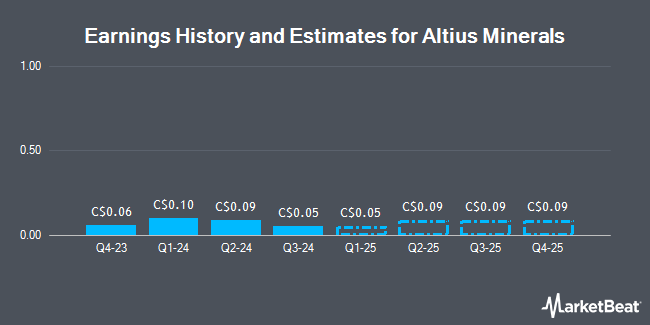

Altius Minerals Co. (TSE:ALS - Free Report) - Equities researchers at Scotiabank dropped their FY2026 earnings estimates for shares of Altius Minerals in a note issued to investors on Wednesday, March 19th. Scotiabank analyst O. Wowkodaw now anticipates that the company will post earnings of $0.32 per share for the year, down from their prior estimate of $0.42. Scotiabank currently has a "Outperform" rating and a $33.00 price target on the stock. The consensus estimate for Altius Minerals' current full-year earnings is $0.35 per share.

ALS has been the subject of a number of other reports. TD Securities decreased their target price on Altius Minerals from C$32.00 to C$31.00 and set a "buy" rating for the company in a research report on Thursday, March 13th. BMO Capital Markets increased their price target on Altius Minerals from C$23.00 to C$24.00 in a research note on Thursday, January 30th.

View Our Latest Research Report on Altius Minerals

Altius Minerals Stock Performance

Shares of ALS stock traded down C$0.13 during trading hours on Monday, hitting C$25.51. 60,431 shares of the company were exchanged, compared to its average volume of 101,362. The company has a current ratio of 8.36, a quick ratio of 6.49 and a debt-to-equity ratio of 19.48. The stock has a market capitalization of C$1.18 billion, a price-to-earnings ratio of 86.34 and a beta of 0.94. The firm has a fifty day simple moving average of C$26.54 and a 200 day simple moving average of C$26.38. Altius Minerals has a 52-week low of C$20.20 and a 52-week high of C$29.03.

Altius Minerals Company Profile

(

Get Free Report)

Altius Minerals Corp is engaged in the business of obtaining diversified mining royalty. It holds interests in mining operations that produce metals and minerals such as copper, zinc, nickel, cobalt, gold, silver, and potash. The corporation also holds other pre-development stage royalty interests and various earlier stage royalties.

Featured Articles

Before you consider Altius Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altius Minerals wasn't on the list.

While Altius Minerals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.